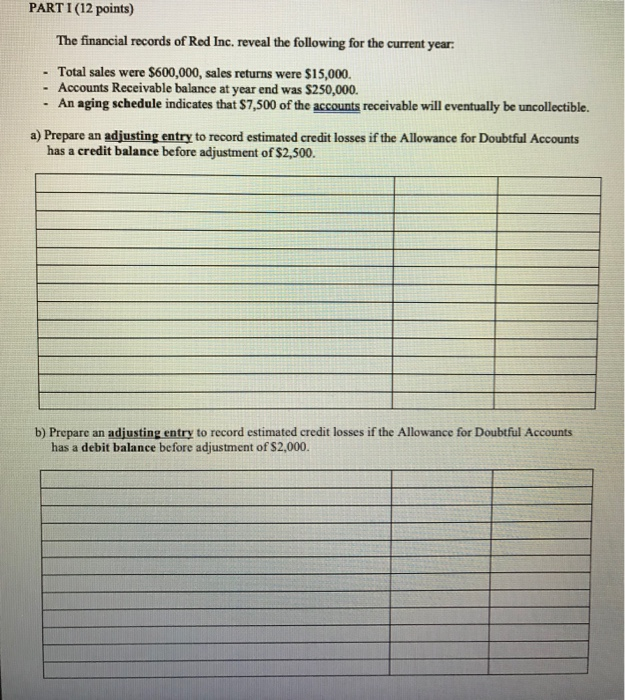

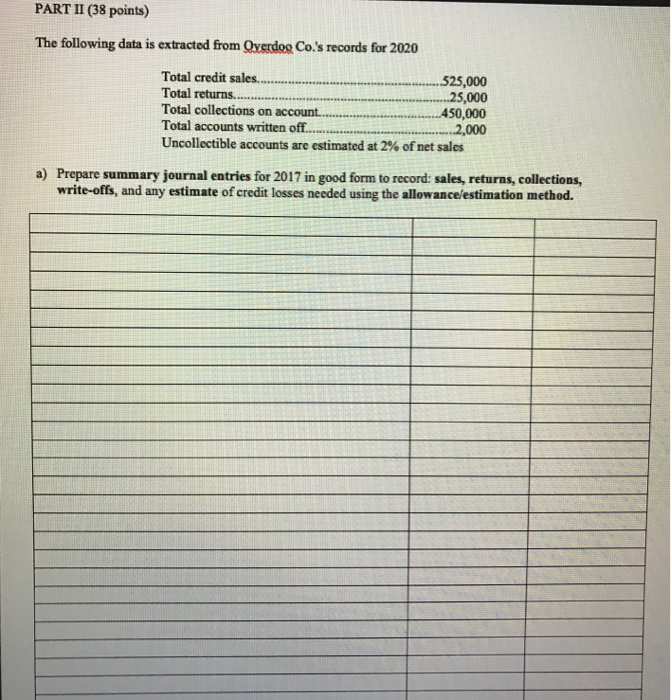

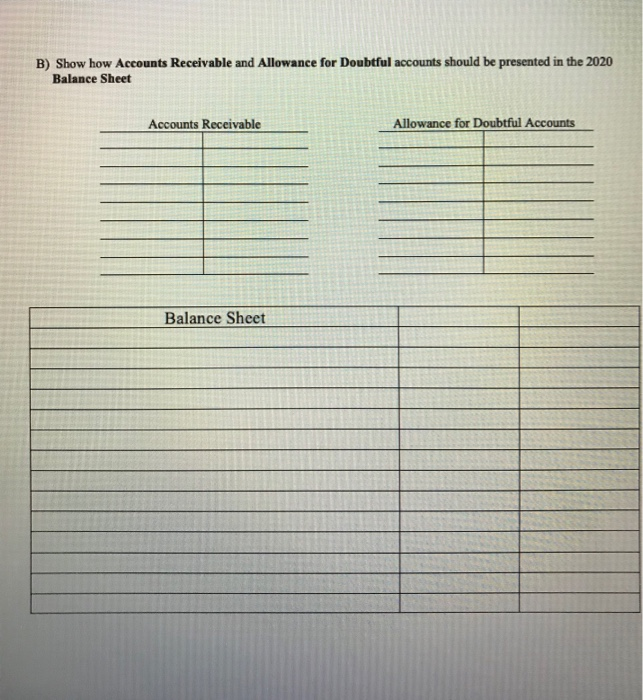

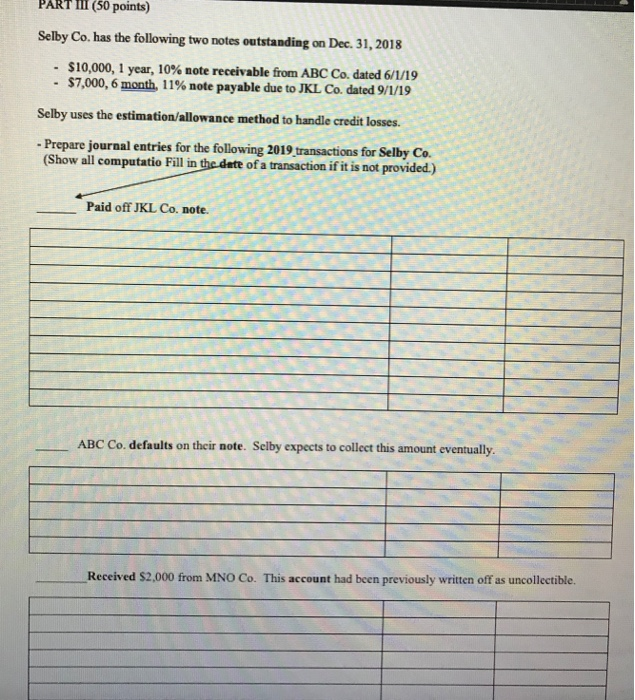

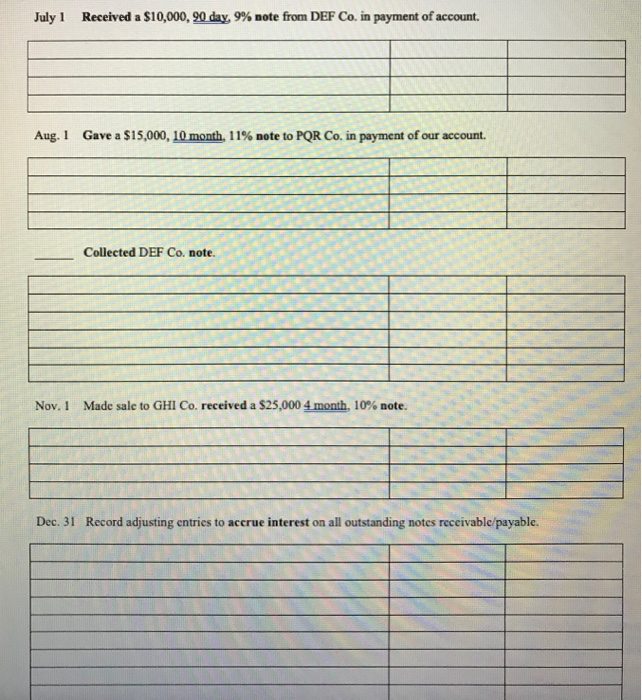

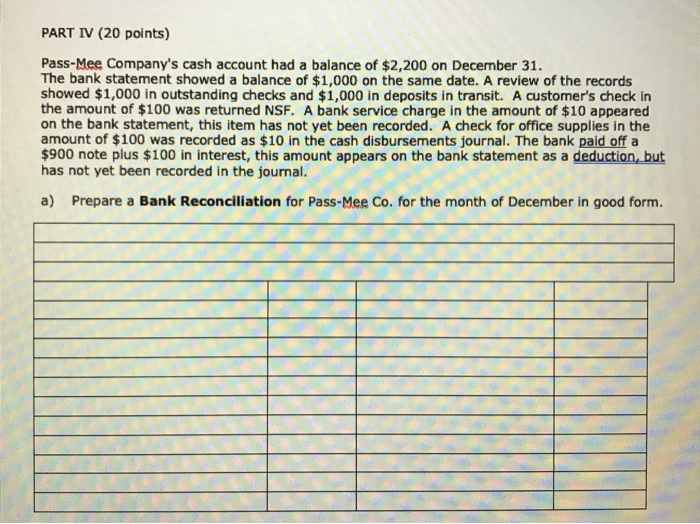

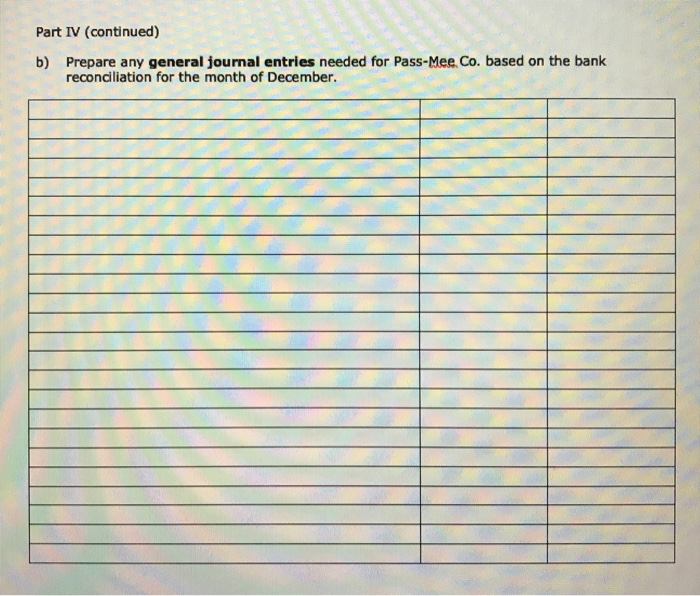

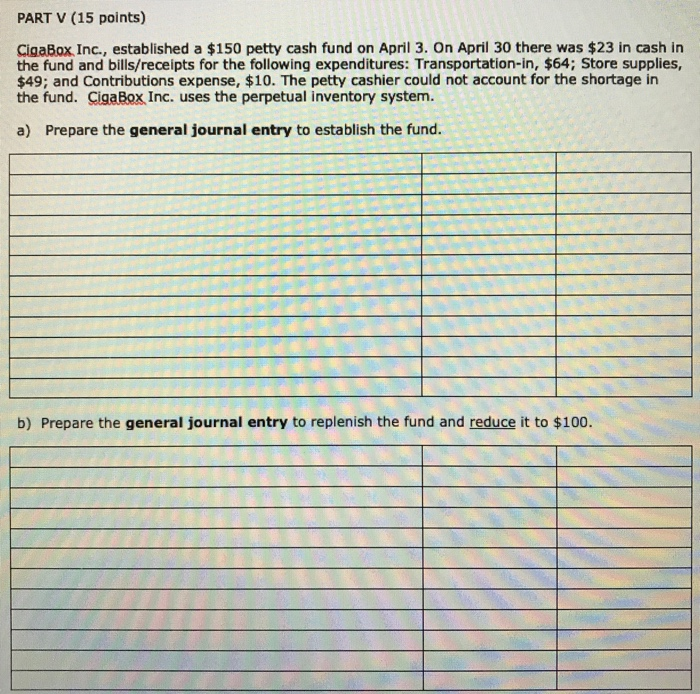

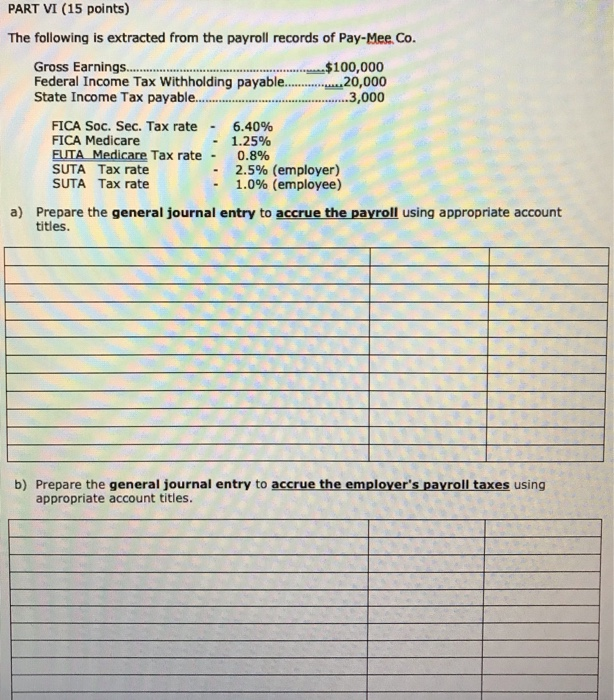

PART I (12 points) The financial records of Red Inc. reveal the following for the current year. - Total sales were $600,000, sales returns were $15,000. - Accounts Receivable balance at year end was $250,000. . An aging schedule indicates that $7,500 of the accounts receivable will eventually be uncollectible. a) Prepare an adjusting entry to record estimated credit losses if the Allowance for Doubtful Accounts has a credit balance before adjustment of $2,500. . / / b) Prepare an adjusting entry to record estimated credit losses if the Allowance for Doubtful Accounts has a debit balance before adjustment of $2,000. PART II (38 points) The following data is extracted from Overdog Co.'s records for 2020 Total credit sales. 525,000 Total returns........... ..25,000 Total collections on account..... 450,000 Total accounts written off.... Uncollectible accounts are estimated at 2% of net sales -2,000 a) Prepare summary journal entries for 2017 in good form to record: sales, returns, collections, write-offs, and any estimate of credit losses needed using the allowancelestimation method. B) Show how Accounts Receivable and Allowance for Doubtful accounts should be presented in the 2020 Balance Sheet Accounts Receivable Allowance for Doubtful Accounts Balance Sheet PART III (50 points) Selby Co. has the following two notes outstanding on Dec 31, 2018 $10,000, 1 year, 10% note receivable from ABC Co. dated 6/1/19 . $7,000, 6 month, 11% note payable due to JKL Co. dated 9/1/19 Selby uses the estimation/allowance method to handle credit losses. Prepare journal entries for the following 2019 transactions for Selby Co. (Show all computatio Fill in the date of a transaction if it is not provided.) Paid off JKL Co. note. / 1 / / / / / / / / / / / ABC Co. defaults on their note. Selby expects to collect this amount eventually ! Received $2,000 from MNO Co. This account had been previously written off as uncollectible. July 1 Received a $10,000, 90 day, 9% note from DEF Co. in payment of account. Aug. 1 Gave a $15,000, 10 month, 11% note to PQR Co. in payment of our account. Collected DEF Co. note. Nov. 1 Made sale to GHI Co. received a $25,000 4 month, 10% note. Dec. 31 Record adjusting entries to accrue interest on all outstanding notes receivable/payable. / / / / / / / III / / / / / / / / / / / - / / PART IV (20 points) Pass-Mee Company's cash account had a balance of $2,200 on December 31. The bank statement showed a balance of $1,000 on the same date. A review of the records showed $1,000 in outstanding checks and $1,000 in deposits in transit. A customer's check in the amount of $100 was returned NSF. A bank service charge in the amount of $10 appeared on the bank statement, this item has not yet been recorded. A check for office supplies in the amount of $100 was recorded as $10 in the cash disbursements journal. The bank paid off a $900 note plus $100 in interest, this amount appears on the bank statement as a deduction, but has not yet been recorded in the journal. a) Prepare a Bank Reconciliation for Pass-Mee Co. for the month of December in good form. / / / / / / / / / / / / / / / / / / / / / / / / / / / / / / / / / / / / / / / / / / / / / / / / / / / / N / / / / / / / / / / / / / / / / / / / / / / / / / / / / / / / / / / / / / / / / / / / / / / / / / / / / / / / / 1 / / / / / / / / / / / / . / / / / / / / / Part IV (continued) b) Prepare any general journal entries needed for Pass-Mee.Co. based on the bank reconciliation for the month of December. TI TU / / / / / / PART V (15 points) CigaBox, Inc., established a $150 petty cash fund on April 3. On April 30 there was $23 in cash in the fund and bills/receipts for the following expenditures: Transportation-in, $64; Store supplies, $49; and Contributions expense, $10. The petty cashier could not account for the shortage in the fund. CigaBox Inc. uses the perpetual inventory system. a) Prepare the general journal entry to establish the fund. 1 1 | 1 N / / TIL | / / / / / / | / / / / / 11/17 / / / b) Prepare the general journal entry to replenish the fund and reduce it to $100. 11 T 11 17 PART VI (15 points) The following is extracted from the payroll records of Pay-Mee. Co. Gross Earnings........ ......$100,000 Federal Income Tax Withholding payable............. ...20,000 State Income Tax payable.... ...3,000 FICA Soc. Sec. Tax rate - 6.40% FICA Medicare 1.25% FUTA Medicare Tax rate - 0.8% SUTA Tax rate 2.5% (employer) SUTA Tax rate 1.0% (employee) a) Prepare the general journal entry to accrue the payroll using appropriate account tites / A / / X / / / / / / / / / / / / / / / / / / / / / b) Prepare the general journal entry to accrue the employer's payroll taxes using appropriate account titles