Answered step by step

Verified Expert Solution

Question

1 Approved Answer

Part I - Multiple choice questions ( 3 points) Students choose the best option (1/4 point) and give the brief explanation (1/4 point) for each

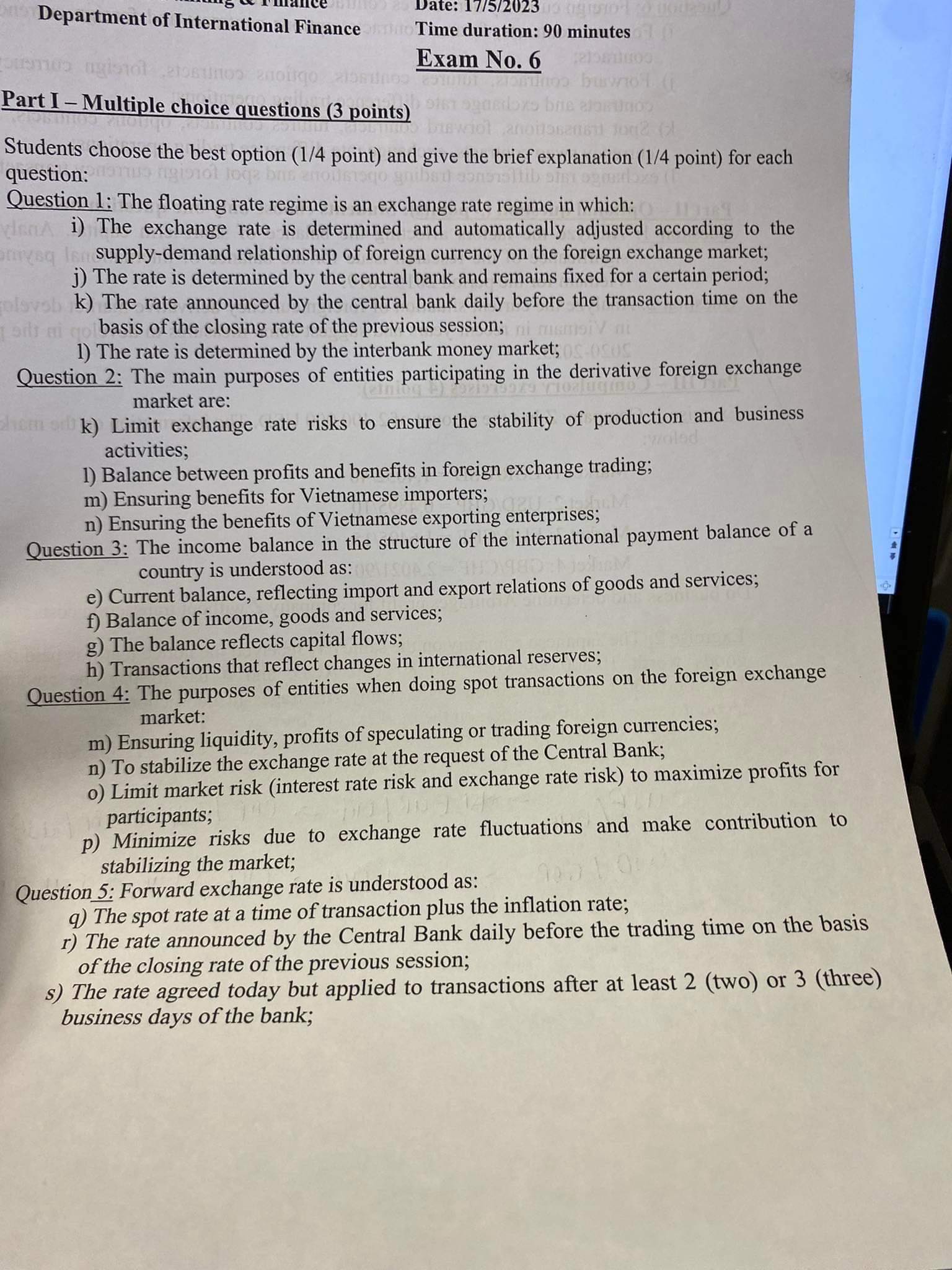

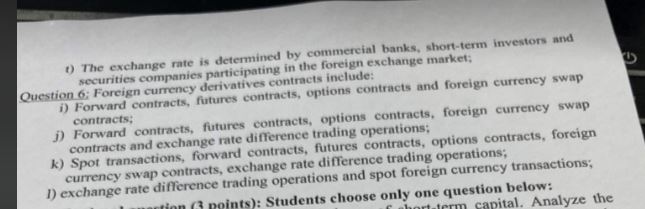

Part I - Multiple choice questions ( 3 points) Students choose the best option (1/4 point) and give the brief explanation (1/4 point) for each question: Question 1: The floating rate regime is an exchange rate regime in which: i) The exchange rate is determined and automatically adjusted according to the supply-demand relationship of foreign currency on the foreign exchange market; j) The rate is determined by the central bank and remains fixed for a certain period; k) The rate announced by the central bank daily before the transaction time on the basis of the closing rate of the previous session; 1) The rate is determined by the interbank money market; Question 2: The main purposes of entities participating in the derivative foreign exchange market are: k) Limit exchange rate risks to ensure the stability of production and business activities; 1) Balance between profits and benefits in foreign exchange trading; m) Ensuring benefits for Vietnamese importers; n) Ensuring the benefits of Vietnamese exporting enterprises; Question 3: The income balance in the structure of the international payment balance of a country is understood as: e) Current balance, reflecting import and export relations of goods and services; f) Balance of income, goods and services; g) The balance reflects capital flows; h) Transactions that reflect changes in international reserves; Question 4: The purposes of entities when doing spot transactions on the foreign exchange market: m) Ensuring liquidity, profits of speculating or trading foreign currencies; n) To stabilize the exchange rate at the request of the Central Bank; o) Limit market risk (interest rate risk and exchange rate risk) to maximize profits for participants; p) Minimize risks due to exchange rate fluctuations and make contribution to stabilizing the market; Question 5: Forward exchange rate is understood as: q) The spot rate at a time of transaction plus the inflation rate; r) The rate announced by the Central Bank daily before the trading time on the basis of the closing rate of the previous session; s) The rate agreed today but applied to transactions after at least 2 (two) or 3 (three) business days of the bank; t) The exchange rate is determined by commercial banks, short-term investors and securities companies participating in the foreign exchange market; uestion 6: Foreign currency derivatives contracts include: i) Forward contracts, futures contracts, options contracts and foreign currency swap contracts: j) Forwand contracts, futures contracts, options contracts, foreign currency swap contracts and exchange rate difference trading operations: k) Spot transactions, forward contracts, futures contracts, options contracts, foreign currency swap contracts, exchange rate difference trading operations; 1) exchange rate difference trading operations and spot foreign currency transactions

Part I - Multiple choice questions ( 3 points) Students choose the best option (1/4 point) and give the brief explanation (1/4 point) for each question: Question 1: The floating rate regime is an exchange rate regime in which: i) The exchange rate is determined and automatically adjusted according to the supply-demand relationship of foreign currency on the foreign exchange market; j) The rate is determined by the central bank and remains fixed for a certain period; k) The rate announced by the central bank daily before the transaction time on the basis of the closing rate of the previous session; 1) The rate is determined by the interbank money market; Question 2: The main purposes of entities participating in the derivative foreign exchange market are: k) Limit exchange rate risks to ensure the stability of production and business activities; 1) Balance between profits and benefits in foreign exchange trading; m) Ensuring benefits for Vietnamese importers; n) Ensuring the benefits of Vietnamese exporting enterprises; Question 3: The income balance in the structure of the international payment balance of a country is understood as: e) Current balance, reflecting import and export relations of goods and services; f) Balance of income, goods and services; g) The balance reflects capital flows; h) Transactions that reflect changes in international reserves; Question 4: The purposes of entities when doing spot transactions on the foreign exchange market: m) Ensuring liquidity, profits of speculating or trading foreign currencies; n) To stabilize the exchange rate at the request of the Central Bank; o) Limit market risk (interest rate risk and exchange rate risk) to maximize profits for participants; p) Minimize risks due to exchange rate fluctuations and make contribution to stabilizing the market; Question 5: Forward exchange rate is understood as: q) The spot rate at a time of transaction plus the inflation rate; r) The rate announced by the Central Bank daily before the trading time on the basis of the closing rate of the previous session; s) The rate agreed today but applied to transactions after at least 2 (two) or 3 (three) business days of the bank; t) The exchange rate is determined by commercial banks, short-term investors and securities companies participating in the foreign exchange market; uestion 6: Foreign currency derivatives contracts include: i) Forward contracts, futures contracts, options contracts and foreign currency swap contracts: j) Forwand contracts, futures contracts, options contracts, foreign currency swap contracts and exchange rate difference trading operations: k) Spot transactions, forward contracts, futures contracts, options contracts, foreign currency swap contracts, exchange rate difference trading operations; 1) exchange rate difference trading operations and spot foreign currency transactions Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started