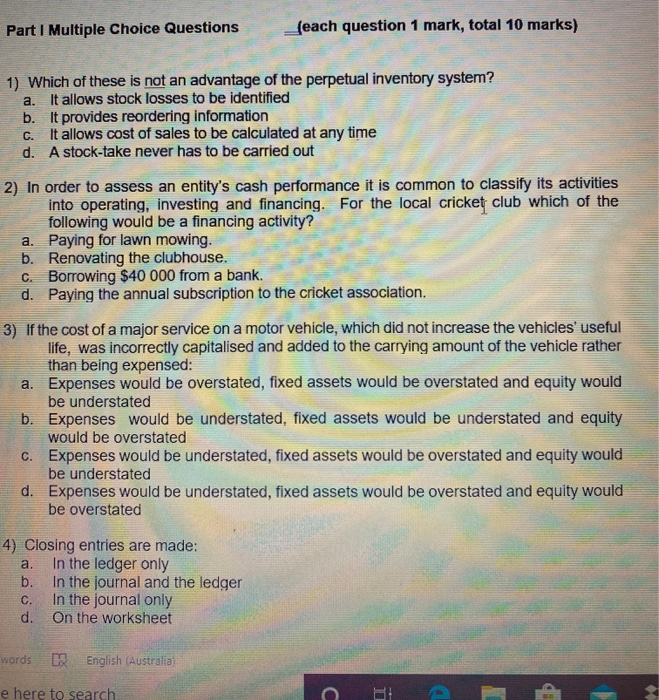

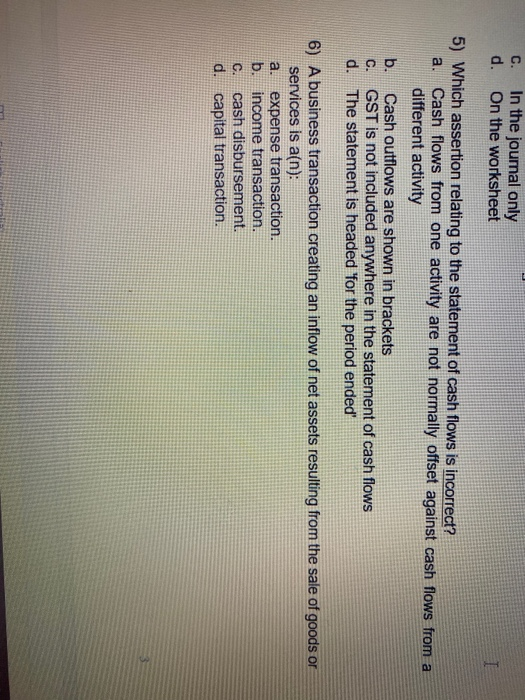

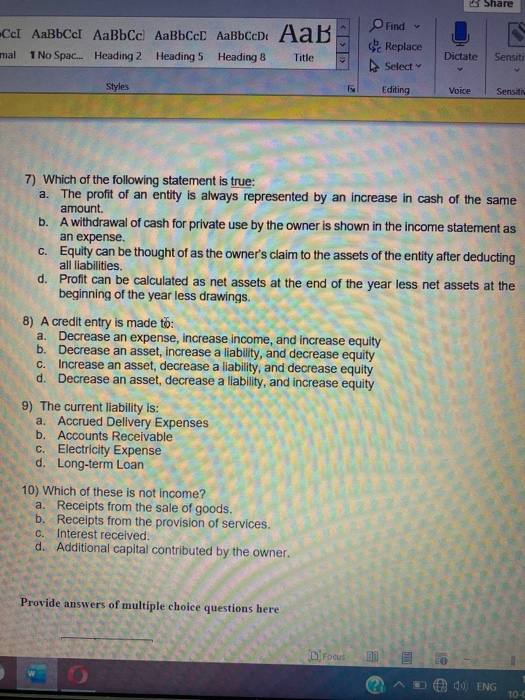

Part I Multiple Choice Questions (each question 1 mark, total 10 marks) C. 1) Which of these is not an advantage of the perpetual inventory system? a. It allows stock losses to be identified b. It provides reordering information It allows cost of sales to be calculated at any time d. A stock-take never has to be carried out 2) In order to assess an entity's cash performance it is common to classify its activities into operating, investing and financing. For the local cricket club which of the following would be a financing activity? a. Paying for lawn mowing. b. Renovating the clubhouse. C. Borrowing $40 000 from a bank. d. Paying the annual subscription to the cricket association. 3) If the cost of a major service on a motor vehicle, which did not increase the vehicles' useful life, was incorrectly capitalised and added to the carrying amount of the vehicle rather than being expensed: a. Expenses would be overstated, fixed assets would be overstated and equity would be understated b. Expenses would be understated, fixed assets would be understated and equity wou be overstated C. Expenses would be understated, fixed assets would be overstated and equity would be understated d. Expenses would be understated, fixed assets would be overstated and equity would be overstated 4) Closing entries are made: a. In the ledger only b. In the journal and the ledger C. In the journal only d. On the worksheet words English (Australia) e here to search C i C. In the journal only d. On the worksheet I a. 5) Which assertion relating to the statement of cash flows is incorrect? Cash flows from one activity are not normally offset against cash flows from a different activity b. Cash outflows are shown in brackets GST is not included anywhere in the statement of cash flows d. The statement is headed for the period ended' C. a. 6) A business transaction creating an inflow of net assets resulting from the sale of goods or services is a(n): expense transaction. b. income transaction. cash disbursement. d. capital transaction. C. 3 Share r el . Find c Replace Select mal 1 No Spac... Heading 2 Heading 5 Heading 8 Title Dictate Sensiti Styles Editing Voice Sensitive 7) Which of the following statement is true: a. The profit of an entity is always represented by an increase in cash of the same amount b. A withdrawal of cash for private use by the owner is shown in the income statement as an expense. C. Equity can be thought of as the owner's claim to the assets of the entity after deducting all liabilities. d. Profit can be calculated as net assets at the end of the year less net assets at the beginning of the year less drawings. 8) A credit entry is made to: a. Decrease an expense, increase income, and increase equity b. Decrease an asset, increase a liability, and decrease equity C. Increase an asset, decrease a liability, and decrease equity d. Decrease an asset, decrease a liability, and increase equity 9) The current liability is: a. Accrued Delivery Expenses b. Accounts Receivable C. Electricity Expense d. Long-term Loan 10) Which of these is not income? a. Receipts from the sale of goods. b. Receipts from the provision of services. c. Interest received. d. Additional capital contributed by the owner. Provide answers of multiple choice questions here D Focus d) ENG 10