Answered step by step

Verified Expert Solution

Question

1 Approved Answer

Part I: Buying a Car Rene wants to buy a BMW 5 3 5 i Sedan that she found online. The dealet has offered her

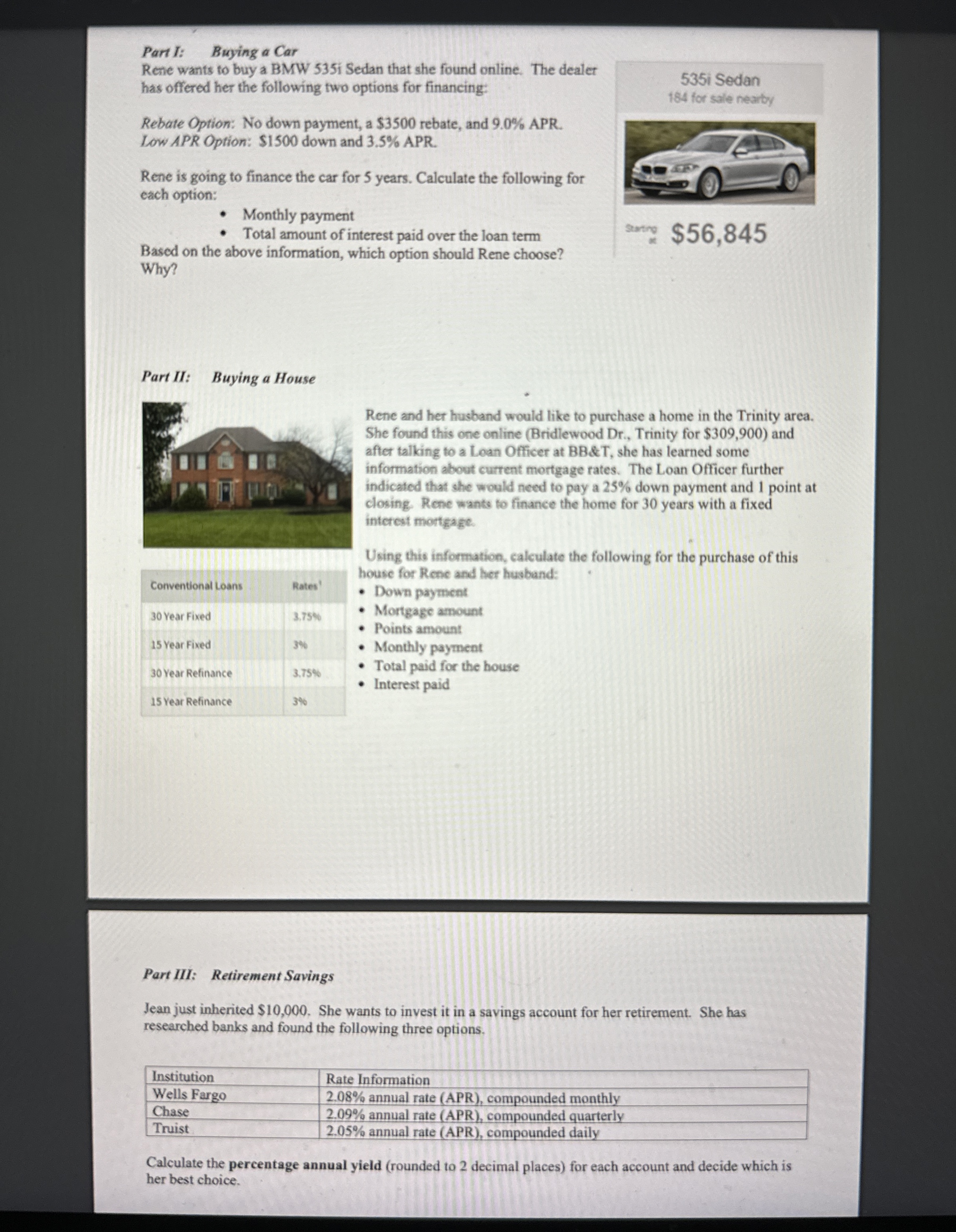

Part I: Buying a Car

Rene wants to buy a BMW i Sedan that she found online. The dealet has offered her the following two options for financing:

Rebate Option: No down payment, a $ rebate, and APR.

Low APR Option: $ down and APR.

Rene is going to finance the car for years. Calculate the following for each option:

Monthly payment

Total amount of interest paid over the loan term

Based on the above information, which option should Rene choose? Why?

Part II:

Buying a House

Rene and her husband would like to purchase a home in the Trinity area. She found this one online Bridlewood Dr Trinity for $ and after talking to a Loan Officer at BB&T she has learned some information about current mortgage rates. The Loan Officer further indicated that she would need to pay a down payment and point at closing. Rene wants to finance the home for years with a fixed interest mortgage Year Fixed,

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started