Answered step by step

Verified Expert Solution

Question

1 Approved Answer

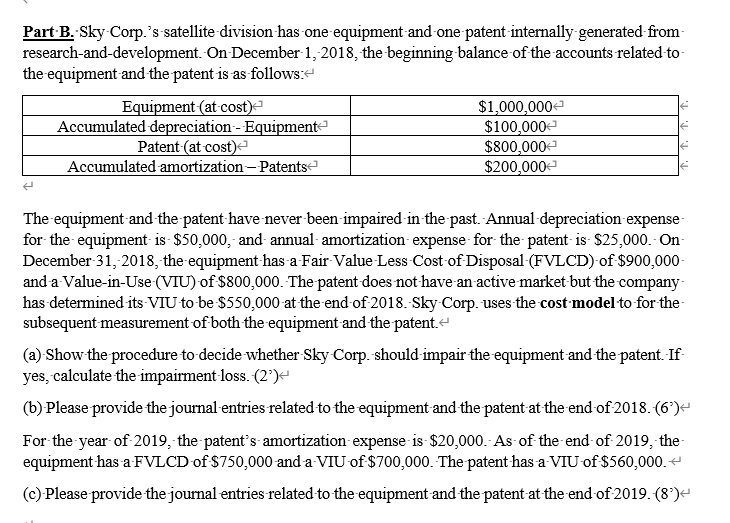

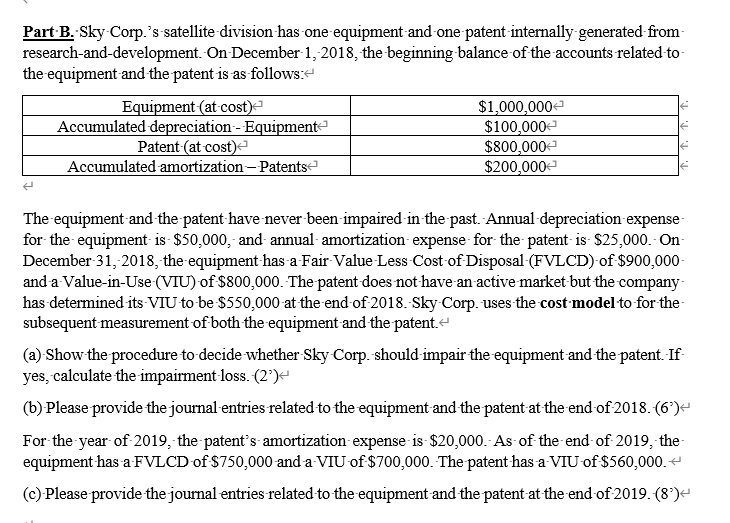

Part B. Sky-Corp.'s satellite division has one equipment and one patent internally-generated from research-and-development. On December 1, 2018, the beginning balance of the accounts related

Part B. Sky-Corp.'s satellite division has one equipment and one patent internally-generated from research-and-development. On December 1, 2018, the beginning balance of the accounts related to the equipment and the patent is as follows: < Equipment (at cost) < Accumulated depreciation - Equipment Patent (at cost) Accumulated amortization-Patents $1,000,000 $100,000 $800,000 $200,000 The equipment and the patent have never been impaired in the past. Annual depreciation expense for the equipment is $50,000, and annual amortization expense for the patent- is $25,000.- On- December 31, 2018, the equipment has a Fair Value Less Cost of Disposal (FVLCD) of $900,000- and-a-Value-in-Use-(VIU) of $800,000. The patent does not have an active market but the company has determined its VIU to be $550,000 at the end of 2018. Sky Corp. uses the cost model to for the subsequent measurement of both the equipment and the patent. < (a)-Show the procedure to decide whether Sky Corp. should impair the equipment and the patent. -If- yes, calculate the impairment-loss. (2') < (b) Please provide the journal entries related to the equipment and the patent at the end of 2018. (6') < For the year of 2019, the patent's amortization expense is $20,000. As of the end of 2019, the equipment has a FVLCD of $750,000 and a VIU of $700,000. The patent has a VIU of $560,000. < (c) Please provide the journal entries related to the equipment and the patent at the end of 2019. (8')

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started