Answered step by step

Verified Expert Solution

Question

1 Approved Answer

Part C (1) Only need part C (2) Part C (1) Chapter 6 Journal entries for Capital Projects Fund transactions At the start of 2019,

Part C (1)

Only need part C (2)

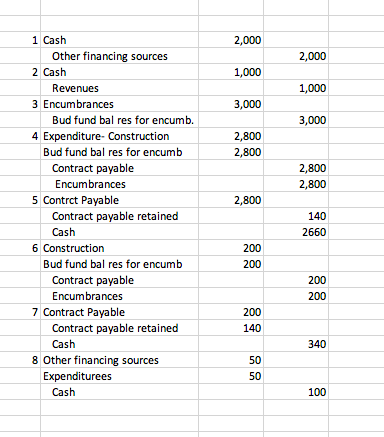

Part C (1) Chapter 6 Journal entries for Capital Projects Fund transactions At the start of 2019, Croton's Capital Projects Fund had no assets or liabilities. Prepare appropriate journal en- tries to record these transactions in the Capital Projects Fund. (We suggest you post the journal entries to general ledger T-accounts.) 1. Croton undertook construction of a new police station, designed to house both the Croton police and the county sheriff and to serve as a detention center. To finance construction, Croton received a cash grant of $1,000 from the county as an advance pending incurrence of expenditures. It also sold $2,000 of 20-year general obligation bonds. The bonds, sold April 1, 2019, were to be redeemed in equal semiannual install- ments of principal, with interest on the unpaid balance at the rate of 5 percent per annum, starting October 1, 2019. 2. Croton awarded two contracts, one for architectural and construction supervision services ($200) and one for construction ($2,800). 3. The construction contract was completed in a timely manner, and the contractor submitted an invoice for $2,800. The invoice was paid, except that 5 percent was withheld, pending completion of inspection. 4. All construction and construction supervision work was completed. The construction architect/supervisor was paid in full, and the contractor was paid the balance due. Part C (2) Chapter 6 Journal entries for Debt Service Fund transactions At the start of 2019, Croton's Debt Service Fund had no assets or liabilities. Prepare appropriate journal entries to record these transactions in the Debt Service Fund and where appropriate, in the General Fund. (We suggest you post opening balances and the journal entries to general ledger T-accounts.) 1. The General Fund transferred $1,200 cash to the Debt Service Fund. 2. The first installment of principal and interest on the bonds sold in Part C (1) came due for payment. 3. The principal and interest due for payment were paid. 4. Debt service on bonds sold by Croton in previous years came due and was paid. Principal and interest pay- ments on those bonds were $600 and $470, respectively. 2,000 2,000 1,000 1,000 3,000 3,000 2,800 2,800 2,800 2,800 2,800 1 Cash Other financing sources 2 Cash Revenues 3 Encumbrances Bud fund bal res for encumb. 4 Expenditure- Construction Bud fund bal res for encumb Contract payable Encumbrances 5 Contrct Payable Contract payable retained Cash 6 Construction Bud fund bal res for encumb Contract payable Encumbrances 7 Contract Payable Contract payable retained Cash 8 Other financing sources Expenditurees Cash 140 2660 200 200 200 Part C (1) Chapter 6 Journal entries for Capital Projects Fund transactions At the start of 2019, Croton's Capital Projects Fund had no assets or liabilities. Prepare appropriate journal en- tries to record these transactions in the Capital Projects Fund. (We suggest you post the journal entries to general ledger T-accounts.) 1. Croton undertook construction of a new police station, designed to house both the Croton police and the county sheriff and to serve as a detention center. To finance construction, Croton received a cash grant of $1,000 from the county as an advance pending incurrence of expenditures. It also sold $2,000 of 20-year general obligation bonds. The bonds, sold April 1, 2019, were to be redeemed in equal semiannual install- ments of principal, with interest on the unpaid balance at the rate of 5 percent per annum, starting October 1, 2019. 2. Croton awarded two contracts, one for architectural and construction supervision services ($200) and one for construction ($2,800). 3. The construction contract was completed in a timely manner, and the contractor submitted an invoice for $2,800. The invoice was paid, except that 5 percent was withheld, pending completion of inspection. 4. All construction and construction supervision work was completed. The construction architect/supervisor was paid in full, and the contractor was paid the balance due. Part C (2) Chapter 6 Journal entries for Debt Service Fund transactions At the start of 2019, Croton's Debt Service Fund had no assets or liabilities. Prepare appropriate journal entries to record these transactions in the Debt Service Fund and where appropriate, in the General Fund. (We suggest you post opening balances and the journal entries to general ledger T-accounts.) 1. The General Fund transferred $1,200 cash to the Debt Service Fund. 2. The first installment of principal and interest on the bonds sold in Part C (1) came due for payment. 3. The principal and interest due for payment were paid. 4. Debt service on bonds sold by Croton in previous years came due and was paid. Principal and interest pay- ments on those bonds were $600 and $470, respectively. 2,000 2,000 1,000 1,000 3,000 3,000 2,800 2,800 2,800 2,800 2,800 1 Cash Other financing sources 2 Cash Revenues 3 Encumbrances Bud fund bal res for encumb. 4 Expenditure- Construction Bud fund bal res for encumb Contract payable Encumbrances 5 Contrct Payable Contract payable retained Cash 6 Construction Bud fund bal res for encumb Contract payable Encumbrances 7 Contract Payable Contract payable retained Cash 8 Other financing sources Expenditurees Cash 140 2660 200 200 200Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started