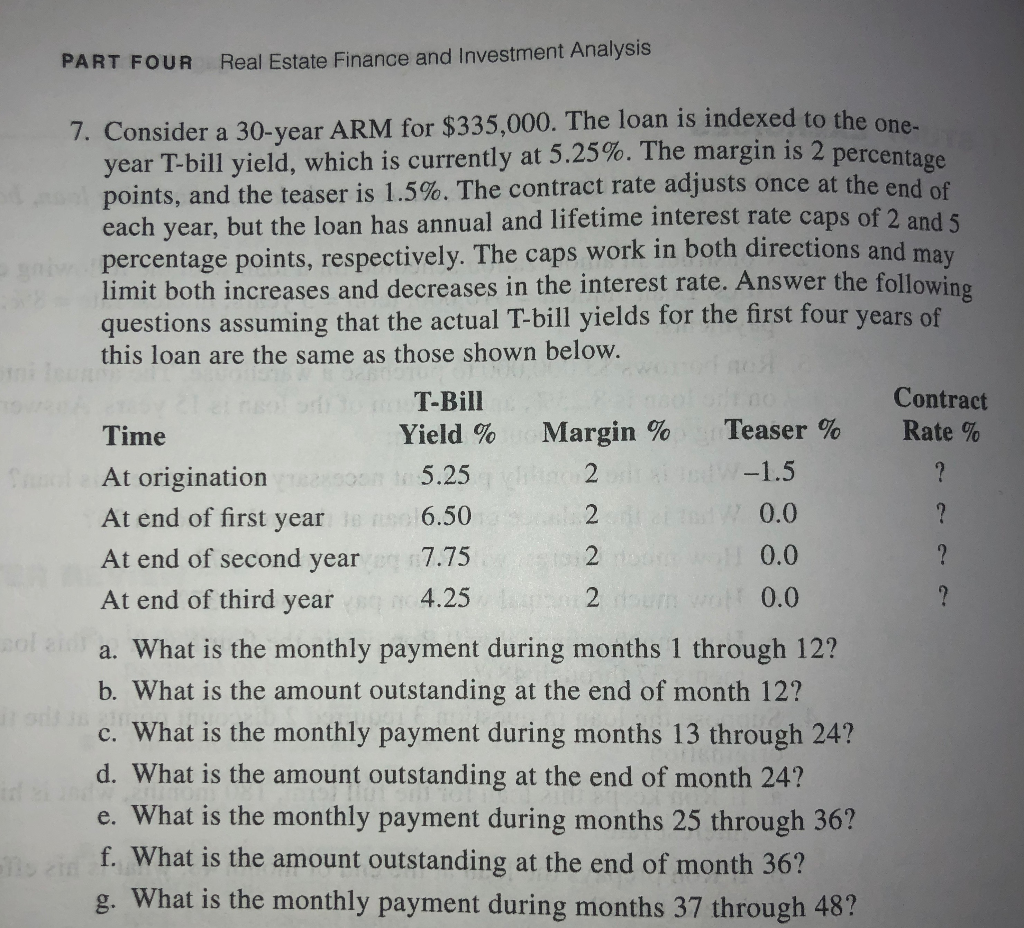

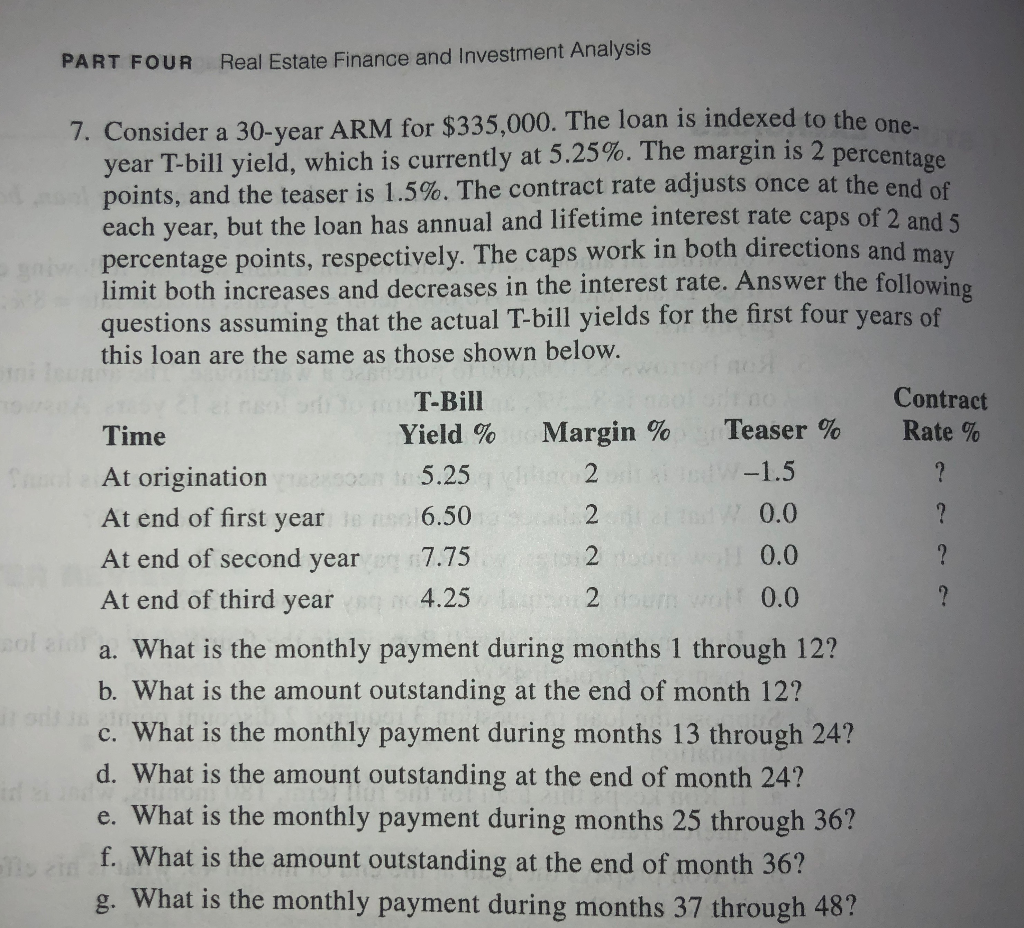

PART FOUR Real Estate Finance and Investment Analysis 7. Consider a 30-year ARM for $335,000. The loan is indexed to the one year T-bill yield, which is currently at 5.25%. The margin is 2 points, and the teaser is 1.5%. The contract rate adjusts once at the end of each year, but the loan has annual and lifetime interest rate caps of 2 and 5 percentage points, respectively. The caps work in both directions and may limit both increases and decreases in the interest rate. Answer the following questions assuming that the actual T-bill yields for the first four years of this loan are the same as those shown below. percentage lu Contract Rate % -Bill Teaser % Margin % Yield % Time -1.5 ? At origination 2 5.25 0.0 ? 2 At end of first year e c 6.50 0.0 At end of second year r 2 7.75 At end of third year 2 um otf 0.0 4.25 ol aid a. What is the monthly payment during months 1 through 12? b. What is the amount outstanding at the end of month 12? c. What is the monthly payment during months 13 through 24? d. What is the amount outstanding at the end of month 24? e. What is the monthly payment during months 25 through 36? f. What is the amount outstanding at the end of month 36? g. What is the monthly payment during months 37 through 48? no zi PART FOUR Real Estate Finance and Investment Analysis 7. Consider a 30-year ARM for $335,000. The loan is indexed to the one year T-bill yield, which is currently at 5.25%. The margin is 2 points, and the teaser is 1.5%. The contract rate adjusts once at the end of each year, but the loan has annual and lifetime interest rate caps of 2 and 5 percentage points, respectively. The caps work in both directions and may limit both increases and decreases in the interest rate. Answer the following questions assuming that the actual T-bill yields for the first four years of this loan are the same as those shown below. percentage lu Contract Rate % -Bill Teaser % Margin % Yield % Time -1.5 ? At origination 2 5.25 0.0 ? 2 At end of first year e c 6.50 0.0 At end of second year r 2 7.75 At end of third year 2 um otf 0.0 4.25 ol aid a. What is the monthly payment during months 1 through 12? b. What is the amount outstanding at the end of month 12? c. What is the monthly payment during months 13 through 24? d. What is the amount outstanding at the end of month 24? e. What is the monthly payment during months 25 through 36? f. What is the amount outstanding at the end of month 36? g. What is the monthly payment during months 37 through 48? no zi