Answered step by step

Verified Expert Solution

Question

1 Approved Answer

Part I Maple Company had the following export and Import transactions during 205 : 1. On March 1, Maple sold goods to a Canadian company

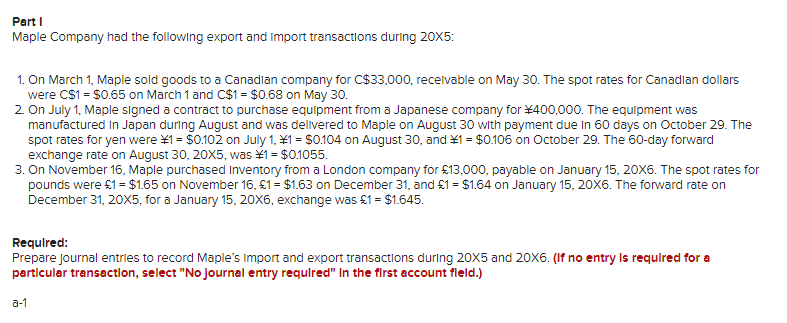

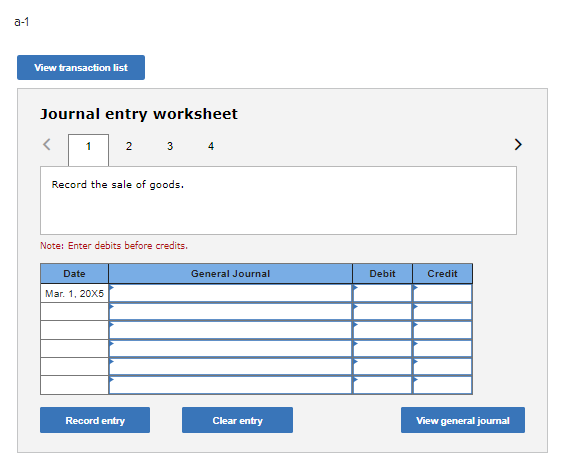

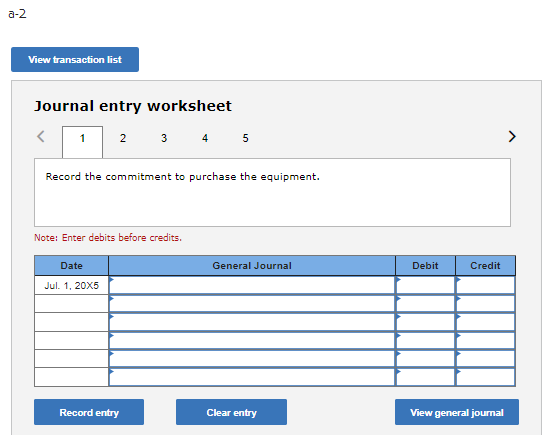

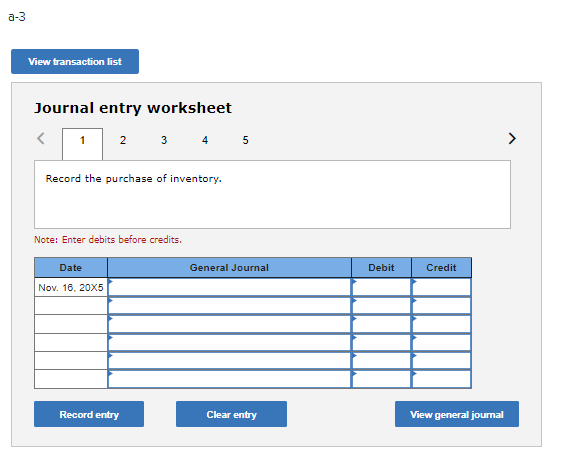

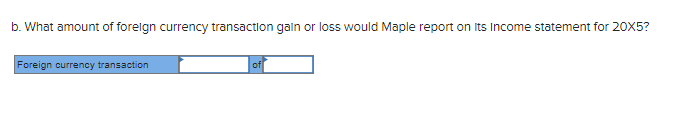

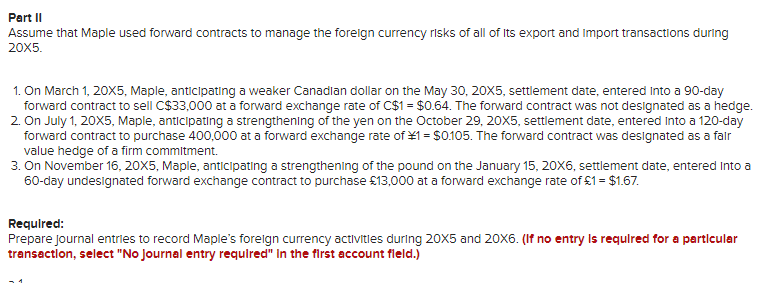

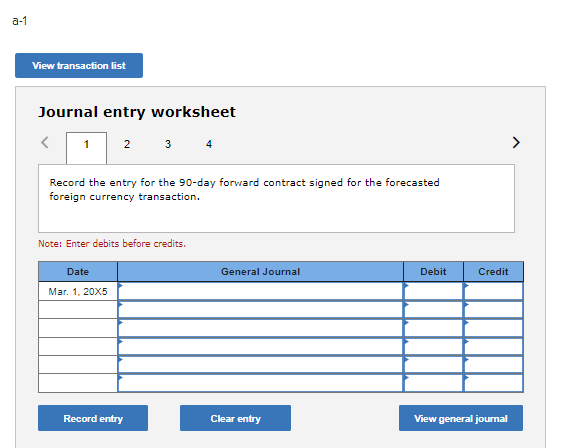

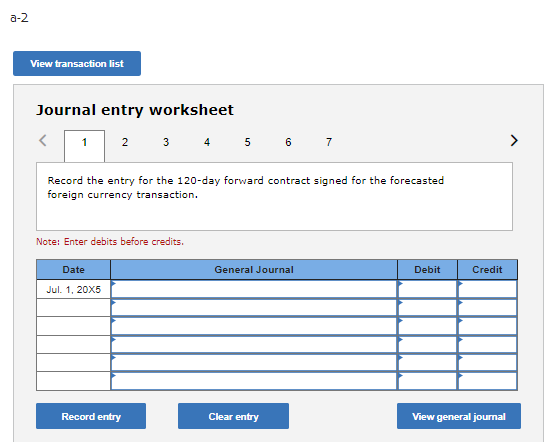

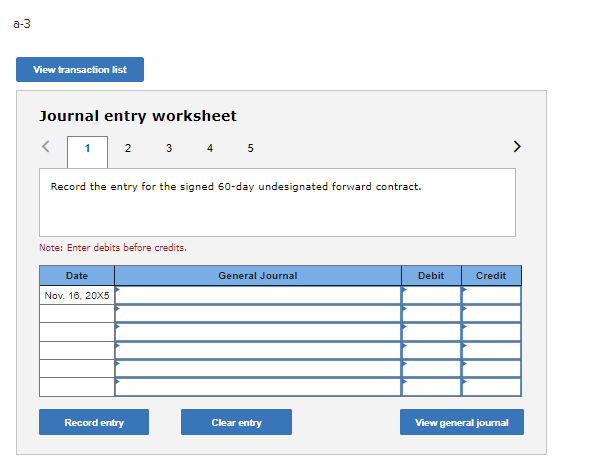

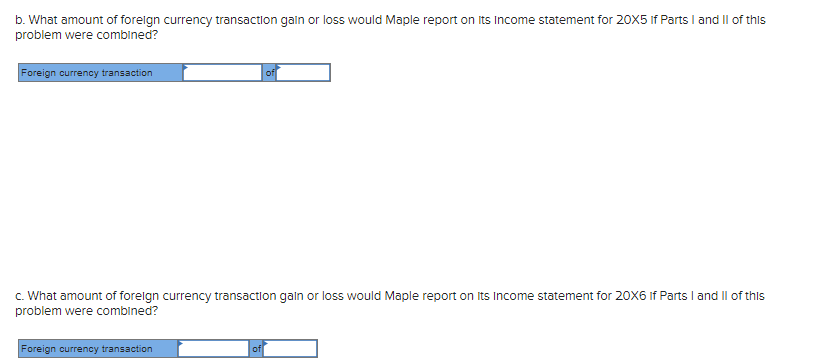

Part I Maple Company had the following export and Import transactions during 205 : 1. On March 1, Maple sold goods to a Canadian company for C$33,000, recelvable on May 30 . The spot rates for Canadian dollars were C$1=$0.65 on March 1 and C$1=$0.68 on May 30 . 2. On July 1 , Maple signed a contract to purchase equipment from a Japanese company for 400,000. The equipment was manufactured in Japan during August and was delivered to Maple on August 30 with payment due in 60 days on October 29 . The spot rates for yen were 1=$0.102 on July 1,1=$0.104 on August 30 , and 1=$0.106 on October 29 . The 60-day forward exchange rate on August 30,205, was 1=$0.1055. 3. On November 16 , Maple purchased Inventory from a London company for 13,000, payable on January 15 , 20X6. The spot rates for pounds were 1=$1.65 on November 16,1=$1.63 on December 31 , and 1=$1.64 on January 15 , 20X6. The forward rate on December 31,205, for a January 15 , 20X6, exchange was 1=$1.645. Requlred: Prepare journal entrles to record Maple's Import and export transactions during 205 and 206. (If no entry Is requlred for a particular transaction, select "No journal entry requlred" In the first account fleld.) a1 Journal entry worksheet 4 Note: Enter debits before credits. Journal entry worksheet 45 Record the commitment to purchase the equipment. Note: Enter debits before credits. Journal entry worksheet 4 Note: Enter debits before credits. b. What amount of foreign currency transaction gain or loss would Maple report on its Income statement for 205 ? Part II Assume that Maple used forward contracts to manage the foreign currency rlsks of all of Its export and Import transactions during 205. forward contract to sell C$33,000 at a forward exchange rate of C$1=$0.64. The forward contract was not designated as a hedge. forward contract to purchase 400,000 at a forward exchange rate of 1=$0.105. The forward contract was designated as a falr value hedge of a firm commitment. 3. On November 16,205, Maple, anticipating a strengthening of the pound on the January 15,206, settlement date, entered Into a 60-day undesignated forward exchange contract to purchase 13,000 at a forward exchange rate of 1=$1.67. Required: Prepare journal entrles to record Maple's forelgn currency actlvitles during 205 and 206. (If no entry Is requlred for a particular transaction, select "No journal entry requlred" In the filst account fleld.) Journal entry worksheet Record the entry for the 90-day forvard contract signed for the forecasted foreign currency transaction. Note: Enter debits before credits. Journal entry worksheet 34567 Record the entry for the 120-day forward contract signed for the forecasted foreign currency transaction. Note: Enter debits before credits. Journal entry worksheet 5 Record the entry for the signed 60-day undesignated forward contract. Note: Enter debits before credits. b. What amount of foreign currency transaction gain or loss would Maple report on its Income statement for 205 If Parts I and II of this problem were combined? c. What amount of foreign currency transaction gain or loss would Maple report on its Income statement for 20X6 if Parts I and II of this problem were combined

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started