Answered step by step

Verified Expert Solution

Question

1 Approved Answer

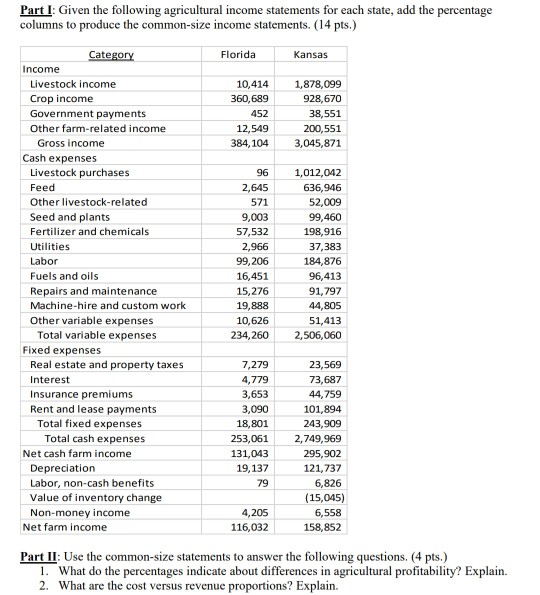

Part I: Given the following agricultural income statements for each state, add the percentage columns to produce the common-size income statements. (14 pts.) ate Florida

Part I: Given the following agricultural income statements for each state, add the percentage columns to produce the common-size income statements. (14 pts.) ate Florida Kansas Income Livestock income Crop income Government payments Other farm-related income 10,414 1,878,099 928,670 38,551 200,551 384,104 3,045,871 360,689 452 12,549 Gross income Cash expenses Livestock purchases Feed Other livestock-related Seed and plants Fertilizer and chemicals Utilities Labor Fuels and oils Repairs and maintenance Machine-hire and custom work Other variable expenses 961,012,042 636,946 52,009 99,460 198,916 37,383 184,876 96,413 91,797 44,805 51,413 234,260 2,506,060 2,645 571 9,003 57,532 966 99,206 16,451 15,276 19,888 10,626 Total variable expenses Fixed expenses Real estate and property taxes Interest Insurance premiums Rent and lease payments 7,279 4,779 3,653 3,090 18,801 23,569 73,687 44,759 101,894 243,909 253,061 2,749,969 295,902 121,737 6,826 (15,045) 6,558 158,852 Total fixed expenses Total cash expenses Net cash farm income 131,043 19,137 79 Depreciation Labor, non-cash benefits Value of inventory change Non-money income 4,205 116,032 Net farm income Part II: Use the common-size statements to answer the following questions. (4 pts.) . What do the percentages indicate about differences in agricultural profitability? Explain. 2. What are the cost versus revenue proportions? Explain

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started