Answered step by step

Verified Expert Solution

Question

1 Approved Answer

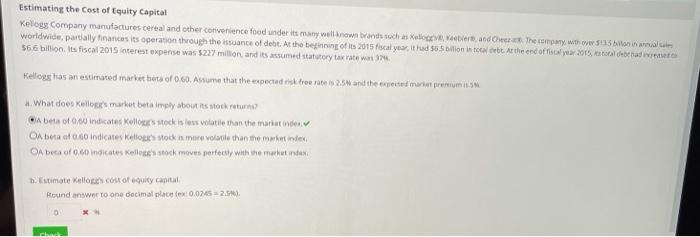

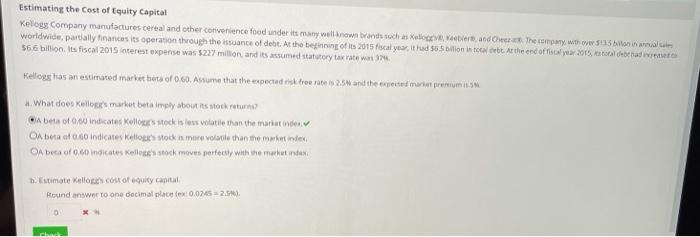

Part B Part B please Estimating the cost of Equity Capital Kellogg Company manufactures cereal and other convenience food under its many wellnown brandstochas Kedo,

Part B

Part B please

Estimating the cost of Equity Capital Kellogg Company manufactures cereal and other convenience food under its many wellnown brandstochas Kedo, bere and Cheathewompany with w3:25 billion in a worldwide, partially finances its operation through the issuance of debt. At the beginning of its 2015 fiscal year it had $6.5 billion in tott At the end of four year 2015, oral debe trade $6.6 billion. Its fiscal 2015 interest expense was $227 million and its assumed statutory tax rate Kellogg has an estimated market bota of 0.60. Assume that the expected to free meer as 2.5W and the expected market premium in What does Kellose market besimply about its mock returne? A beta of 0.00 indicates Kollouts stock is less volatile than the marketer A bota foco indicates Kellogg's stock is more late then we met index A bea of 0.co indicates Kellogg's stock moves perfectly with the marketinden b. Estimate Wallos cost of equity capital Round answer to one decimal place x 0.02452.51 0 be Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started