Answered step by step

Verified Expert Solution

Question

1 Approved Answer

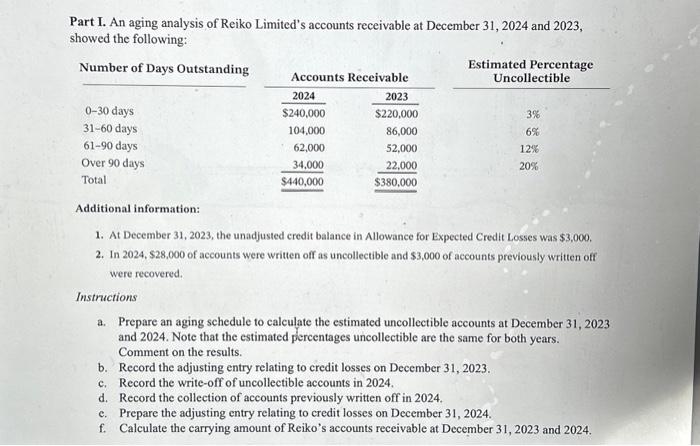

Part I. An aging analysis of Reiko Limited's accounts receivable at December 31, 2024 and 2023, showed the following: Number of Days Outstanding 0-30 days

Part I. An aging analysis of Reiko Limited's accounts receivable at December 31, 2024 and 2023, showed the following: Number of Days Outstanding 0-30 days 31-60 days 61-90 days Over 90 days Total Additional information: Accounts Receivable 2024 $240,000 104,000 62,000 34,000 $440,000 2023 $220,000 86,000 52,000 22,000 $380,000 Estimated Percentage Uncollectible 3% 6% 12% 20% 1. At December 31, 2023, the unadjusted credit balance in Allowance for Expected Credit Losses was $3,000. 2. In 2024, $28,000 of accounts were written off as uncollectible and $3,000 of accounts previously written off were recovered. b. Record the adjusting entry relating to credit losses on December 31, 2023. Record the write-off of uncollectible accounts in 2024. Instructions a. Prepare an aging schedule to calculate the estimated uncollectible accounts at December 31, 2023 and 2024. Note that the estimated percentages uncollectible are the same for both years. Comment on the results. C. d. Record the collection of accounts previously written off in 2024. e. Prepare the adjusting entry relating to credit losses on December 31, 2024. f. Calculate the carrying amount of Reiko's accounts receivable at December 31, 2023 and 2024.

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started