Answered step by step

Verified Expert Solution

Question

1 Approved Answer

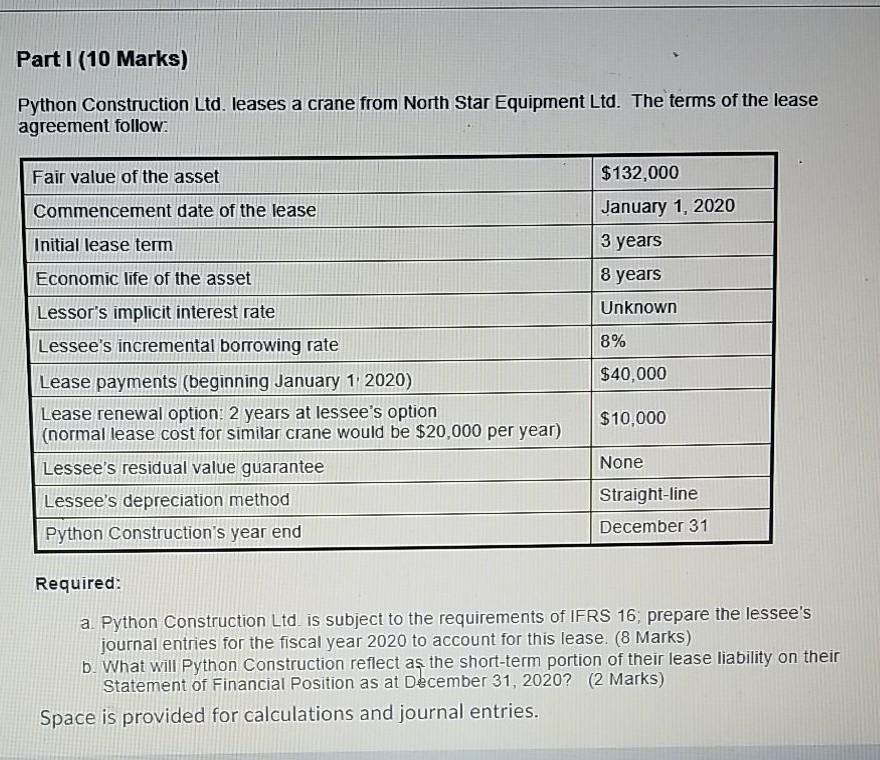

Part I (10 Marks) Python Construction Ltd. leases a crane from North Star Equipment Ltd. The terms of the lease agreement follow Fair value of

Part I (10 Marks) Python Construction Ltd. leases a crane from North Star Equipment Ltd. The terms of the lease agreement follow Fair value of the asset Commencement date of the lease $132,000 January 1, 2020 3 years Initial lease term 8 years Unknown 8% $40,000 Economic life of the asset Lessor's implicit interest rate Lessee's incremental borrowing rate Lease payments (beginning January 1 2020) Lease renewal option: 2 years at lessee's option (normal lease cost for similar crane would be $20,000 per year) Lessee's residual value guarantee Lessee's depreciation method Python Construction's year end $10,000 None Straight-line December 31 Required: a. Python Construction Ltd is subject to the requirements of IFRS 16, prepare the lessee's journal entries for the fiscal year 2020 to account for this lease. (8 Marks) b. What will Python Construction reflect as the short-term portion of their lease liability on their Statement of Financial Position as at December 31, 2020? (2 Marks) Space is provided for calculations and journal entries

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started