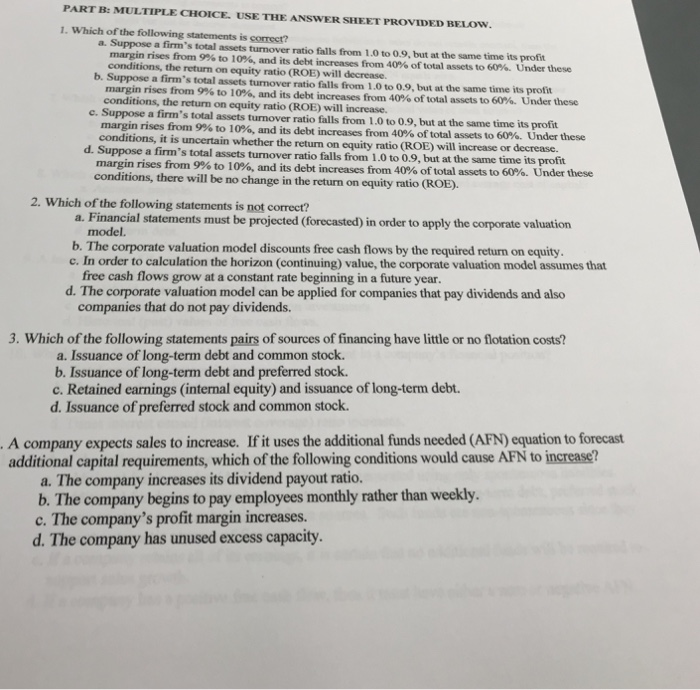

PART B: MULTIPLE CHOICE. USE THE ANSWER SHEET PROVIDED BELOW. 1. Which of the following statements is correct? a. Suppose a firm's total assets turnover ratio falls from 1.0 to 0.9, but at the same time its profit margin rises from 9% to 10%, and its debt increases from 40% of total assets to 60%. Under these conditions, the return on equity ratio (ROE) will decrease b. Suppose a firm's total assets tunover ratio falls from 1.0 to 0.9, but at the same time its profit margin rises from 9% to 10%, and its debt increases from 40% of total assets to 60%. Under these conditions, the return on equity ratio (ROE) will increase. e. Suppose a firm's total assets turnover ratio falls from 1.0 to 0.9, but at the same time its profit margin rises from 9% to 10%, and its debt increases from 40% of total assets to 60%, Under these conditions, it is uncertain whether the return on equity ratio (ROE) will increase or decrease. d. Suppose a firm's total assets turnover ratio falls from 1.0 to 0.9, but at the same time its profit margin rises from 9% to 10%, and its debt increases from 40% of total assets to 609, Under these conditions, there will be no change in the return on equity ratio (ROE) 2. Which of the following statements is not correct? a. Financial statements must be projected (forecasted) in order to apply the corporate valuation model. b. The corporate valuation model discounts free cash flows by the required return on equity. c. In order to calculation the horizon (continuing) value, the corporate valuation model assumes that free cash flows grow at a constant rate beginning in a future year. d. The corporate valuation model can be applied for companies that pay dividends and also companies that do not pay dividends. 3. Which of the following statements pairs of sources of financing have little or no flotation costs? a. Issuance of long-term debt and common stock. b. Issuance of long-term debt and preferred stock. c. Retained earnings (internal equity) and issuance of long-term debt. d. Issuance of preferred stock and common stock A company expects sales to increase. If it uses the additional funds needed (AFN) equation to forecast additional capital requirements, which of the following conditions would cause AFN to increase? a. The company increases its dividend payout ratio. b. The company begins to pay employees monthly rather than weekly c. The company's profit margin increases. d. The company has unused excess capacity