Question

Part B: What is the PV of a 4-year 6.5% coupon bond using forward rates (use par= 100)? 2. Suppose that an investor purchases a

Part B: What is the PV of a 4-year 6.5% coupon bond using forward rates (use par= 100)?

2. Suppose that an investor purchases a 6% coupon bond with 20 years to maturity at a price of $89.32 per $ 100 par value. The yield to maturity for this bond is 7%. Determine the dollar return that must be generated from reinvestment income in order to generate a yield of 7% and the % of the reinvestment income relative to the total dollar return needed to generate a 7% yield. Use semi-annual compounding. (since the bond is a discount, you need to factor in capital gains at the time of maturity)

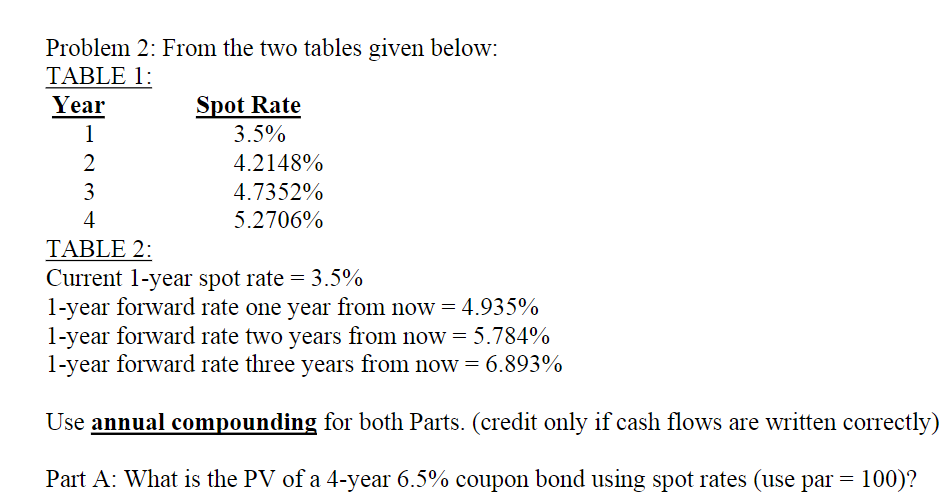

1 Problem 2: From the two tables given below: TABLE 1: Year Spot Rate 3.5% 2 4.2148% 3 4.7352% 4 5.2706% TABLE 2: Current 1-year spot rate = 3.5% 1-year forward rate one year from now = 4.935% 1-year forward rate two years from now = 5.784% 1-year forward rate three years from now = 6.893% Use annual compounding for both Parts. (credit only if cash flows are written correctly) Part A: What is the PV of a 4-year 6.5% coupon bond using spot rates (use par = 100)? 1 Problem 2: From the two tables given below: TABLE 1: Year Spot Rate 3.5% 2 4.2148% 3 4.7352% 4 5.2706% TABLE 2: Current 1-year spot rate = 3.5% 1-year forward rate one year from now = 4.935% 1-year forward rate two years from now = 5.784% 1-year forward rate three years from now = 6.893% Use annual compounding for both Parts. (credit only if cash flows are written correctly) Part A: What is the PV of a 4-year 6.5% coupon bond using spot rates (use par = 100)Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started