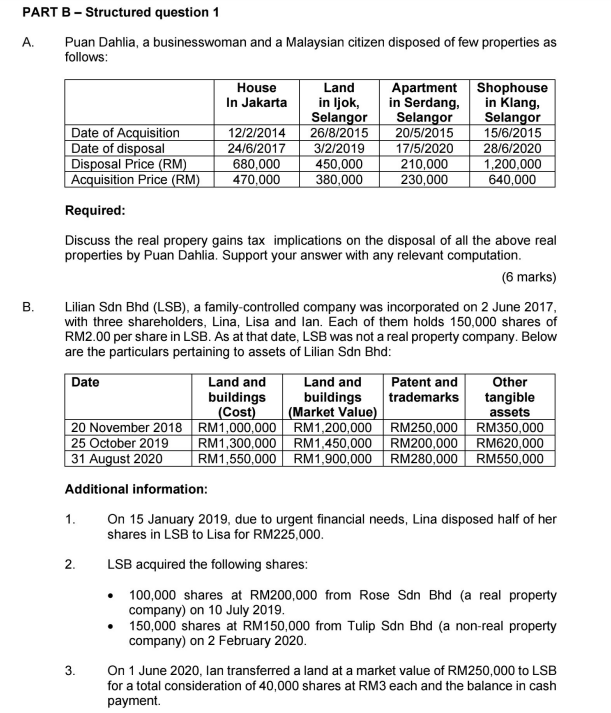

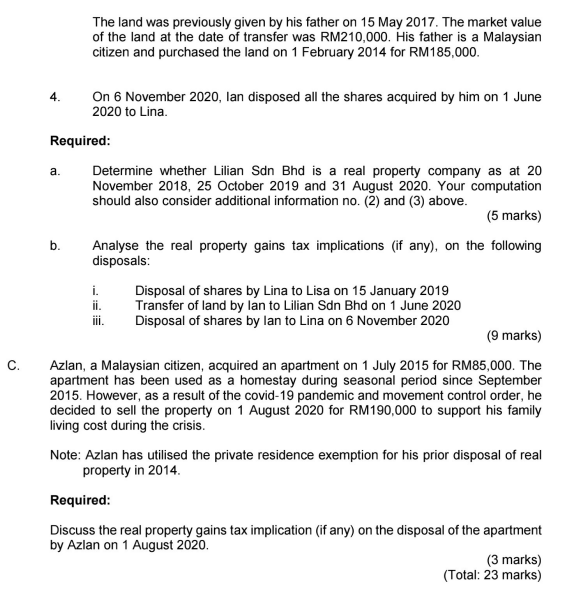

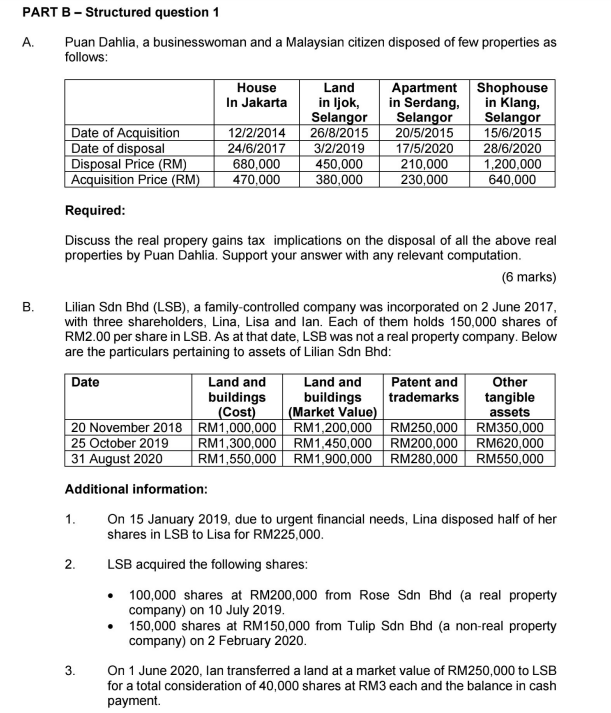

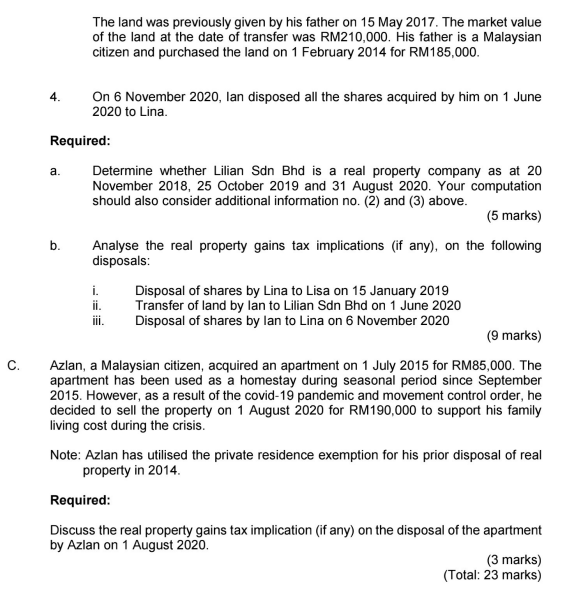

PART B - Structured question 1 A. Puan Dahlia, a businesswoman and a Malaysian citizen disposed of few properties as follows: House In Jakarta Land in Ijok, Selangor 26/8/2015 Apartment Shophouse in Serdang, Selangor 20/5/2015 in Klang, Selangor 12/2/2014 15/6/2015 24/6/2017 3/2/2019 17/5/2020 28/6/2020 Date of Acquisition Date of disposal Disposal Price (RM) Acquisition Price (RM) 680,000 450,000 210,000 1,200,000 470,000 380,000 230,000 640,000 Required: Discuss the real propery gains tax implications on the disposal of all the above real properties by Puan Dahlia. Support your answer with any relevant computation. (6 marks) B. Lilian Sdn Bhd (LSB), a family-controlled company was incorporated on 2 June 2017, with three shareholders, Lina, Lisa and lan. Each of them holds 150,000 shares of RM2.00 per share in LSB. As at that date, LSB was not a real property company. Below are the particulars pertaining to assets of Lilian Sdn Bhd: Date Land and Land and Patent and trademarks Other tangible buildings (Market Value) assets buildings (Cost) RM1,000,000 RM1,300,000 RM1,450,000 RM200,000 RM620,000 RM1,550,000 RM1,900,000 RM280,000 RM550,000 20 November 2018 25 October 2019 31 August 2020 RM1,200,000 RM250,000 RM350,000 Additional information: 1. On 15 January 2019, due to urgent financial needs, Lina disposed half of her shares in LSB to Lisa for RM225,000. 2. LSB acquired the following shares: 100,000 shares at RM200,000 from Rose Sdn Bhd (a real property company) on 10 July 2019. 150,000 shares at RM150,000 from Tulip Sdn Bhd (a non-real property company) on 2 February 2020. 3. On 1 June 2020, lan transferred a land at a market value of RM250,000 to LSB for a total consideration of 40,000 shares at RM3 each and the balance in cash payment. The land was previously given by his father on 15 May 2017. The market value of the land at the date of transfer was RM210,000. His father is a Malaysian citizen and purchased the land on 1 February 2014 for RM185,000. 4. On 6 November 2020, lan disposed all the shares acquired by him on 1 June 2020 to Lina. Required: a. Determine whether Lilian Sdn Bhd is a real property company as at 20 November 2018, 25 October 2019 and 31 August 2020. Your computation should also consider additional information no. (2) and (3) above. (5 marks) b. Analyse the real property gains tax implications (if any), on the following disposals: i. Disposal of shares by Lina to Lisa on 15 January 2019 Transfer of land by lan to Lilian Sdn Bhd on 1 June 2020 Disposal of shares by lan to Lina on 6 November 2020 iii. (9 marks) C. Azlan, a Malaysian citizen, acquired an apartment on 1 July 2015 for RM85,000. The apartment has been used as a homestay during seasonal period since September 2015. However, as a result of the covid-19 pandemic and movement control order, he decided to sell the property on 1 August 2020 for RM190,000 to support his family living cost during the crisis. Note: Azlan has utilised the private residence exemption for his prior disposal of real property in 2014. Required: Discuss the real property gains tax implication (if any) on the disposal of the apartment by Azlan on 1 August 2020. (3 marks) (Total: 23 marks) PART B - Structured question 1 A. Puan Dahlia, a businesswoman and a Malaysian citizen disposed of few properties as follows: House In Jakarta Land in Ijok, Selangor 26/8/2015 Apartment Shophouse in Serdang, Selangor 20/5/2015 in Klang, Selangor 12/2/2014 15/6/2015 24/6/2017 3/2/2019 17/5/2020 28/6/2020 Date of Acquisition Date of disposal Disposal Price (RM) Acquisition Price (RM) 680,000 450,000 210,000 1,200,000 470,000 380,000 230,000 640,000 Required: Discuss the real propery gains tax implications on the disposal of all the above real properties by Puan Dahlia. Support your answer with any relevant computation. (6 marks) B. Lilian Sdn Bhd (LSB), a family-controlled company was incorporated on 2 June 2017, with three shareholders, Lina, Lisa and lan. Each of them holds 150,000 shares of RM2.00 per share in LSB. As at that date, LSB was not a real property company. Below are the particulars pertaining to assets of Lilian Sdn Bhd: Date Land and Land and Patent and trademarks Other tangible buildings (Market Value) assets buildings (Cost) RM1,000,000 RM1,300,000 RM1,450,000 RM200,000 RM620,000 RM1,550,000 RM1,900,000 RM280,000 RM550,000 20 November 2018 25 October 2019 31 August 2020 RM1,200,000 RM250,000 RM350,000 Additional information: 1. On 15 January 2019, due to urgent financial needs, Lina disposed half of her shares in LSB to Lisa for RM225,000. 2. LSB acquired the following shares: 100,000 shares at RM200,000 from Rose Sdn Bhd (a real property company) on 10 July 2019. 150,000 shares at RM150,000 from Tulip Sdn Bhd (a non-real property company) on 2 February 2020. 3. On 1 June 2020, lan transferred a land at a market value of RM250,000 to LSB for a total consideration of 40,000 shares at RM3 each and the balance in cash payment. The land was previously given by his father on 15 May 2017. The market value of the land at the date of transfer was RM210,000. His father is a Malaysian citizen and purchased the land on 1 February 2014 for RM185,000. 4. On 6 November 2020, lan disposed all the shares acquired by him on 1 June 2020 to Lina. Required: a. Determine whether Lilian Sdn Bhd is a real property company as at 20 November 2018, 25 October 2019 and 31 August 2020. Your computation should also consider additional information no. (2) and (3) above. (5 marks) b. Analyse the real property gains tax implications (if any), on the following disposals: i. Disposal of shares by Lina to Lisa on 15 January 2019 Transfer of land by lan to Lilian Sdn Bhd on 1 June 2020 Disposal of shares by lan to Lina on 6 November 2020 iii. (9 marks) C. Azlan, a Malaysian citizen, acquired an apartment on 1 July 2015 for RM85,000. The apartment has been used as a homestay during seasonal period since September 2015. However, as a result of the covid-19 pandemic and movement control order, he decided to sell the property on 1 August 2020 for RM190,000 to support his family living cost during the crisis. Note: Azlan has utilised the private residence exemption for his prior disposal of real property in 2014. Required: Discuss the real property gains tax implication (if any) on the disposal of the apartment by Azlan on 1 August 2020. (3 marks) (Total: 23 marks)