Answered step by step

Verified Expert Solution

Question

1 Approved Answer

part c Question 2 Suppose stock A is currently traded at 100. In one year, its price will be either 110 or 90. The risk-

part c

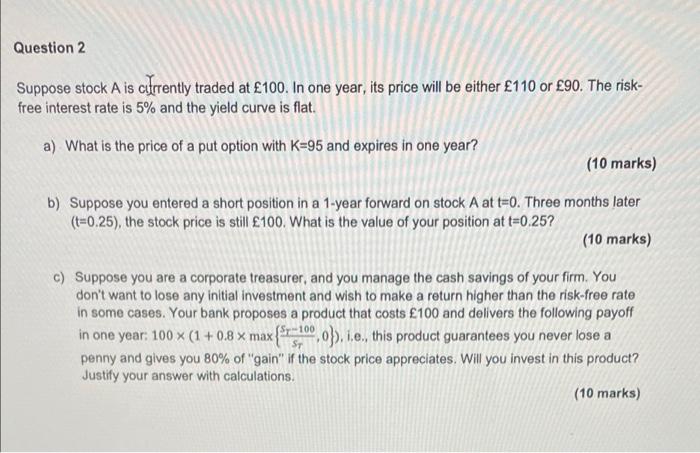

Question 2 Suppose stock A is currently traded at 100. In one year, its price will be either 110 or 90. The risk- free interest rate is 5% and the yield curve is flat. a) What is the price of a put option with K=95 and expires in one year? (10 marks) b) Suppose you entered a short position in a 1-year forward on stock A at t=0. Three months later (t=0.25), the stock price is still 100. What is the value of your position at t=0.25? (10 marks) c) Suppose you are a corporate treasurer, and you manage the cash savings of your firm. You don't want to lose any initial investment and wish to make a return higher than the risk-free rate in some cases. Your bank proposes a product that costs 100 and delivers the following payoff in one year 100% (1 + 0.8 x max {{ $200,0}), i.e., this product guarantees you never lose a penny and gives you 80% of "gain" if the stock price appreciates. Will you invest in this product? Justify your answer with calculations. (10 marks) Sy Question 2 Suppose stock A is currently traded at 100. In one year, its price will be either 110 or 90. The risk- free interest rate is 5% and the yield curve is flat. a) What is the price of a put option with K=95 and expires in one year? (10 marks) b) Suppose you entered a short position in a 1-year forward on stock A at t=0. Three months later (t=0.25), the stock price is still 100. What is the value of your position at t=0.25? (10 marks) c) Suppose you are a corporate treasurer, and you manage the cash savings of your firm. You don't want to lose any initial investment and wish to make a return higher than the risk-free rate in some cases. Your bank proposes a product that costs 100 and delivers the following payoff in one year 100% (1 + 0.8 x max {{ $200,0}), i.e., this product guarantees you never lose a penny and gives you 80% of "gain" if the stock price appreciates. Will you invest in this product? Justify your answer with calculations. (10 marks) Sy

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started