Answered step by step

Verified Expert Solution

Question

1 Approved Answer

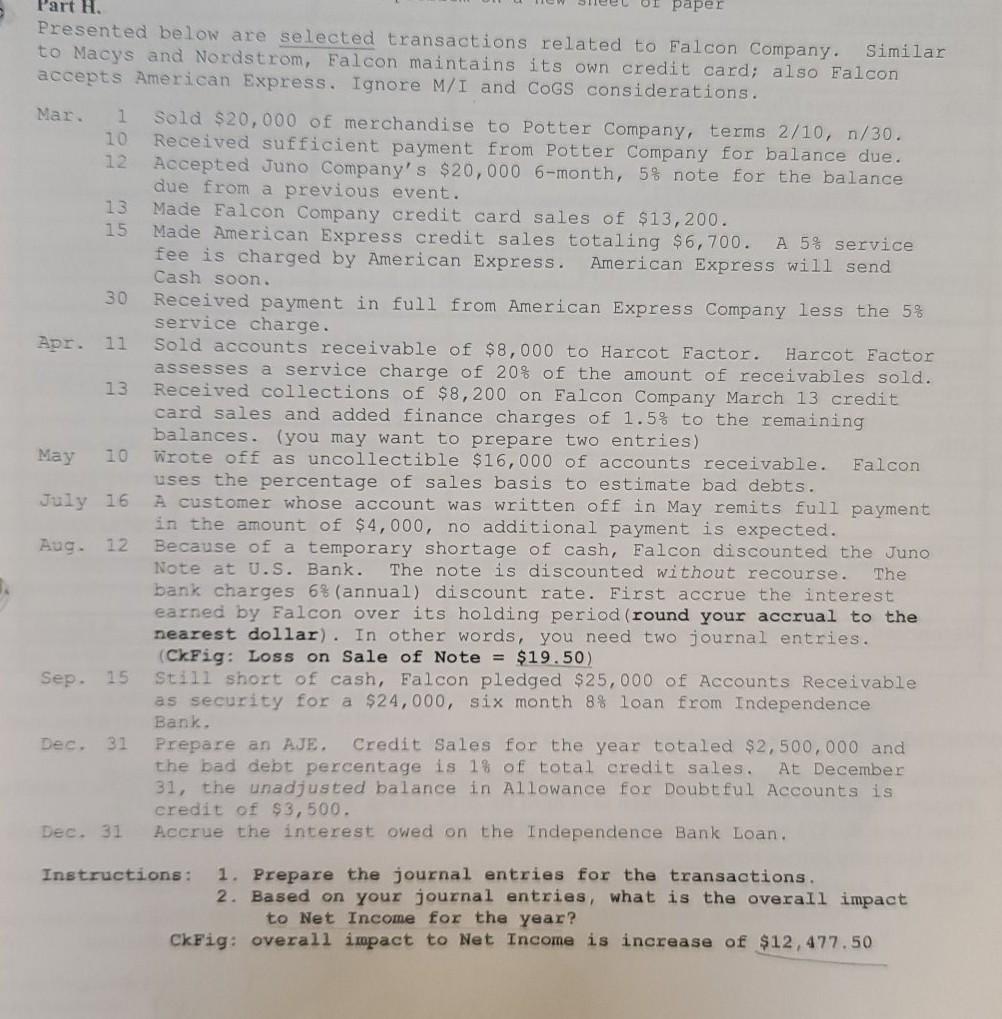

Part H. paper Presented below are selected transactions related to Falcon Company. Similar to Macys and Nordstrom, Falcon maintains its own credit card; also Falcon

Part H. paper Presented below are selected transactions related to Falcon Company. Similar to Macys and Nordstrom, Falcon maintains its own credit card; also Falcon accepts American Express. Ignore M/L and COGS considerations. Mar. 1 Sold $20,000 of merchandise to Potter Company, terms 2/10, n/30. 10 Received sufficient payment from Potter Company for balance due. 12 Accepted Juno Company's $20,000 6-month, 5% note for the balance due from a previous event. 13 Made Falcon Company credit card sales of $13,200. 15 Made American Express credit sales totaling $6,700. A5% service fee is charged by American Express. American Express will send Cash soon. 30 Received payment in full from American Express Company less the 5% service charge. Apr. 11 Sold accounts receivable of $8,000 to Harcot Factor. Harcot Factor assesses a service charge of 20% of the amount of receivables sold. 13 Received collections of $8,200 on Falcon Company March 13 credit card sales and added finance charges of 1.5% to the remaining balances. (you may want to prepare two entries) May 10 Wrote off as uncollectible $16,000 of account receivable. Falcon uses the percentage of sales basis to estimate bad debts. July 16 A customer whose account was written off in May remits full payment in the amount of $4,000, no additional payment is expected. Aug. 12 Because of a temporary shortage of cash, Falcon discounted the Juno Note at U.S. Bank. The note is discounted without recourse. The bank charges 6% (annual) discount rate. First accrue the interest earned by Falcon over its holding period (round your accrual to the nearest dollar). In other words, you need two journal entries. (CKFig: Loss on Sale of Note = $19.50) Sep. 15 Still short of cash, Falcon pledged $25,000 of Accounts Receivable as security for a $24,000, six month 8% loan from Independence Bank. Dec. 31 Prepare an AJE. Credit Sales for the year totaled $2,500,000 and the bad debt percentage is 1% of total credit sales. At December 31, the unadjusted balance in Allowance for Doubtful Accounts is credit of $3,500. Dec. 31 Accrue the interest owed on the Independence Bank Loan. Instructions: 1. Prepare the journal entries for the transactions. 2. Based on your journal entries, what is the overall impact to Net Income for the year? CkFig: overall impact to Net Income is increase of $12,477.50 Part H. paper Presented below are selected transactions related to Falcon Company. Similar to Macys and Nordstrom, Falcon maintains its own credit card; also Falcon accepts American Express. Ignore M/L and COGS considerations. Mar. 1 Sold $20,000 of merchandise to Potter Company, terms 2/10, n/30. 10 Received sufficient payment from Potter Company for balance due. 12 Accepted Juno Company's $20,000 6-month, 5% note for the balance due from a previous event. 13 Made Falcon Company credit card sales of $13,200. 15 Made American Express credit sales totaling $6,700. A5% service fee is charged by American Express. American Express will send Cash soon. 30 Received payment in full from American Express Company less the 5% service charge. Apr. 11 Sold accounts receivable of $8,000 to Harcot Factor. Harcot Factor assesses a service charge of 20% of the amount of receivables sold. 13 Received collections of $8,200 on Falcon Company March 13 credit card sales and added finance charges of 1.5% to the remaining balances. (you may want to prepare two entries) May 10 Wrote off as uncollectible $16,000 of account receivable. Falcon uses the percentage of sales basis to estimate bad debts. July 16 A customer whose account was written off in May remits full payment in the amount of $4,000, no additional payment is expected. Aug. 12 Because of a temporary shortage of cash, Falcon discounted the Juno Note at U.S. Bank. The note is discounted without recourse. The bank charges 6% (annual) discount rate. First accrue the interest earned by Falcon over its holding period (round your accrual to the nearest dollar). In other words, you need two journal entries. (CKFig: Loss on Sale of Note = $19.50) Sep. 15 Still short of cash, Falcon pledged $25,000 of Accounts Receivable as security for a $24,000, six month 8% loan from Independence Bank. Dec. 31 Prepare an AJE. Credit Sales for the year totaled $2,500,000 and the bad debt percentage is 1% of total credit sales. At December 31, the unadjusted balance in Allowance for Doubtful Accounts is credit of $3,500. Dec. 31 Accrue the interest owed on the Independence Bank Loan. Instructions: 1. Prepare the journal entries for the transactions. 2. Based on your journal entries, what is the overall impact to Net Income for the year? CkFig: overall impact to Net Income is increase of $12,477.50

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started