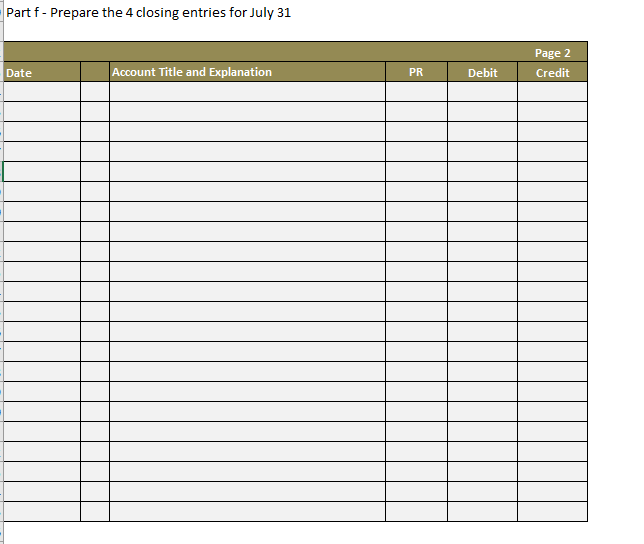

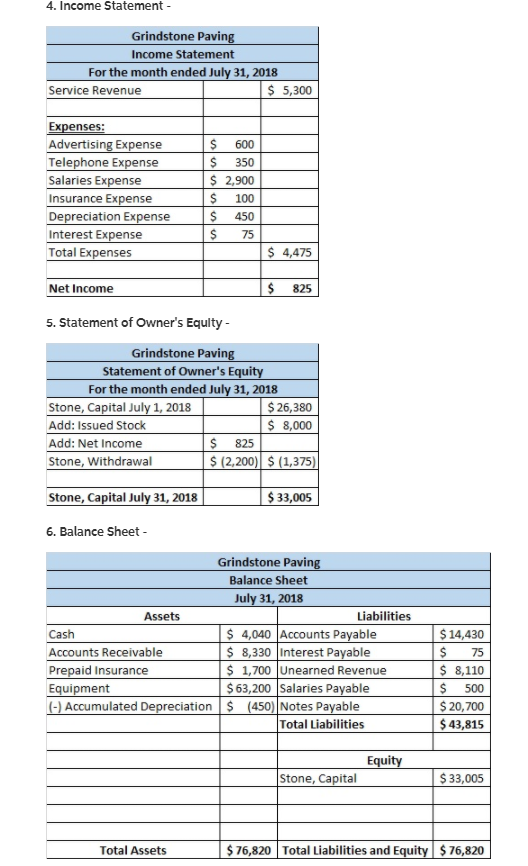

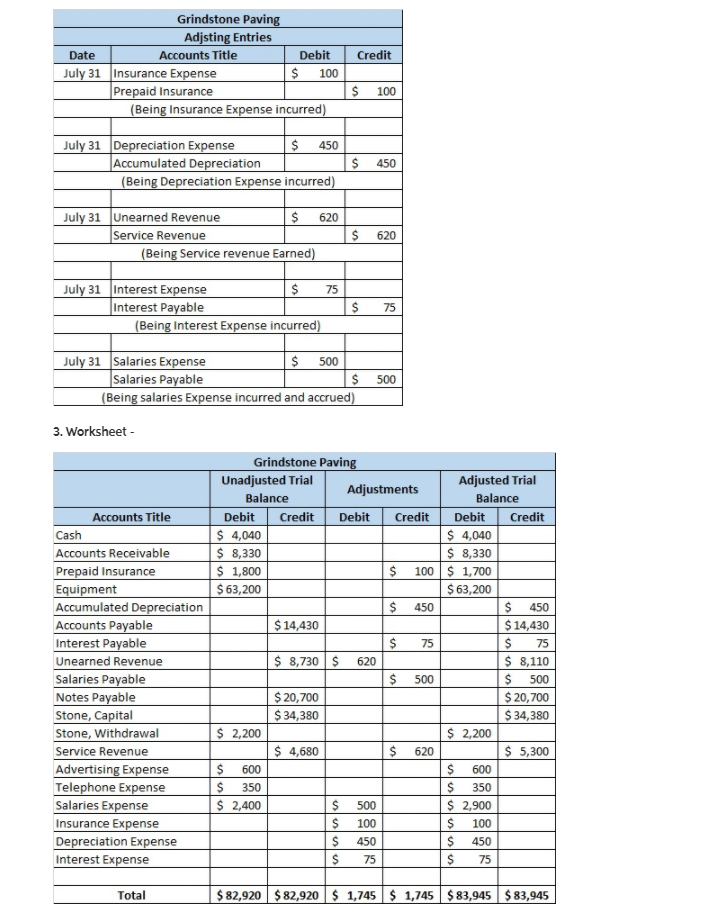

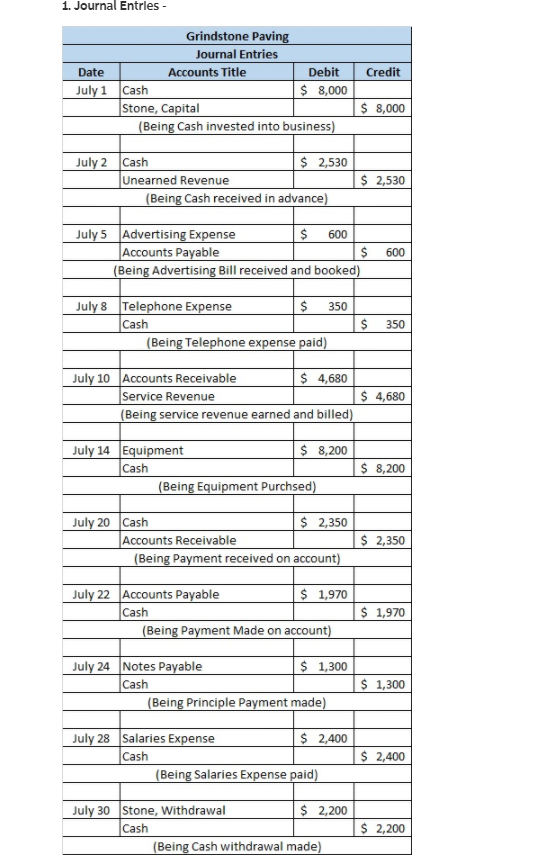

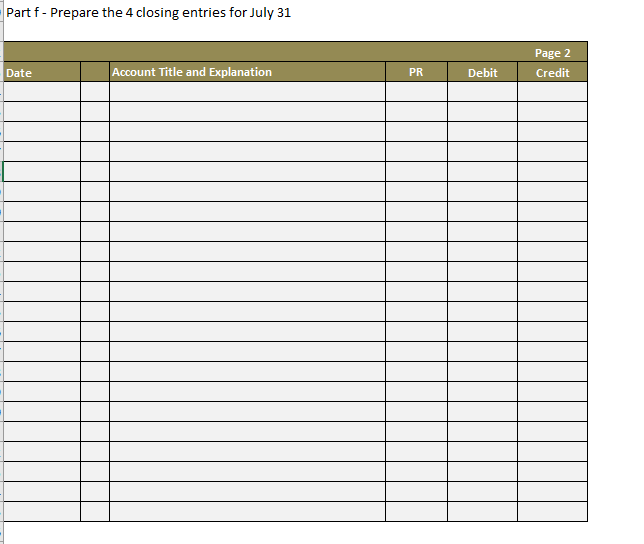

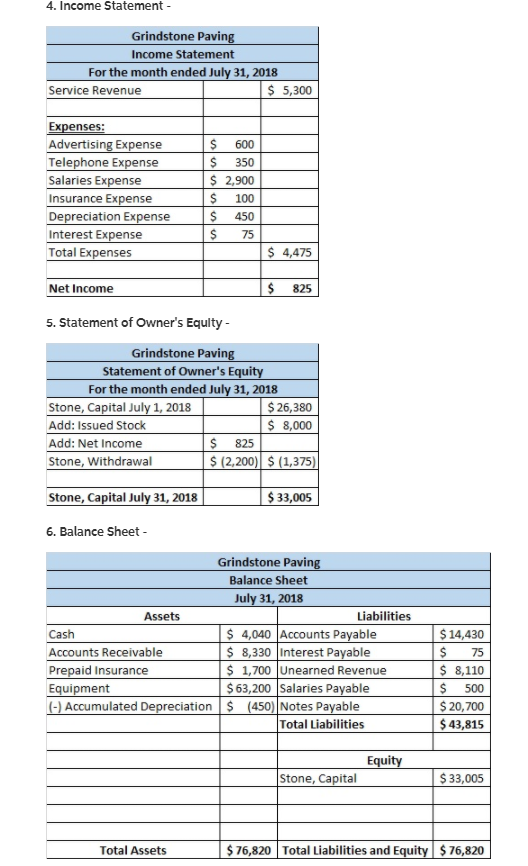

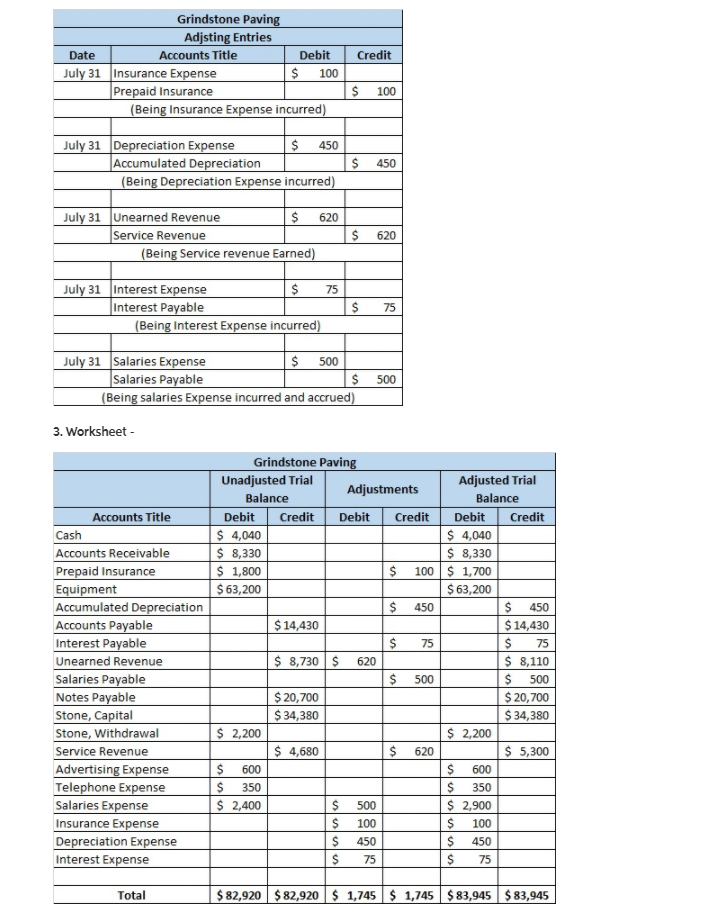

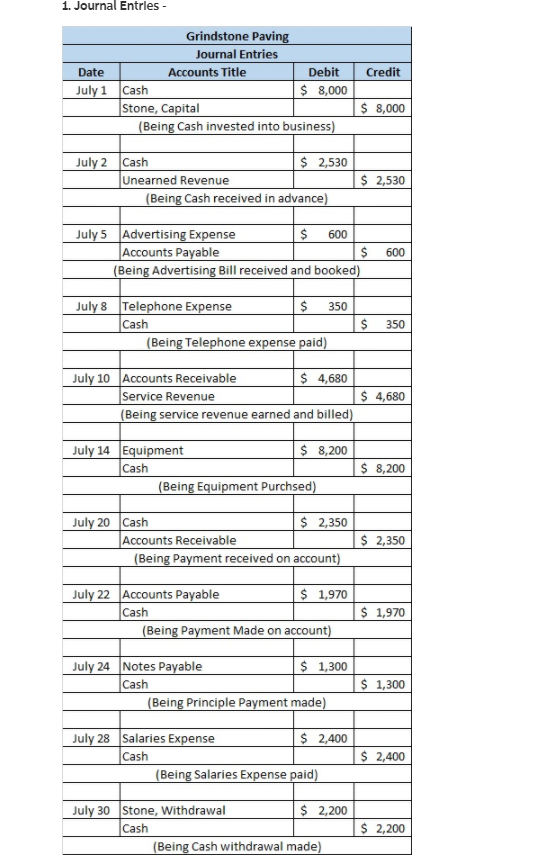

Part f - Prepare the 4 closing entries for July 31 Page 2 Credit Date Account Title and Explanation PR Debit 4. Income Statement- Grindstone Paving Income Statement For the month ended July 31, 2018 Service Revenue $ 5,300 Expenses: Advertising Expense Telephone Expense Salaries Expense Insurance Expense Depreciation Expense Interest Expense Total Expenses $ 600 $ 350 $ 2,900 $ 100 $ 450 $ 75 $ 4,475 Net Income $ 825 5. Statement of Owner's Equity- Grindstone Paving Statement of Owner's Equity For the month ended July 31, 2018 Stone, Capital July 1, 2018 $ 26,380 Add: Issued Stock $ 8,000 Add: Net Income $ 825 Stone, Withdrawal $ (2,200) $ (1,375) Stone, Capital July 31, 2018 $ 33,005 6. Balance Sheet Grindstone Paving Balance Sheet July 31, 2018 Assets Liabilities Cash $ 4,040 Accounts Payable Accounts Receivable $ 8,330 Interest Payable Prepaid Insurance $ 1,700 Unearned Revenue Equipment $63,200 Salaries Payable (-) Accumulated Depreciation $ (450) Notes Payable Total Liabilities $ 14,430 $ 75 $ 8,110 S 500 $ 20,700 $ 43,815 Equity Stone, Capital $ 33,005 Total Assets $ 76,820 Total Liabilities and Equity $ 76,820 Credit Grindstone Paving Adjsting Entries Date Accounts Title Debit July 31 Insurance Expense $ 100 Prepaid Insurance (Being Insurance Expense incurred) $ 100 July 31 Depreciation Expense $ 450 Accumulated Depreciation (Being Depreciation Expense incurred) $ 450 620 July 31 Unearned Revenue $ Service Revenue (Being Service revenue Earned) $ 620 July 31 Interest Expense $ 75 Interest Payable (Being Interest Expense incurred) $ 75 500 July 31 Salaries Expense $ Salaries Payable $ (Being salaries Expense incurred and accrued) 500 3. Worksheet - Accounts Title Cash Accounts Receivable Prepaid Insurance Equipment Accumulated Depreciation Accounts Payable Interest Payable Unearned Revenue Salaries Payable Notes Payable Stone, Capital Stone, Withdrawal Service Revenue Advertising Expense Telephone Expense Salaries Expense Insurance Expense Depreciation Expense Interest Expense Grindstone Paving Unadjusted Trial Adjusted Trial Adjustments Balance Balance Debit Credit Debit Credit Debit Credit $ 4,040 $ 4,040 $ 8,330 $ 8,330 $ 1,800 $ 100 $ 1,700 $63,200 $63,200 $ 450 $ 450 $ 14,430 $ 14,430 $ 75 $ 75 $ 8,730$ 620 $ 8,110 $ 500 $ 500 $ 20,700 $ 20,700 $ 34,380 $ 34,380 $ 2,200 $ 2,200 $ 4,680 $ 620 $ 5,300 $ 600 600 $ 350 350 $ 2,400 $ 500 $ 2,900 $ 100 100 $ 450 $ 75 $ 75 luuuuu 450 Total $ 82,920 $82,920 $ 1,745 $ 1,745 $ 83,945 $ 83,945 1. Journal Entries - Credit Grindstone Paving Journal Entries Date Accounts Title Debit July 1 Cash $ 8,000 Stone, Capital (Being Cash invested into business) $ 8,000 July 2 Cash $ 2,530 Unearned Revenue (Being Cash received in advance) $ 2,530 July 5 Advertising Expense $ 600 Accounts Payable $ (Being Advertising Bill received and booked) 600 July 8 Telephone Expense $ 350 Cash (Being Telephone expense paid) S 350 July 10 Accounts Receivable $ 4,680 Service Revenue $ 4,680 (Being service revenue earned and billed) July 14 Equipment $ 8,200 Cash (Being Equipment Purchsed) $ 8,200 July 20 Cash $ 2,350 Accounts Receivable (Being Payment received on account) $ 2,350 July 22 Accounts Payable $ 1,970 Cash (Being Payment Made on account) $ 1,970 July 24 Notes Payable $ 1,300 Cash (Being Principle Payment made) $ 1,300 July 28 Salaries Expense $ 2,400 Cash (Being Salaries Expense paid) $ 2,400 July 30 Stone, Withdrawal $ 2,200 Cash (Being Cash withdrawal made) $ 2,200