Part B : The second part of this assignment is very similar to Part A (which is below) . You may reference the solution to

Part B:

The second part of this assignment is very similar to Part A (which is below). You may reference the solution to the transaction analysis spreadsheet from Part A to help you in Part B. Your assignment in Part B is to first prepare journal entries in the General Journal tab of this spreadsheet for the same transactions that you analyzed in Part A. After preparing your journal entries, post your entries to the T-accounts in the General Ledger (T-Accounts) tab. Start by inserting the beginning balances in the T-accounts from the Year 0 Balance Sheet and then post your journal entries from the General Journal. Next, calculate the ending balance in each account. Then, prepare Year 1 financial statements based on the ending balances in each T-account. Finally, go back to the General Journal and prepare closing entries. Post your closing entries to the General Ledger T-accounts. Finally, prepare a Post-Closing Trial Balance.

Hints:

Whenever possible, use formulas to reference cells. This not only reduces the likelihood of error, it makes it easier for us to understand why you got the number you did. This applies to all assignments.

Use dates or transaction numbers in your T-accounts to facilitate tracing your journal entries to the T-accounts.

Note that when you prepare closing entries, you will calculate a new (final) balance in retained earnings. This is the balance that should appear in your balance sheet.

Note that there are multiple tabs involved in this assignment, so be sure to look at every tab to make sure you have completed everything.

If you need tutorials on excel, visit https://support.office.com/en-us/article/Excel-video-training-9bc05390-e94c-46af-a5b3-d7c22f6990bb?ui=en-US&rs=en-US&ad=US

-------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------

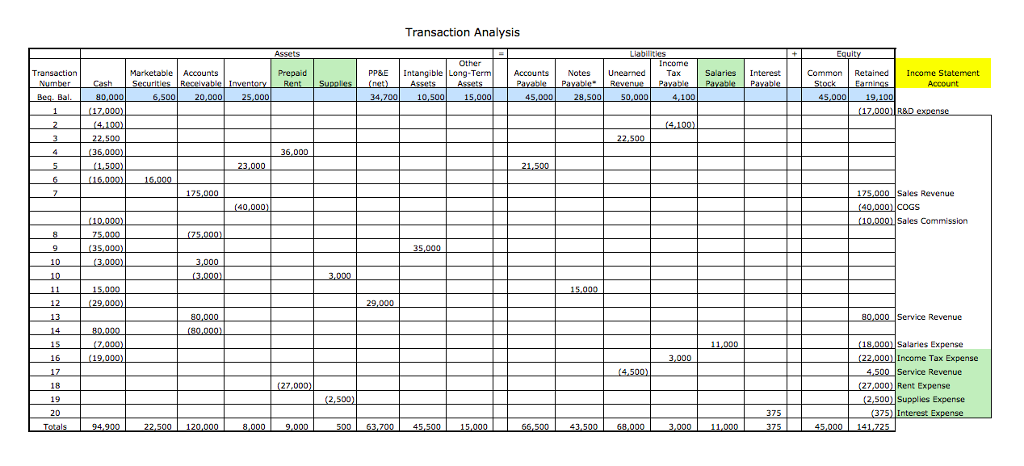

PART A (chart answer key shown below):

(Non-essential info. Only adding just in case):

Part A Instructions (which is already done above on the chart):

Adomain is a start-up company that started last year, in Year 0. You are assigned to make the necessary adjustments for Adomain in Year 1. In the following tabs you will be given Adomain's Year 0 Balance Sheet and Income Statement, as well as a list of transactions for Year 1. You are also given a blank transaction analysis sheet where you should record the Year 1 transactions. The transaction analysis page, if used correctly, will help you determine the ending balances in all accounts.

The transactions include normal economic events during the course of the year and adjustments that need to be recorded at the end of the year (HINT: There are adjusting adjustments, which are transactions 3, 4, 10 and 11. You will need to consider the facts on your own to determine the adjustments).

Transaction Analysis Assets Other Income Prepaid PPBE Intangible Long-Term Transaction Accounts Notes Unearned Tax Salaries Interest Common Retained Income Statement 21.500 Sales Revenue COGS Sales Commission (1nonu) .triteke, 35,000 3,000 Service Revenue 22,000! Income Tax Expense 4,500 Service Revenue 7.000) Rent Expense 2,500) Supplies Expense 27.000 375 Interest 00 142 Transaction Analysis Assets Other Income Prepaid PPBE Intangible Long-Term Transaction Accounts Notes Unearned Tax Salaries Interest Common Retained Income Statement 21.500 Sales Revenue COGS Sales Commission (1nonu) .triteke, 35,000 3,000 Service Revenue 22,000! Income Tax Expense 4,500 Service Revenue 7.000) Rent Expense 2,500) Supplies Expense 27.000 375 Interest 00 142Step by Step Solution

There are 3 Steps involved in it

Step: 1

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started