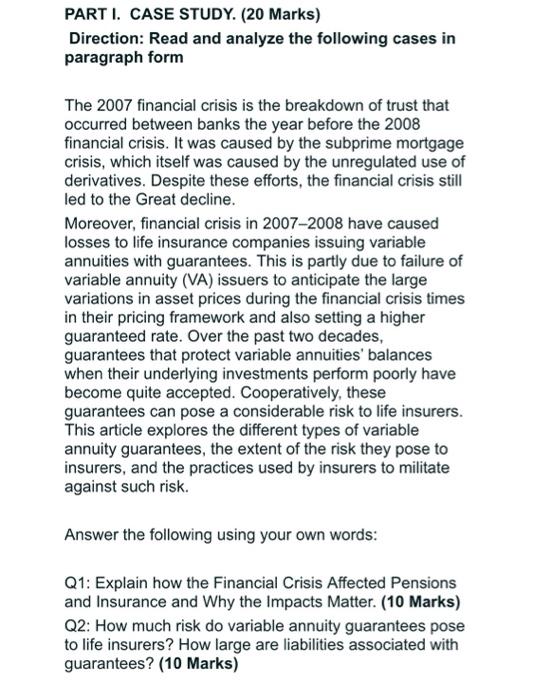

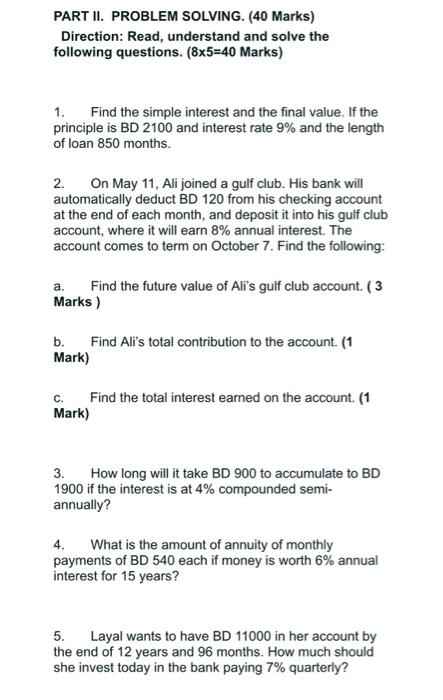

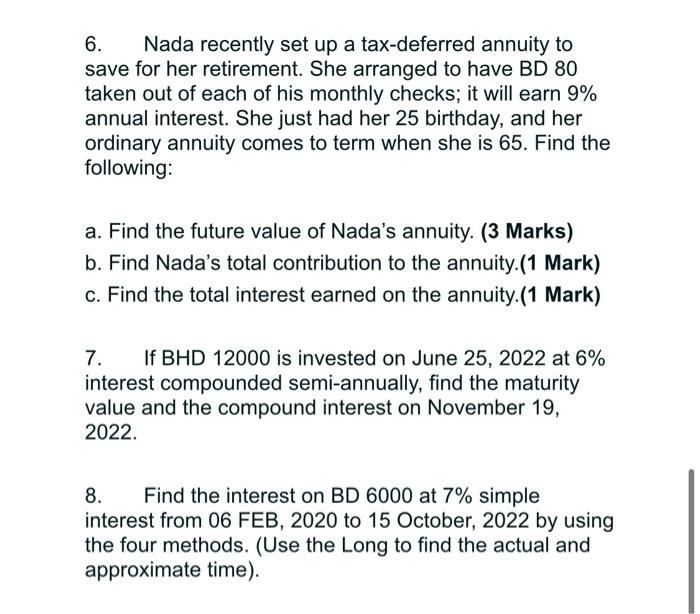

PART I. CASE STUDY. (20 Marks) Direction: Read and analyze the following cases in paragraph form The 2007 financial crisis is the breakdown of trust that occurred between banks the year before the 2008 financial crisis. It was caused by the subprime mortgage crisis, which itself was caused by the unregulated use of derivatives. Despite these efforts, the financial crisis still led to the Great decline. Moreover, financial crisis in 2007-2008 have caused losses to life insurance companies issuing variable annuities with guarantees. This is partly due to failure of variable annuity (VA) issuers to anticipate the large variations in asset prices during the financial crisis times in their pricing framework and also setting a higher guaranteed rate. Over the past two decades, guarantees that protect variable annuities' balances when their underlying investments perform poorly have become quite accepted. Cooperatively, these guarantees can pose a considerable risk to life insurers. This article explores the different types of variable annuity guarantees, the extent of the risk they pose to insurers, and the practices used by insurers to militate against such risk. Answer the following using your own words: Q1: Explain how the Financial Crisis Affected Pensions and Insurance and Why the Impacts Matter. (10 Marks) Q2: How much risk do variable annuity guarantees pose to life insurers? How large are liabilities associated with guarantees? (10 Marks) PART II. PROBLEM SOLVING. (40 Marks) Direction: Read, understand and solve the following questions. (8x5=40 Marks) 1. Find the simple interest and the final value. If the principle is BD 2100 and interest rate 9% and the length of loan 850 months. 2. On May 11, Ali joined a gulf club. His bank will automatically deduct BD 120 from his checking account at the end of each month, and deposit it into his gulf club account, where it will earn 8% annual interest. The account comes to term on October 7. Find the following: a. Find the future value of Ali's gulf club account. ( 3 Marks ) b. Find Ali's total contribution to the account. (1 Mark) c. Find the total interest earned on the account. (1 Mark) 3. How long will it take BD 900 to accumulate to BD 1900 if the interest is at 4% compounded semi- annually? 4. What is the amount of annuity of monthly payments of BD 540 each if money is worth 6% annual interest for 15 years? 5. Layal wants to have BD 11000 in her account by the end of 12 years and 96 months. How much should she invest today in the bank paying 7% quarterly? 6. Nada recently set up a tax-deferred annuity to save for her retirement. She arranged to have BD 80 taken out of each of his monthly checks; it will earn 9% annual interest. She just had her 25 birthday, and her ordinary annuity comes to term when she is 65. Find the following: a. Find the future value of Nada's annuity. (3 Marks) b. Find Nada's total contribution to the annuity. (1 Mark) c. Find the total interest earned on the annuity. (1 Mark) 7. If BHD 12000 is invested on June 25, 2022 at 6% interest compounded semi-annually, find the maturity value and the compound interest on November 19, 2022. 8. Find the interest on BD 6000 at 7% simple interest from 06 FEB, 2020 to 15 October, 2022 by using the four methods. (Use the Long to find the actual and approximate time)