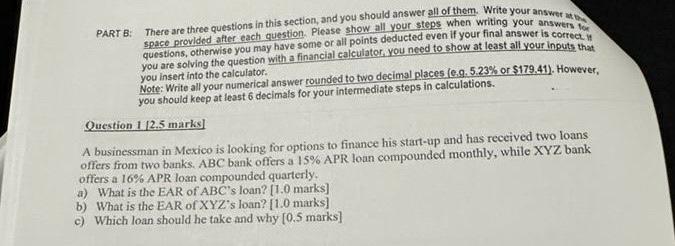

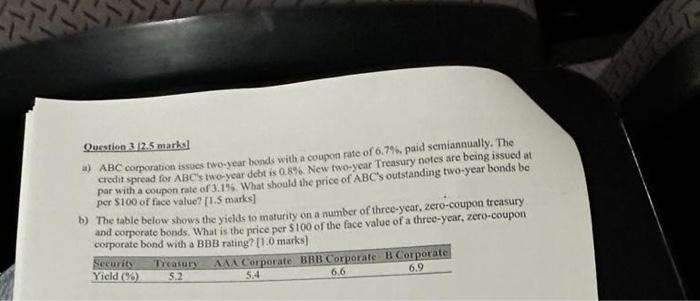

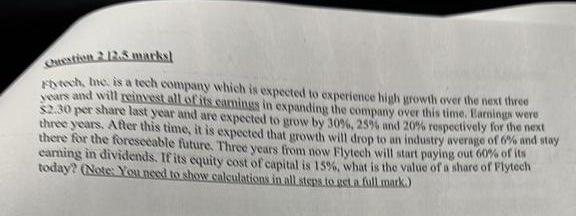

PART B: There are three questions in this section, and you should answer all of them. Write your answer at by space provided after each question. Piease show all your steps when writing your answers tor questions, otherwise you may have some or all points deducted even you need to show at least all your inputs that you are solving the question with a financial calculator, you neced so she you insert into the calculator. Note: Write all your numerical answer rounded to two decimal places (e.g. 5.23. you should keep at least 6 decimals for your intermediate steps in calculations. Question 1 [2.5 marks] A businessman in Mexico is looking for options to finance his start-up and has received two loans offers from two banks. ABC bank offers a I 5% APR loan compounded monthly, while XYZ bank offers a 16% APR loan compounded quarterly. a) What is the EAR of ABC's loan? [1.0 marks] b) What is the EAR of XYZ's loan? [1.0 marks] c) Which loan should he take and why [0.5 marks] Question 3/12.5 marks a) ABC corporation issues two-year bonds with a coupon rate of 6.7%, paid scmiannually. The crodit spread for ABC's two-year debt is 0.8%. New two-year Treasury notes are being issued at par with a coupon rate of 3.1%. What should the price of ABC s outstanding two-year bonds be per $100 of face value? [1.5 marks] b) The table below shows the yiclds to maturity on a number of three-year, zero-coupon treasury and corporate bonds. What is the price per $100 of the face value of a three-year, zero-coupon comarate bond with a BBB ratins? [1.0 marks] ousatisu 2.12 .5 mantas Notech, the is a tech eompany which is expected to experience high growth over the next three years and will reiowest all of its camings in expanding the company over this time. Earninger were \$2.30 per share last year and are expected to grow by 30%,25% and 20% respectively for the next three years, After this time, it is expected that growth will drop to an industry average of 6% and stay there for the foresceable future. Three years from now Flytech will start paying out 60% of its caming in dividends. If its equity cast of capital is 15%, what is the value of a share of Plytech today? (Nose: Youned to show calsulations inall steps to get a full moakd) PART B: There are three questions in this section, and you should answer all of them. Write your answer at by space provided after each question. Piease show all your steps when writing your answers tor questions, otherwise you may have some or all points deducted even you need to show at least all your inputs that you are solving the question with a financial calculator, you neced so she you insert into the calculator. Note: Write all your numerical answer rounded to two decimal places (e.g. 5.23. you should keep at least 6 decimals for your intermediate steps in calculations. Question 1 [2.5 marks] A businessman in Mexico is looking for options to finance his start-up and has received two loans offers from two banks. ABC bank offers a I 5% APR loan compounded monthly, while XYZ bank offers a 16% APR loan compounded quarterly. a) What is the EAR of ABC's loan? [1.0 marks] b) What is the EAR of XYZ's loan? [1.0 marks] c) Which loan should he take and why [0.5 marks] Question 3/12.5 marks a) ABC corporation issues two-year bonds with a coupon rate of 6.7%, paid scmiannually. The crodit spread for ABC's two-year debt is 0.8%. New two-year Treasury notes are being issued at par with a coupon rate of 3.1%. What should the price of ABC s outstanding two-year bonds be per $100 of face value? [1.5 marks] b) The table below shows the yiclds to maturity on a number of three-year, zero-coupon treasury and corporate bonds. What is the price per $100 of the face value of a three-year, zero-coupon comarate bond with a BBB ratins? [1.0 marks] ousatisu 2.12 .5 mantas Notech, the is a tech eompany which is expected to experience high growth over the next three years and will reiowest all of its camings in expanding the company over this time. Earninger were \$2.30 per share last year and are expected to grow by 30%,25% and 20% respectively for the next three years, After this time, it is expected that growth will drop to an industry average of 6% and stay there for the foresceable future. Three years from now Flytech will start paying out 60% of its caming in dividends. If its equity cast of capital is 15%, what is the value of a share of Plytech today? (Nose: Youned to show calsulations inall steps to get a full moakd)