Part B please!

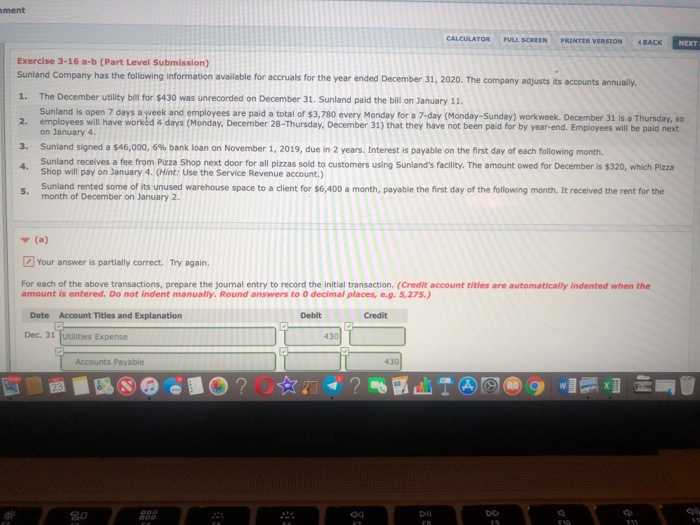

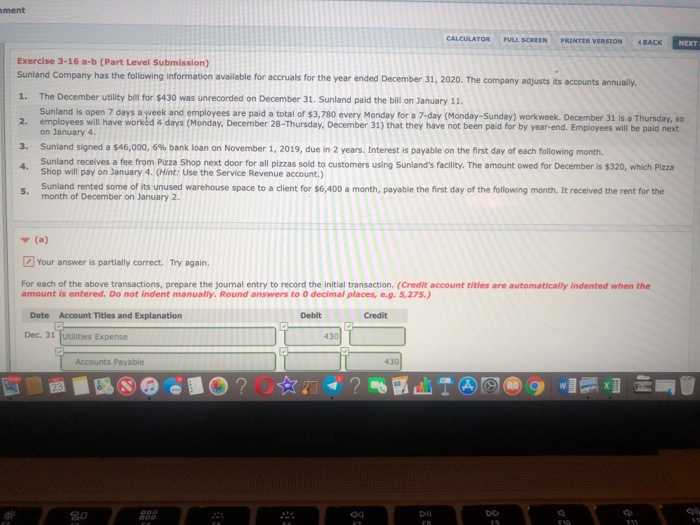

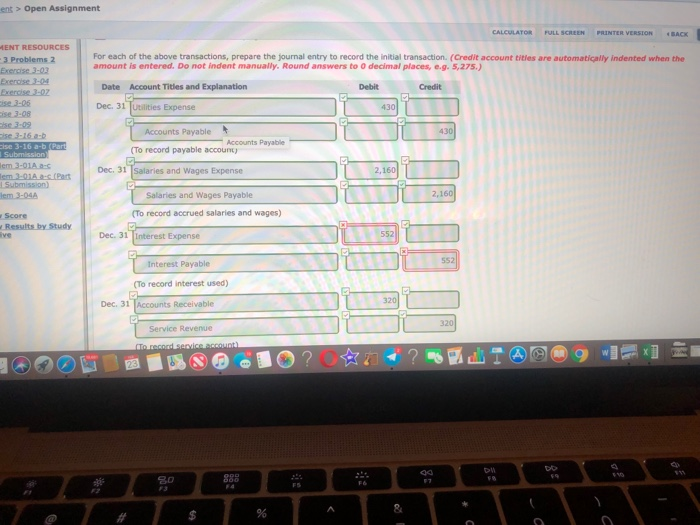

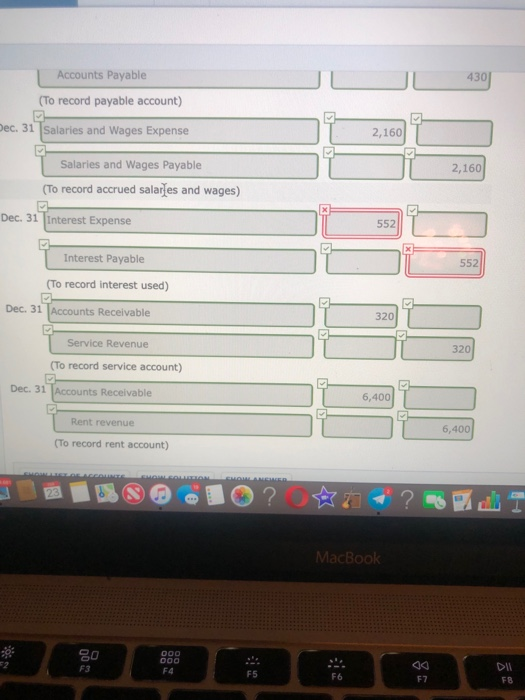

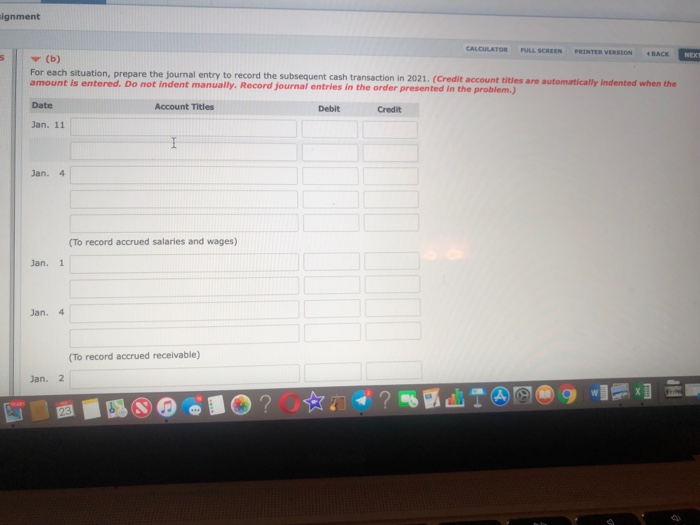

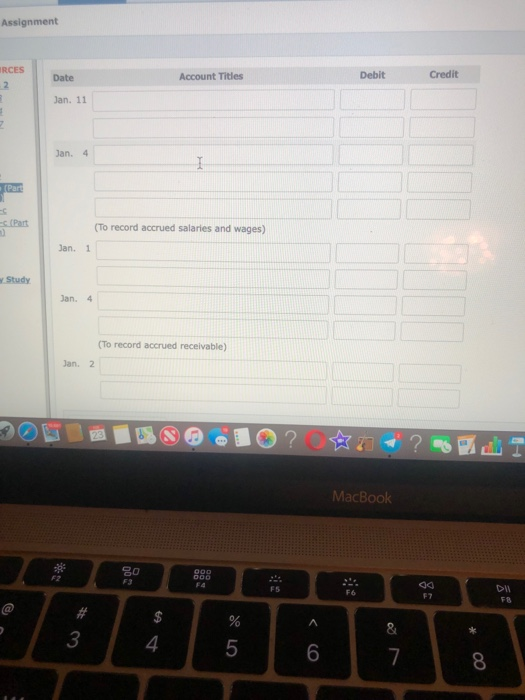

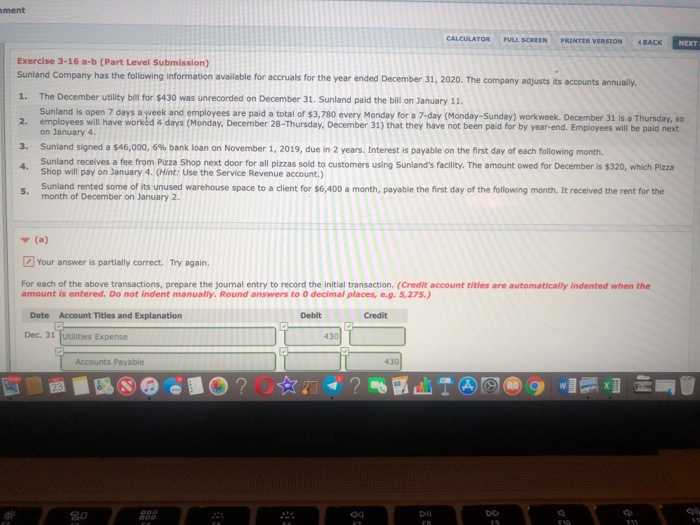

ment CALCULATOR FULL SCREEN PRINTER VERSION 48ACK Exercise 3-16 a-b (Part Level Submission) Sunland Company has the following information available for accruals for the year ended December 31, 2020. The company adjusts its accounts annually. 1. The December utlity bil for $430 was unrecorded on December 31. Sunland paid the bill on January 11 2. employees will have workld 4 days (Monday, December 28-Thursday, December 31) that they have not been paid for by year-end. Employees will be paid next 3. Sunland signed a $46,000, 6% bank loan on November 1, 2019, due in 2 years. Interest is payable on the first day of each following month. Sunland is open 7 days a week and employees are paid a total of on January 4, Sunland receives a fee from Pizza Shop next door for all pizzas sold to customers using Sunland's facility. The amount owed for December is $320, which Pizza Shop will pay on January 4. (Hint: Use the Service Revenue account.) Sunland rented some of its unused warehouse space to a client for $6,400 a month, payable the first day of the following month. It received the rent for the month of December on January 2 S. Your answer is partially correct. Try again. For each of the above transactions, prepare the journal entry to record the initial transaction. (Credit account titles are automatically Indented when the amount is entered. Do not indent manually, Round answers to O decimal places, e.g. 5,275.) Date Account Titles and Explanation Debit Credit Dec. 31 Utilities Expense Accounts Payable ent> Open Assignment CALCuLATOR' FULLSCREEN PRNTERVERSO. .SACX ENT RESOURCES 3 Problems 2 For each of the above transactions, prepare the journal entry to record the initial transaction. (Credit account tities are automatically indented when the amount is entered. Do not indent manually, Round answers to 0 decimal places, e.g. 5,275.) Date Account Titles and Explanation DebitCredit ise 3-05 Dec. 31 Utbilities Expense 430 Accounts Payable 430 Accounts Payable (To record payable account Dec, 31 Salaries and Wages Expense 2,16 Salaries and Wages Payable 2,160 Score (To record accrued salaries and wages) Dec. 31 Interest Expense 552 Interest Payable (To record interest used) Dec. 31 |Accounts Receivable Service Revenue Accounts Payable JLJ 430 To record payable account) ec. 31 Salaries and Wages Expense 2,160 Salaries and Wages Payable 2,160 (To record accrued salarles and wages) Dec. 31 Interest Expense 552 Interest Payable (To record interest used) Accounts Receivable 552 Dec. 31 320 Service Revenue 320 To record service account) Dec. 31 nts Receivable 6,400 Rent revenue 6,400 (To record rent account) MacBoolk Dl F8 F3 F4 F5 F6 F7 ignment FULL SCREEN PRINTER VERSION BACK For each situation, prepare the journal entry to record the subsequent cash transaction in 2021. t account titles are automatically Indented when the amount is entered. Do not indent manually, Record journa Date Jan. 11 I entries in the order presented in the problem.) Account Titles Debit Credit Jan. 4 (To record accrued salaries and wages) Jan. 1 Jan. 4 (To record accrued receivable) Jan. 2 Assignment RCES Date Account Titles Debit Credit Jan. 11 an. 4 To record accrued salaries and wages) Jan. 1 Study Jan. 4 (To record accrued receivable) Jan. 2 MacBook F3 FS F6 F7 F8 3 4 5 6 8