Question

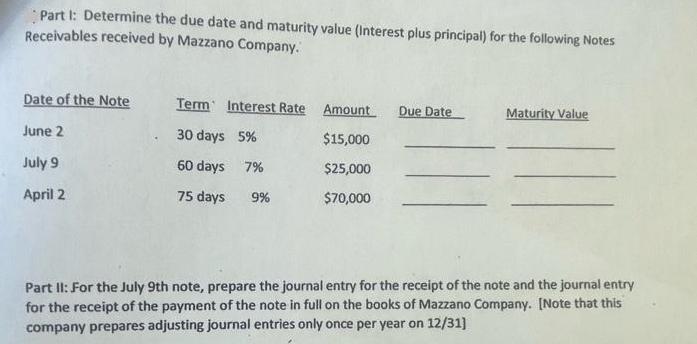

Part I: Determine the due date and maturity value (Interest plus principal) for the following Notes Receivables received by Mazzano Company. Date of the

Part I: Determine the due date and maturity value (Interest plus principal) for the following Notes Receivables received by Mazzano Company. Date of the Note June 2 July 9 April 2 Term Interest Rate 30 days 5% 60 days 7% 75 days 9% Amount Due Date $15,000 $25,000 $70,000 Maturity Value Part II: For the July 9th note, prepare the journal entry for the receipt of the note and the journal entry for the receipt of the payment of the note in full on the books of Mazzano Company. [Note that this company prepares adjusting journal entries only once per year on 12/31]

Step by Step Solution

3.47 Rating (154 Votes )

There are 3 Steps involved in it

Step: 1

Part 1 To determine the due date and maturity value for the Notes Receivables received by Mazzano Co...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get StartedRecommended Textbook for

College Accounting

Authors: Heintz and Parry

20th Edition

1285892070, 538489669, 9781111790301, 978-1285892078, 9780538489669, 1111790302, 978-0538745192

Students also viewed these Accounting questions

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

View Answer in SolutionInn App