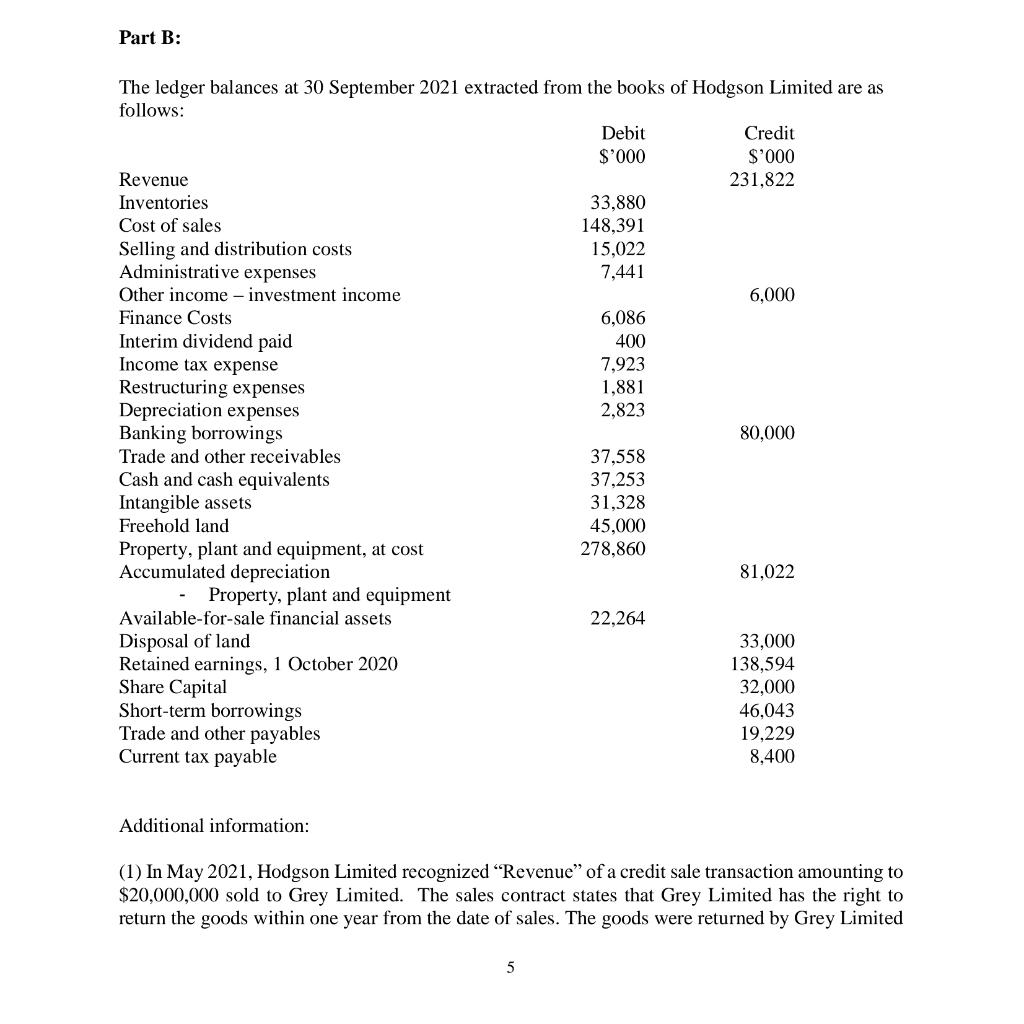

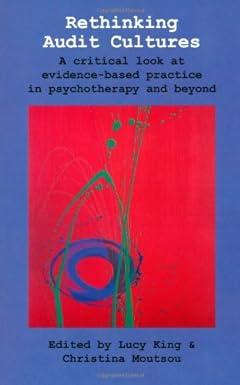

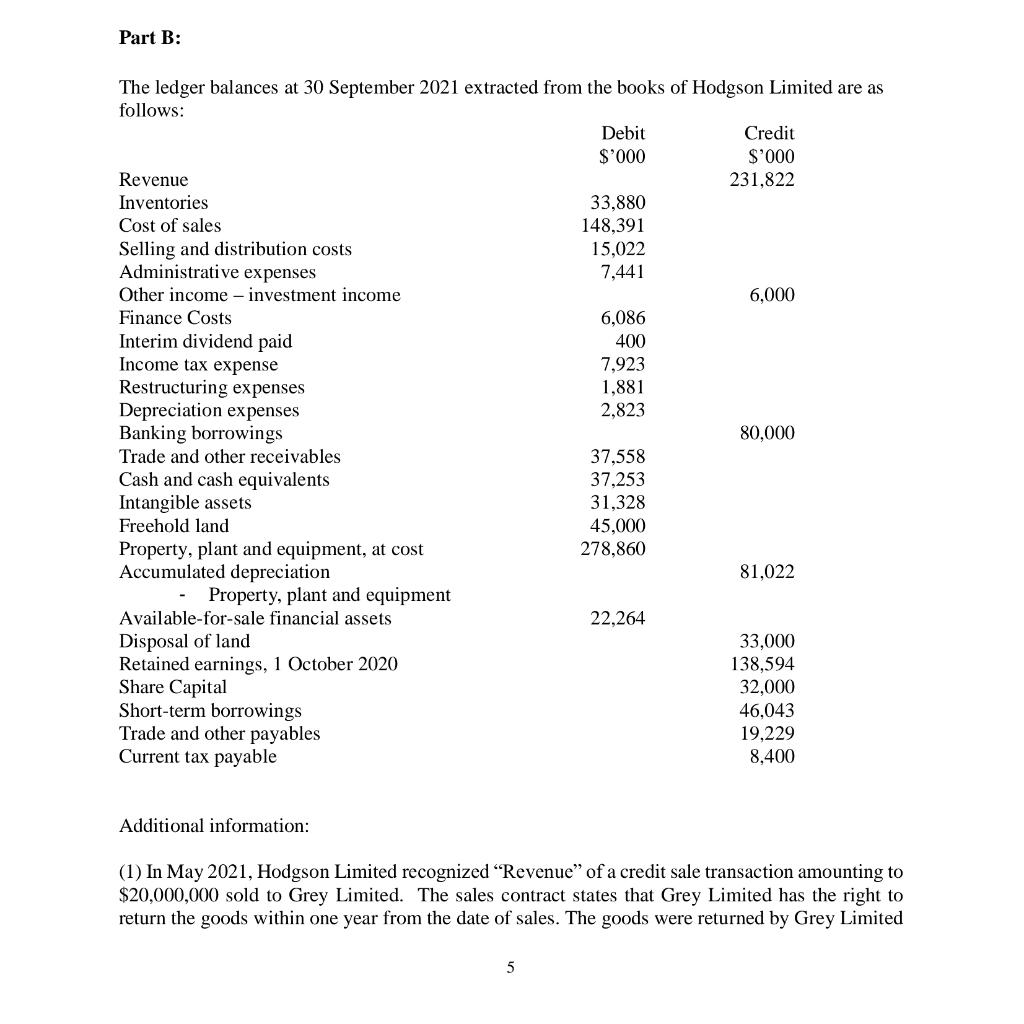

Part B: The ledger balances at 30 September 2021 extracted from the books of Hodgson Limited are as follows: Debit Credit $'000 $'000 Revenue 231,822 Inventories 33,880 Cost of sales 148,391 Selling and distribution costs 15,022 Administrative expenses 7,441 Other income - investment income 6,000 Finance Costs 6,086 Interim dividend paid 400 Income tax expense 7,923 Restructuring expenses 1,881 Depreciation expenses 2,823 Banking borrowings 80,000 Trade and other receivables 37,558 Cash and cash equivalents 37,253 Intangible assets 31,328 Freehold land 45,000 Property, plant and equipment, at cost 278,860 Accumulated depreciation 81,022 Property, plant and equipment Available-for-sale financial assets 22,264 Disposal of land 33.000 Retained earnings, 1 October 2020 138,594 Share Capital 32,000 Short-term borrowings 46,043 Trade and other payables 19,229 Current tax payable 8,400 Additional information: (1) In May 2021, Hodgson Limited recognized "Revenue" of a credit sale transaction amounting to $20,000,000 sold to Grey Limited. The sales contract states that Grey Limited has the right to return the goods within one year from the date of sales. The goods were returned by Grey Limited 5 Intermediate Accounting 1 Assignment 2 2021-22 Sem2 in July but all the relevant transactions have not been recorded. Cost of the related sales amounted to $12,800,000. (2) Hodgson Limited uses perpetual system to record inventories. (3) Depreciation charges on all items of property, plant and equipment for the year ended 30 September 2021 have been made before the extraction of ledger balances. Depreciation charges are to be grouped under "Administrative expense" in the financial statement. (4) "Bank borrowings represent a bank loan. $10,000,000 will become due during the year ending 30 September 2022. (5) The fair value of the "financial asscts at 30 September 2021 is close to their carrying amounts. (6)" Disposal of land" represents the sales proceeds of a plot of freehold land sold during the year ended 30 September 2021. The cost of land was $28,500,000. The land is held for sale. Required: Prepare the Statement of Comprehensive Income (using function of expenses method) for the year ended 30 September 2021 and the Statement of Financial Position as at 30 September 2021 of Hodgson Limited. You are required to present the figures in thousands. Your presentation of the two statements has to comply with the format required under IFRS (please refer to Chapter 2 & 3, Spiceland). 6 Part B: The ledger balances at 30 September 2021 extracted from the books of Hodgson Limited are as follows: Debit Credit $'000 $'000 Revenue 231,822 Inventories 33,880 Cost of sales 148,391 Selling and distribution costs 15,022 Administrative expenses 7,441 Other income - investment income 6,000 Finance Costs 6,086 Interim dividend paid 400 Income tax expense 7,923 Restructuring expenses 1,881 Depreciation expenses 2,823 Banking borrowings 80,000 Trade and other receivables 37,558 Cash and cash equivalents 37,253 Intangible assets 31,328 Freehold land 45,000 Property, plant and equipment, at cost 278,860 Accumulated depreciation 81,022 Property, plant and equipment Available-for-sale financial assets 22,264 Disposal of land 33.000 Retained earnings, 1 October 2020 138,594 Share Capital 32,000 Short-term borrowings 46,043 Trade and other payables 19,229 Current tax payable 8,400 Additional information: (1) In May 2021, Hodgson Limited recognized "Revenue" of a credit sale transaction amounting to $20,000,000 sold to Grey Limited. The sales contract states that Grey Limited has the right to return the goods within one year from the date of sales. The goods were returned by Grey Limited 5 Intermediate Accounting 1 Assignment 2 2021-22 Sem2 in July but all the relevant transactions have not been recorded. Cost of the related sales amounted to $12,800,000. (2) Hodgson Limited uses perpetual system to record inventories. (3) Depreciation charges on all items of property, plant and equipment for the year ended 30 September 2021 have been made before the extraction of ledger balances. Depreciation charges are to be grouped under "Administrative expense" in the financial statement. (4) "Bank borrowings represent a bank loan. $10,000,000 will become due during the year ending 30 September 2022. (5) The fair value of the "financial asscts at 30 September 2021 is close to their carrying amounts. (6)" Disposal of land" represents the sales proceeds of a plot of freehold land sold during the year ended 30 September 2021. The cost of land was $28,500,000. The land is held for sale. Required: Prepare the Statement of Comprehensive Income (using function of expenses method) for the year ended 30 September 2021 and the Statement of Financial Position as at 30 September 2021 of Hodgson Limited. You are required to present the figures in thousands. Your presentation of the two statements has to comply with the format required under IFRS (please refer to Chapter 2 & 3, Spiceland). 6