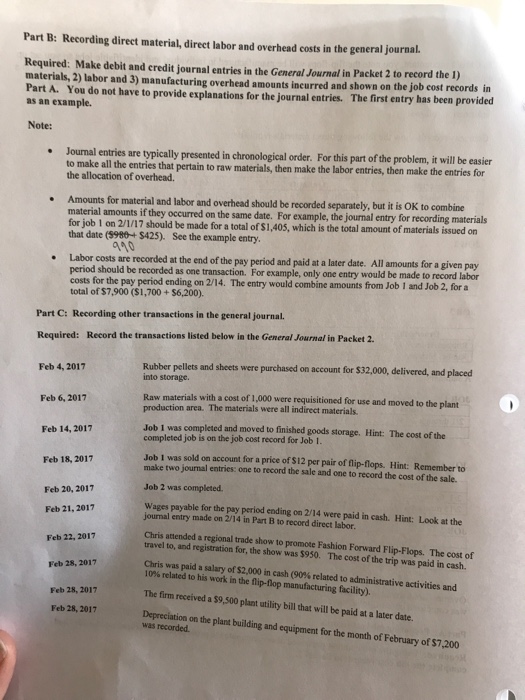

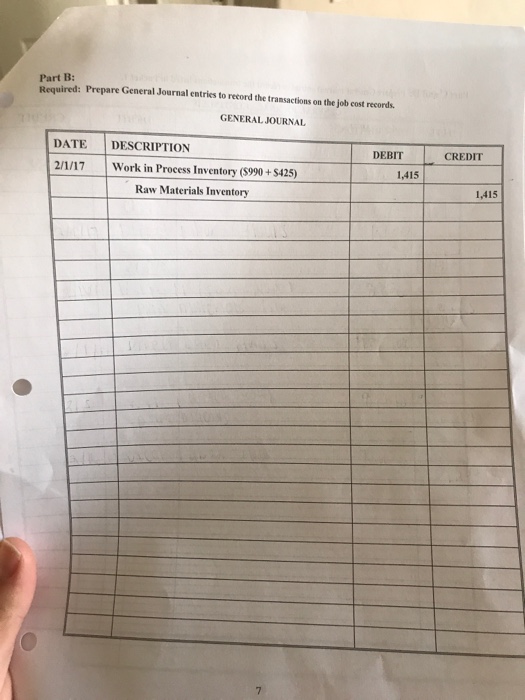

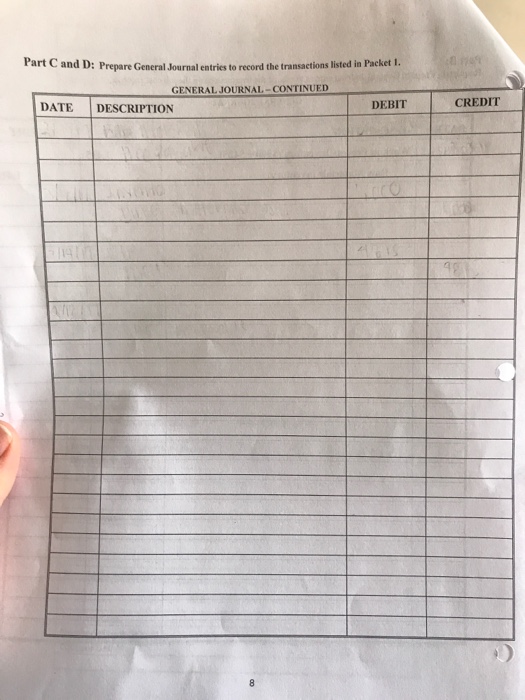

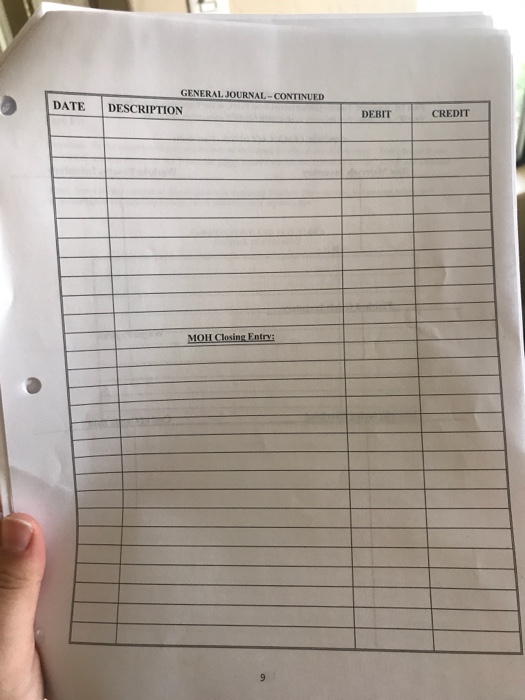

Part B: Recording direct material, direet labor and overhead costs in the general journal. Required: Make debit and credit journal entries in the General Journal in Packet 2 to record the 1) materials, 2) labor and 3) manufacturing overhead amounts incurred and shown on the job cost records in Part A. You do not have to provide explanations for the journal entries. The first entry has been provided as an example. Note: . Journal entries are typically presented in chronological order. For this part of the problem, it will be easier to make all the entries that pertain to raw materials, then make the labor entries, then make the entries for the allocation of overhead. Amounts for material and labor and overhead should be recorded separately, but it is OK to combine material amounts if they occurred on the same date. For example, the journal entry for recording materials that date (998 $425). See the example entry. Labor costs are recorded at the end of the pay period and paid at a later date. All amounts for a given pay made fora 40 period should be recorded as one transaction. For example, only one entry would be made to record labor costs for the pay period ending on 214The entry would combine amounts from Job 1 and Job 2, for a total of $7,900 ($1,700+ S6,200). Part C: Recording other transactions in the general journal. Required: Record the transactions listed below in the General Journal in Packet 2. Feb 4, 2017 Rubber pellets and sheets were purchased on account for $32,000, delivered, and placed into storage. Raw materials with a cost of 1 production area. The materials were all indirect materials Job I was completed and moved to finished goods storage. Hint: The cost of the completed job is on the job cost record for Job 1. Job I was sold on account for a price of S12 per pair of flip-flops. Hint: Remember to Feb 6, 2017 Feb 14, 2017 Feb 18, 2017 make two journal entries: one to record the sale and one to record the cost of the sale. Job 2 was completed Feb 20, 2017 , 2e17 Wages payable for the pay period ending on 2/14 were paid in cash. Hint: Look at the Feb 21, journal entry made on 2/14 in Part B to record direct labor. Chris attended a regional trade show to promote Fashion Forward Flip-Flops. The cost of Feb 22, 2017 Feb 28, 2017 Feb 28, 2017 Feb 28, 2017 1056 related to his work in the flip-flop manufacturing facility). The firm received a $9,500 plant utility bill that will be paid at a later date. Depreciation on the plant building and equipment for the month of February of $7.200 travel to, and registration for, the show was $950. The cost of the trip was paid in cash. Chris was paid a salary of$2,000 in cash (90% related to administrative activities and aed