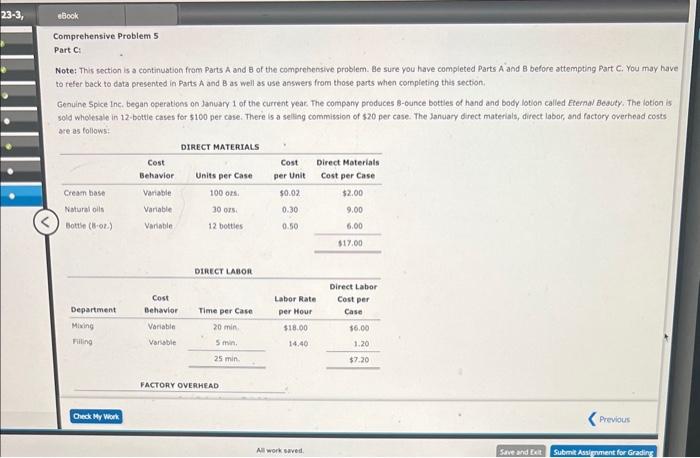

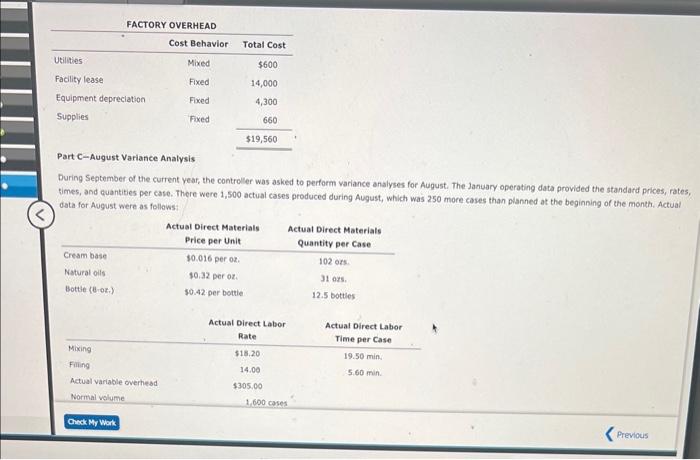

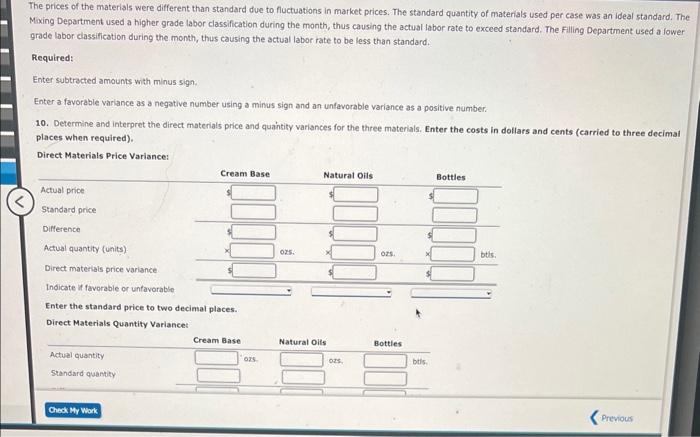

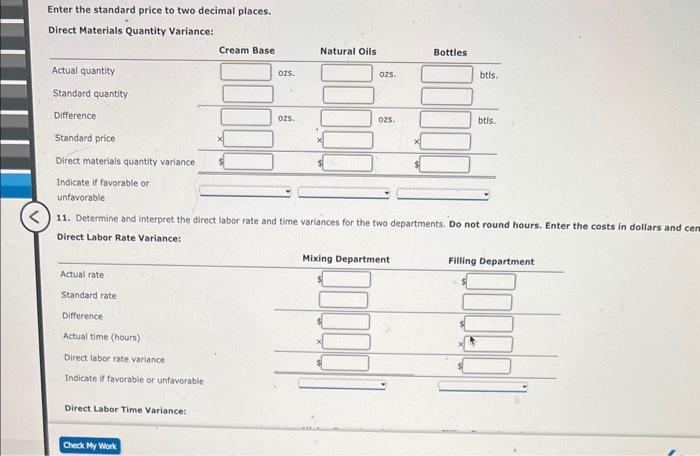

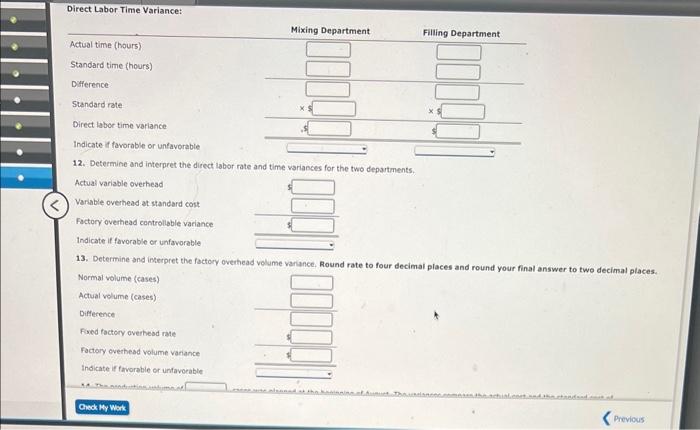

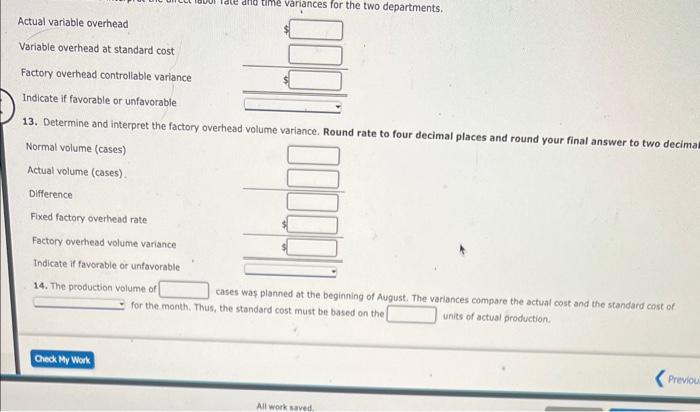

Part C: Note: This section is a continuation from Parts A and B of the comprehensive problem. Be sure you have completed Parts A and B before attempting Part C. You may have to refer back to data presented in Parts A and B as well as use answers from those parts when corppieting thes section. Genuine spice Inc, began operations on January 1 of the current yeac. The compsny produces a-ounce bottles of hand and body lobon called Etemal Beauty. The lotion is sold wholesale in 12 -bottie cases for $100 per case. There is a selling commitsion of $20 per case. The jandary direct materials, direct labor, and factory owerhead costs are as follows? Part C-August Variance Analysis During September of the current year, the controller was asked to perform variance analyses for August. The January operating data provided the standard prices, rates, times, and cuantities per case. There were 1,500 actual cases produced during August, which was 250 more cases than planned at the beginning of the month, Actual data for August were as follows: The prices of the materials were different than standard due to fluctuations in market prices. The standard quantity of materials used per case was an ideal standard. The Maxing Department used a higher grade labor classification during the month, thus causing the actual labor rate to exceed standard. The Filling Department used a fower grade labor classification during the month, thus causing the actual labor rate to be less than standard. Requiredt Enter subtrected amounts with minus sign. Enter a favorable variance as a negative number using a minus sign and an unfavorable variance as a positive number: 10. Determine and interpret the direct materials price and quantity variances for the three materials. Enter the costs in dollars and cents (carried to three decimat places when required). Enter the standard price to two decimal places. Direct Materials Quantity Variance: 11. Determine and interpret the direct labor rate and time variances for the two departments. Do not round hours. Enter the costs in dollars and cei Direct Labor Rate Variance: Direct Labor Time Variance: 12. Determine and interpret the direct labor rate and time variances for the two departments. 13. Determine and interpret the factory overhead volume variance. Round rate to four decimal places and round your final answer to two decima 14. The production volume of cases was planned at the beginning of August. The variances compare the actual cost and the standard cost of for the month. Thus, the standard cost must be based on the units of actual production. Part C: Note: This section is a continuation from Parts A and B of the comprehensive problem. Be sure you have completed Parts A and B before attempting Part C. You may have to refer back to data presented in Parts A and B as well as use answers from those parts when corppieting thes section. Genuine spice Inc, began operations on January 1 of the current yeac. The compsny produces a-ounce bottles of hand and body lobon called Etemal Beauty. The lotion is sold wholesale in 12 -bottie cases for $100 per case. There is a selling commitsion of $20 per case. The jandary direct materials, direct labor, and factory owerhead costs are as follows? Part C-August Variance Analysis During September of the current year, the controller was asked to perform variance analyses for August. The January operating data provided the standard prices, rates, times, and cuantities per case. There were 1,500 actual cases produced during August, which was 250 more cases than planned at the beginning of the month, Actual data for August were as follows: The prices of the materials were different than standard due to fluctuations in market prices. The standard quantity of materials used per case was an ideal standard. The Maxing Department used a higher grade labor classification during the month, thus causing the actual labor rate to exceed standard. The Filling Department used a fower grade labor classification during the month, thus causing the actual labor rate to be less than standard. Requiredt Enter subtrected amounts with minus sign. Enter a favorable variance as a negative number using a minus sign and an unfavorable variance as a positive number: 10. Determine and interpret the direct materials price and quantity variances for the three materials. Enter the costs in dollars and cents (carried to three decimat places when required). Enter the standard price to two decimal places. Direct Materials Quantity Variance: 11. Determine and interpret the direct labor rate and time variances for the two departments. Do not round hours. Enter the costs in dollars and cei Direct Labor Rate Variance: Direct Labor Time Variance: 12. Determine and interpret the direct labor rate and time variances for the two departments. 13. Determine and interpret the factory overhead volume variance. Round rate to four decimal places and round your final answer to two decima 14. The production volume of cases was planned at the beginning of August. The variances compare the actual cost and the standard cost of for the month. Thus, the standard cost must be based on the units of actual production