Answered step by step

Verified Expert Solution

Question

1 Approved Answer

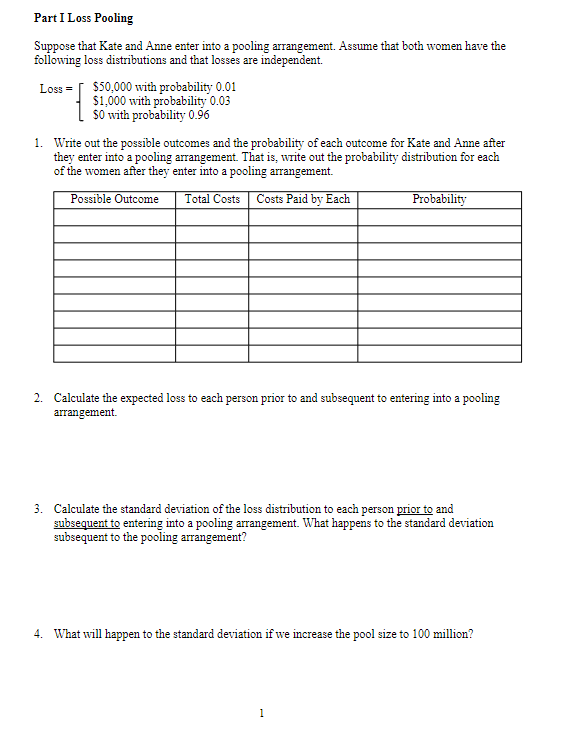

Part I Loss Pooling Suppose that Kate and Anne enter into a pooling arrangement. Assume that both women have the following loss distributions and that

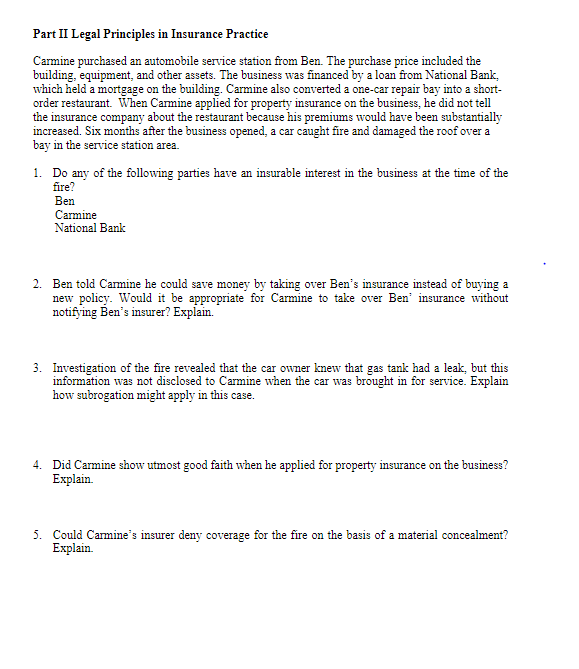

Part I Loss Pooling Suppose that Kate and Anne enter into a pooling arrangement. Assume that both women have the following loss distributions and that losses are independent. Loss=$50,000withprobability0.01$1,000withprobability0.03$0withprobability0.96 1. Write out the possible outcomes and the probability of each outcome for Kate and Anne after they enter into a pooling arrangement. That is, write out the probability distribution for each of the women after they enter into a pooling arrangement. 2. Calculate the expected loss to each person prior to and subsequent to entering into a pooling arrangement. 3. Calculate the standard deviation of the loss distribution to each person prior to and subsequent to entering into a pooling arrangement. What happens to the standard deviation subsequent to the pooling arrangement? 4. What will happen to the standard deviation if we increase the pool size to 100 million? Part II Legal Principles in Insurance Practice Carmine purchased an automobile service station from Ben. The purchase price included the building, equipment, and other assets. The business was financed by a loan from National Bank, which held a mortgage on the building. Carmine also converted a one-car repair bay into a shortorder restaurant. When Carmine applied for property insurance on the business, he did not tell the insurance company about the restaurant because his premiums would have been substantially increased. Six months after the business opened, a car caught fire and damaged the roof over a bay in the service station area. 1. Do any of the following parties have an insurable interest in the business at the time of the fire? Ben Carmine National Bank 2. Ben told Carmine he could save money by taking over Ben's insurance instead of buying a new policy. Would it be appropriate for Carmine to take over Ben' insurance without notifying Ben's insurer? Explain. 3. Investigation of the fire revealed that the car owner knew that gas tank had a leak, but this information was not disclosed to Carmine when the car was brought in for service. Explain how subrogation might apply in this case. 4. Did Carmine show utmost good faith when he applied for property insurance on the business? Explain. 5. Could Carmine's insurer deny coverage for the fire on the basis of a material concealment? Explain

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started