Answered step by step

Verified Expert Solution

Question

1 Approved Answer

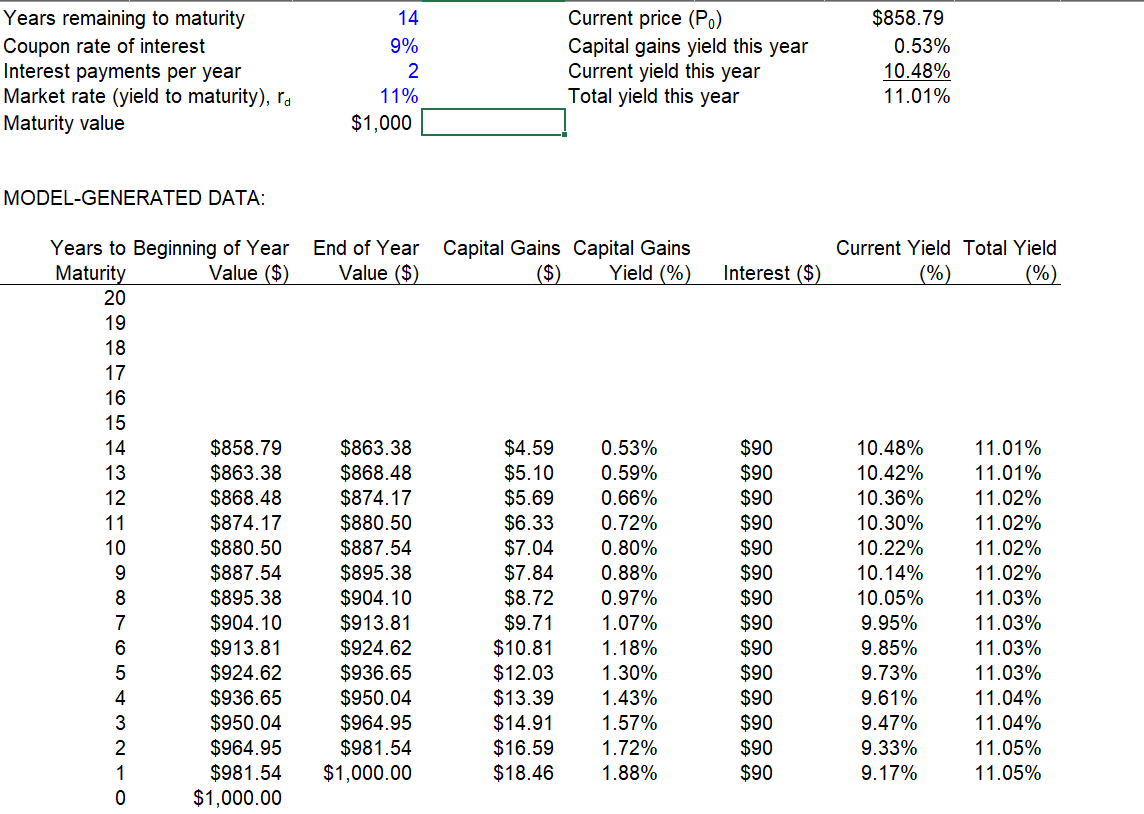

Part B Please Years remaining to maturity Coupon rate of interest Interest payments per year Market rate (yield to maturity), ra Maturity value 14 9%

Part B Please

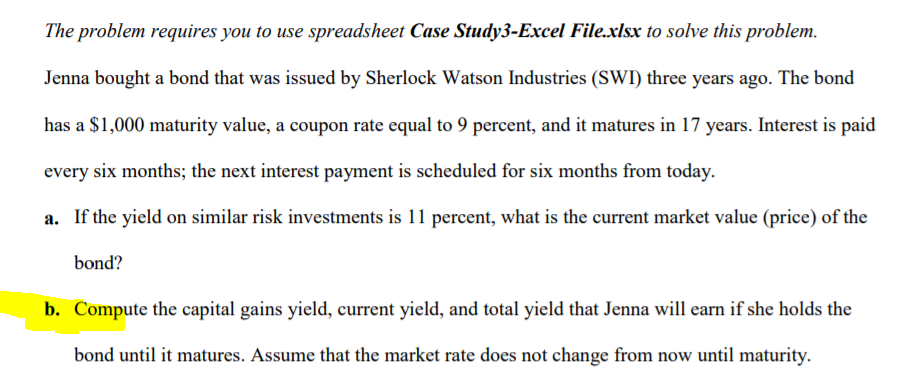

Years remaining to maturity Coupon rate of interest Interest payments per year Market rate (yield to maturity), ra Maturity value 14 9% 2 11% $1,000 Current price (P) Capital gains yield this year Current yield this year Total yield this year $858.79 0.53% 10.48% 11.01% MODEL-GENERATED DATA: End of Year Capital Gains Capital Gains Value ($) ($) Yield (% Current Yield Total Yield (%) (% Interest ($) Years to Beginning of Year Maturity Value ($) 20 19 18 17 16 15 14 $858.79 13 $863.38 12 $868.48 11 $874.17 10 $880.50 9 $887.54 8 $895.38 7 $904.10 6 $913.81 5 $924.62 4 $936.65 3 $950.04 2 $964.95 $981.54 $1,000.00 ON OLOMO $863.38 $868.48 $874.17 $880.50 $887.54 $895.38 $904.10 $913.81 $924.62 $936.65 $950.04 $964.95 $981.54 $1,000.00 $4.59 $5.10 $5.69 $6.33 $7.04 $7.84 $8.72 $9.71 $10.81 $12.03 $13.39 $14.91 $16.59 $18.46 0.53% 0.59% 0.66% 0.72% 0.80% 0.88% 0.97% 1.07% 1.18% 1.30% 1.43% 1.57% 1.72% 1.88% $90 $90 $90 $90 $90 $90 $90 $90 $90 $90 $90 $90 $90 $90 10.48% 10.42% 10.36% 10.30% 10.22% 10.14% 10.05% 9.95% 9.85% 9.73% 9.61% 9.47% 9.33% 9.17% 11.01% 11.01% 11.02% 11.02% 11.02% 11.02% 11.03% 11.03% 11.03% 11.03% 11.04% 11.04% 11.05% 11.05% The problem requires you to use spreadsheet Case Study3-Excel File.xlsx to solve this problem. Jenna bought a bond that was issued by Sherlock Watson Industries (SWI) three years ago. The bond has a $1,000 maturity value, a coupon rate equal to 9 percent, and it matures in 17 years. Interest is paid every six months; the next interest payment is scheduled for six months from today. a. If the yield on similar risk investments is 11 percent, what is the current market value (price) of the bond? b. Compute the capital gains yield, current yield, and total yield that Jenna will earn if she holds the bond until it matures. Assume that the market rate does not change from now until maturityStep by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started