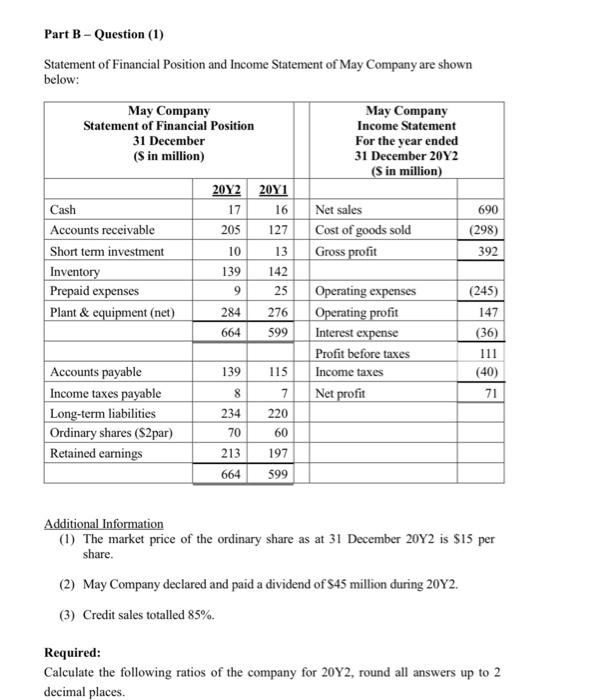

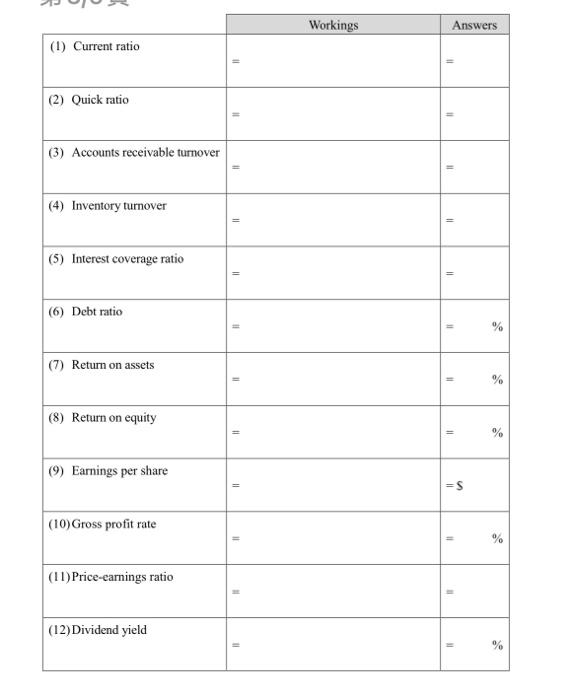

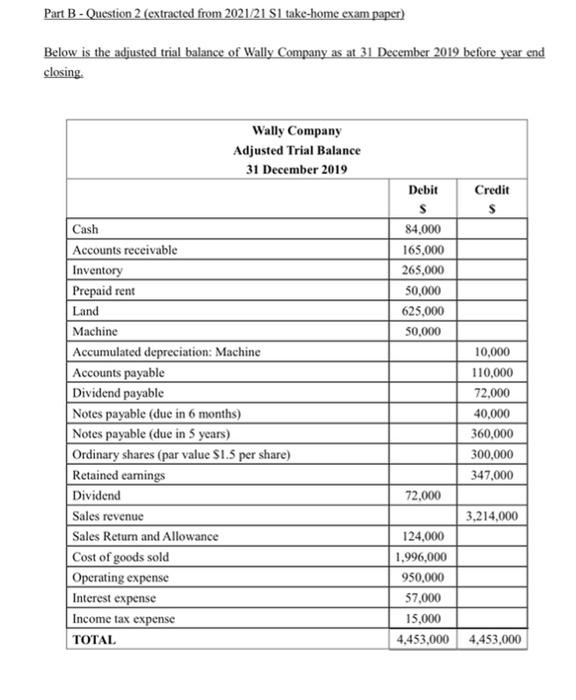

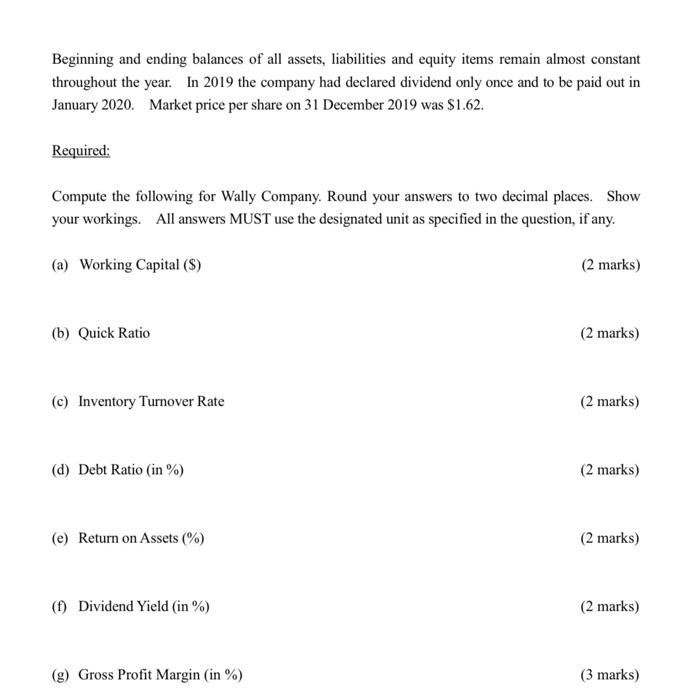

Part B - Question (1) Statement of Financial Position and Income Statement of May Company are shown below: May Company May Company Statement of Financial Position Income Statement 31 December For the year ended (Sin million) 31 December 20Y2 (S in million) 2042 2041 Cash 17 16 Net sales 690 Accounts receivable 205 127 Cost of goods sold (298) Short term investment 10 13 Gross profit 392 Inventory 139 142 Prepaid expenses 9 Operating expenses (245) Plant & equipment (net) 284 276 Operating profit 147 664 599 Interest expense (36) Profit before taxes 111 Accounts payable 139 115 Income taxes (40) Income taxes payable 7 Net profit 71 Long-term liabilities 234 220 Ordinary shares (S2par) 70 60 Retained earnings 213 197 664 599 25 8 Additional Information (1) The market price of the ordinary share as at 31 December 20Y2 is $15 per share. (2) May Company declared and paid a dividend of S45 million during 20Y2. (3) Credit sales totalled 85%. Required: Calculate the following ratios of the company for 20Y2, round all answers up to 2 decimal places. Workings Answers (1) Current ratio (2) Quick ratio (3) Accounts receivable turnover = = (4) Inventory turnover = (5) Interest coverage ratio (6) Debt ratio = % (7) Return on assets 11 (8) Return on equity % (9) Earnings per share =S (10) Gross profit rate = (11) Price-earnings ratio (12) Dividend yield % Part B - Question 2 (extracted from 2021/21 Si take-home exam paper) Below is the adjusted trial balance of Wally Company as at 31 December 2019 before year end closing. Wally Company Adjusted Trial Balance 31 December 2019 Cash Accounts receivable Inventory Prepaid rent Land Machine Accumulated depreciation: Machine Accounts payable Dividend payable Notes payable (due in 6 months) Notes payable (due in 5 years) Ordinary shares (par value $1.5 per share) Retained camings Dividend Sales revenue Sales Retum and Allowance Cost of goods sold Operating expense Interest expense Income tax expense TOTAL Debit Credit $ $ 84.000 165,000 265,000 50,000 625.000 50.000 10,000 110,000 72.000 40.000 360,000 300,000 347,000 72.000 3,214,000 124,000 1.996,000 950,000 57,000 15,000 4.453,000 4,453,000 Beginning and ending balances of all assets, liabilities and equity items remain almost constant throughout the year. In 2019 the company had declared dividend only once and to be paid out in January 2020. Market price per share on 31 December 2019 was $1.62. Required: Compute the following for Wally Company. Round your answers to two decimal places. Show your workings. All answers MUST use the designated unit as specified in the question, if any. (a) Working Capital ($) (2 marks) (b) Quick Ratio (2 marks) (c) Inventory Turnover Rate (2 marks) (d) Debt Ratio (in %) (2 marks) (e) Return on Assets (%) (2 marks) (t) Dividend Yield (in %) (2 marks) (g) Gross Profit Margin (in %)