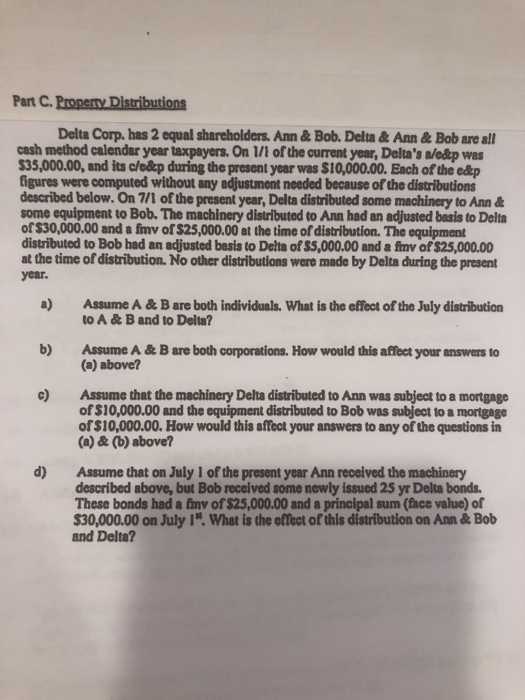

Part C. Properry Distrbutions Delta Corp. has 2 equal shareholders. Ann& Bob. Delta& Ann& Bob are all cash method calendar year taxpayers. On 1/1 of the current year, Delta's a/ekp was 35,000.00, and its cle@cp during the present year was $10,000.00. Each of the edkp figures were computed without any adjustment needed because of the distributions described below. On 7/1 of the present year, Delta distributed some machinery to Ann& some equipment to Bob. The machinery distributed to Ann had an adjusted basis to Delta of $30,000.00 and a fimv of $25,000.00 at the time of distribution. The equipment distributed to Bob had an adjusted basis to Delta of $5,000.00 and a fmv of $25,000.00 at the time of distribution. No other distributions were made by Delta during the present a) Assume A & Bare both individuals. What is the effect of the July distribution Assume A & B are both corporations. How would this affect your answers to year. to A & B and to Delta? b) (a) above? c) Assume that the machinery Delta distributed to Ann was subject to a mortgage of $10,000.00 and the equipment distributed to Bob was subject to a mortgage (a) & (b) above? Assume that on July 1 of the present year Ann received the machinery of$10,000.00. How would this affect your answers to any of the questions in d) described above, but Bob received some newly issued 25 yr Delta bonds These bonds had a imv of $25,000.00 and a principal sum (face value) of $30,000.00 on July It. What is the effect of this distribution on Ann&Bob and Delta? Part C. Properry Distrbutions Delta Corp. has 2 equal shareholders. Ann& Bob. Delta& Ann& Bob are all cash method calendar year taxpayers. On 1/1 of the current year, Delta's a/ekp was 35,000.00, and its cle@cp during the present year was $10,000.00. Each of the edkp figures were computed without any adjustment needed because of the distributions described below. On 7/1 of the present year, Delta distributed some machinery to Ann& some equipment to Bob. The machinery distributed to Ann had an adjusted basis to Delta of $30,000.00 and a fimv of $25,000.00 at the time of distribution. The equipment distributed to Bob had an adjusted basis to Delta of $5,000.00 and a fmv of $25,000.00 at the time of distribution. No other distributions were made by Delta during the present a) Assume A & Bare both individuals. What is the effect of the July distribution Assume A & B are both corporations. How would this affect your answers to year. to A & B and to Delta? b) (a) above? c) Assume that the machinery Delta distributed to Ann was subject to a mortgage of $10,000.00 and the equipment distributed to Bob was subject to a mortgage (a) & (b) above? Assume that on July 1 of the present year Ann received the machinery of$10,000.00. How would this affect your answers to any of the questions in d) described above, but Bob received some newly issued 25 yr Delta bonds These bonds had a imv of $25,000.00 and a principal sum (face value) of $30,000.00 on July It. What is the effect of this distribution on Ann&Bob and Delta