Part c

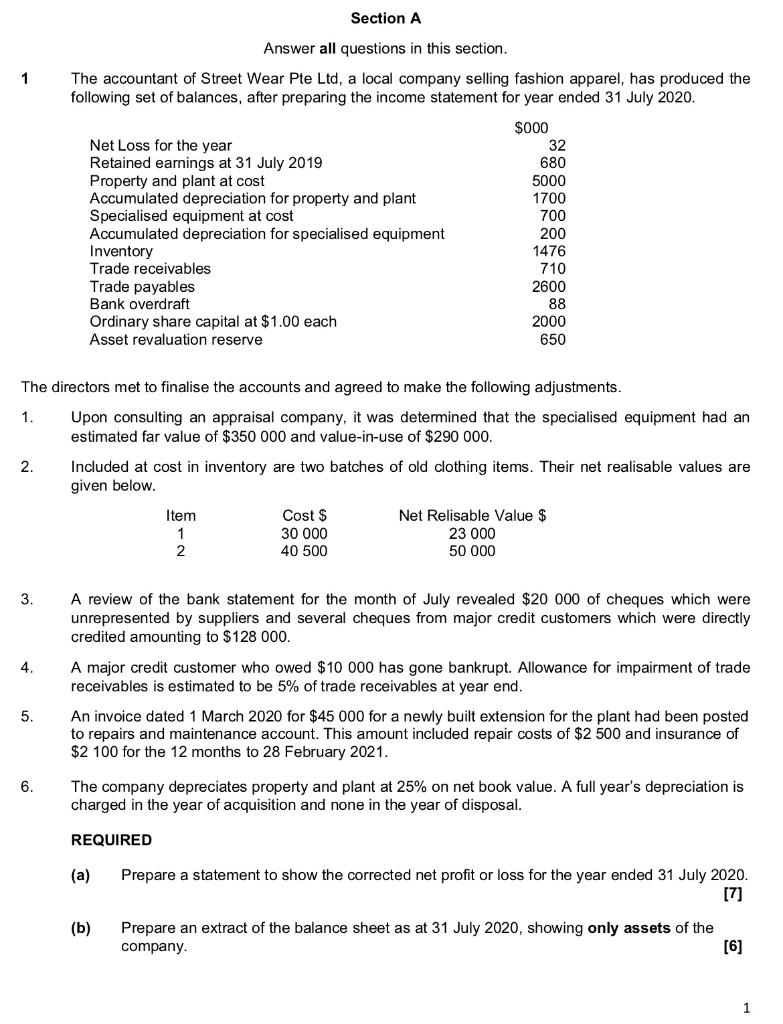

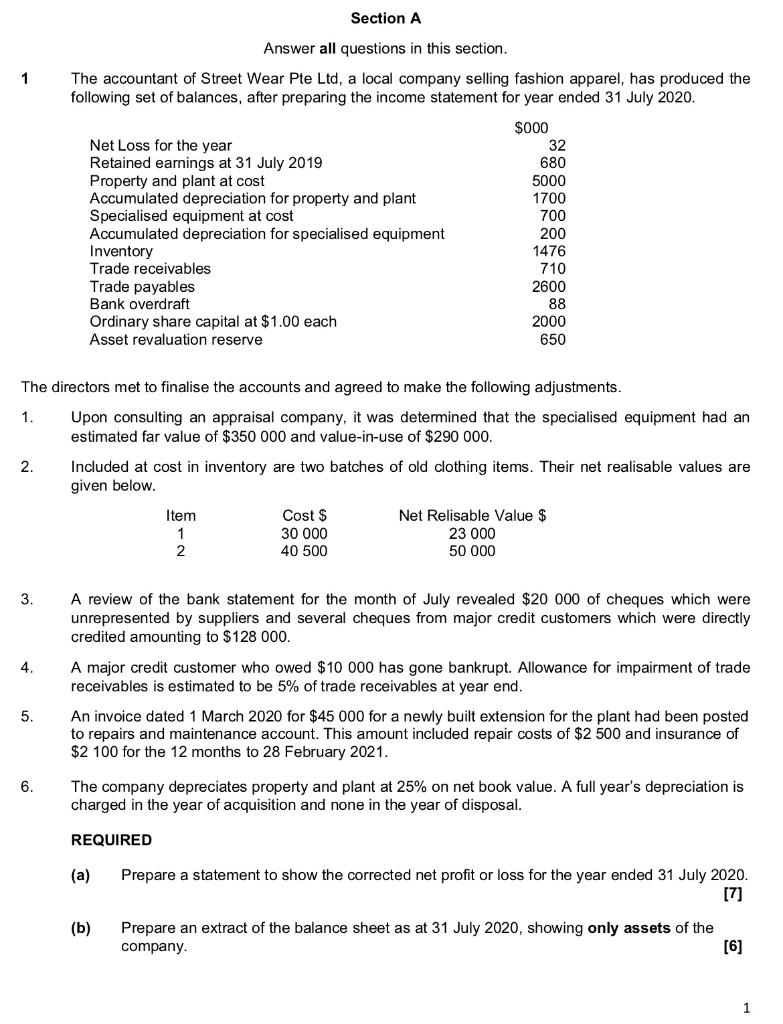

Section A 1 Answer all questions in this section. The accountant of Street Wear Pte Ltd, a local company selling fashion apparel, has produced the following set of balances, after preparing the income statement for year ended 31 July 2020. $000 Net Loss for the year Retained earnings at 31 July 2019 Property and plant at cost Accumulated depreciation for property and plant Specialised equipment at cost Accumulated depreciation for specialised equipment Inventory Trade receivables Trade payables Bank overdraft Ordinary share capital at $1.00 each Asset revaluation reserve 32 680 5000 1700 700 200 1476 710 2600 88 2000 650 The directors met to finalise the accounts and agreed to make the following adjustments. 1. Upon consulting an appraisal company, it was determined that the specialised equipment had an estimated far value of $350 000 and value-in-use of $290 000. 2. Included at cost in inventory are two batches of old clothing items. Their net realisable values are given below. Item 1 2 Cost $ 30 000 40 500 Net Relisable Value $ 23 000 50 000 3. 4. A review of the bank statement for the month of July revealed $20 000 of cheques which were unrepresented by suppliers and several cheques from major credit customers which were directly credited amounting to $128 000. A major credit customer who owed $10 000 has gone bankrupt. Allowance for impairment of trade receivables is estimated to be 5% of trade receivables at year end. An invoice dated 1 March 2020 for $45 000 for a newly built extension for the plant had been posted to repairs and maintenance account. This amount included repair costs of $2 500 and insurance of $2 100 for the 12 months to 28 February 2021. 5. 6. The company depreciates property and plant at 25% on net book value. A full year's depreciation is charged in the year of acquisition and none in the year of disposal. REQUIRED (a) Prepare a statement to show corrected net profit or loss for year ended 31 July 2 [7] (b) Prepare an extract of the balance sheet as at 31 July 2020, showing only assets of the company. [6] 1 (c) Explain your treatment of adjustment (1) above, citing relevant accounting principles affected. [4] Additional information During a recent board meeting, Mr Lim, a newly appointed director proposed changing depreciation method on property and plant from reducing balance method to the straight-line method. (d) Advise Mr Lim about his proposal. Justify your answer with relevant accounting concepts. [3] [Total: 20) 2 Section A 1 Answer all questions in this section. The accountant of Street Wear Pte Ltd, a local company selling fashion apparel, has produced the following set of balances, after preparing the income statement for year ended 31 July 2020. $000 Net Loss for the year Retained earnings at 31 July 2019 Property and plant at cost Accumulated depreciation for property and plant Specialised equipment at cost Accumulated depreciation for specialised equipment Inventory Trade receivables Trade payables Bank overdraft Ordinary share capital at $1.00 each Asset revaluation reserve 32 680 5000 1700 700 200 1476 710 2600 88 2000 650 The directors met to finalise the accounts and agreed to make the following adjustments. 1. Upon consulting an appraisal company, it was determined that the specialised equipment had an estimated far value of $350 000 and value-in-use of $290 000. 2. Included at cost in inventory are two batches of old clothing items. Their net realisable values are given below. Item 1 2 Cost $ 30 000 40 500 Net Relisable Value $ 23 000 50 000 3. 4. A review of the bank statement for the month of July revealed $20 000 of cheques which were unrepresented by suppliers and several cheques from major credit customers which were directly credited amounting to $128 000. A major credit customer who owed $10 000 has gone bankrupt. Allowance for impairment of trade receivables is estimated to be 5% of trade receivables at year end. An invoice dated 1 March 2020 for $45 000 for a newly built extension for the plant had been posted to repairs and maintenance account. This amount included repair costs of $2 500 and insurance of $2 100 for the 12 months to 28 February 2021. 5. 6. The company depreciates property and plant at 25% on net book value. A full year's depreciation is charged in the year of acquisition and none in the year of disposal. REQUIRED (a) Prepare a statement to show corrected net profit or loss for year ended 31 July 2 [7] (b) Prepare an extract of the balance sheet as at 31 July 2020, showing only assets of the company. [6] 1 (c) Explain your treatment of adjustment (1) above, citing relevant accounting principles affected. [4] Additional information During a recent board meeting, Mr Lim, a newly appointed director proposed changing depreciation method on property and plant from reducing balance method to the straight-line method. (d) Advise Mr Lim about his proposal. Justify your answer with relevant accounting concepts. [3] [Total: 20) 2