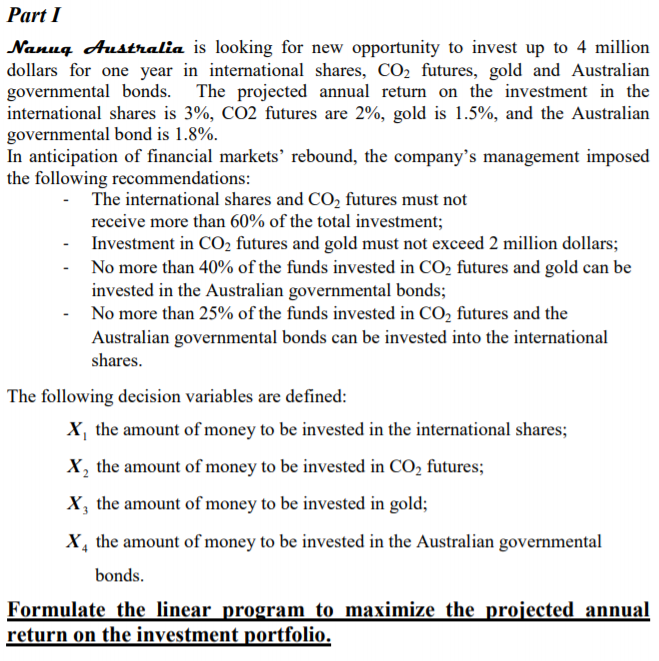

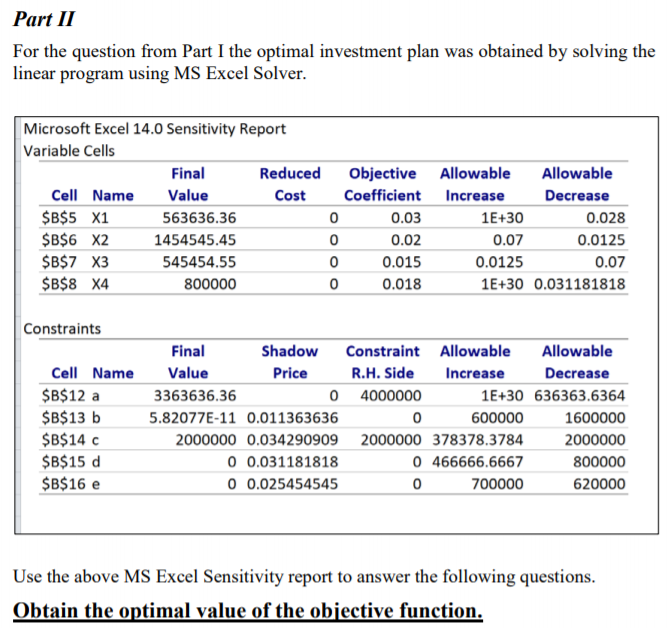

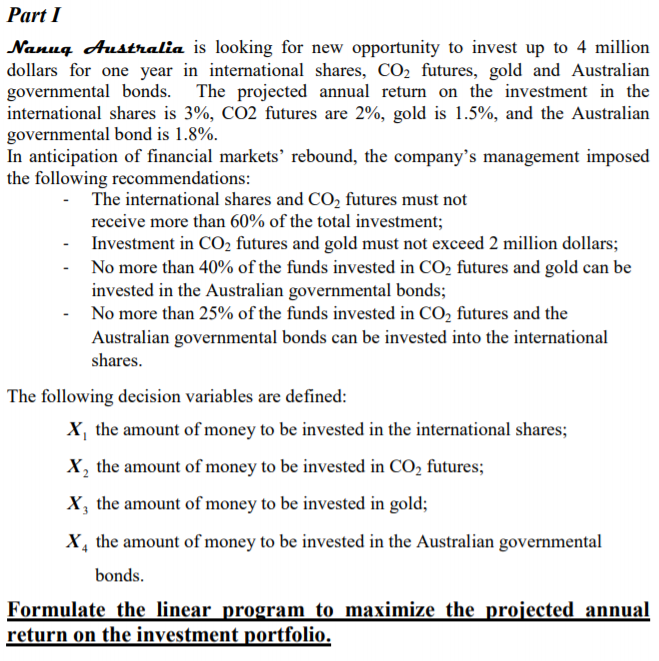

Part I Nanuq Australia is looking for new opportunity to invest up to 4 million dollars for one year in international shares, CO2 futures, gold and Australian governmental bonds. The projected annual return on the investment in the international shares is 3%, CO2 futures are 2%, gold is 1.5%, and the Australian governmental bond is 1.8%. In anticipation of financial markets' rebound, the company's management imposed the following recommendations: The international shares and CO2 futures must not receive more than 60% of the total investment; Investment in CO2 futures and gold must not exceed 2 million dollars; No more than 40% of the funds invested in CO2 futures and gold can be invested in the Australian governmental bonds; No more than 25% of the funds invested in CO2 futures and the Australian governmental bonds can be invested into the international shares The following decision variables are defined: X the amount of money to be invested in the international shares; X2 the amount of money to be invested in CO2 futures; X3 the amount of money to be invested in gold; X2 the amount of money to be invested in the Australian governmental bonds Formulate the linear program to maximize the projected annual return on the investment portfolio. Part II For the question from Part I the optimal investment plan was obtained by solving the linear program using MS Excel Solver Microsoft Excel 14.0 Sensitivity Report Variable Cells Objective Allowable Final Reduced Allowable Cell Name Value Coefficient Increase Cost Decrease $B$5 X1 $B$6 X2 0.03 1E+30 563636.36 0.028 1454545.45 0 0.02 0.07 0.0125 $B$7 X3 545454.55 0 0.015 0.0125 0.07 $B$8 X4 800000 0 0.018 1E+30 0.031181818 Constraints Final Constraint Allowable Allowable Shadow Cell Name Value Price R.H. Side Decrease Increase 0 4000000 $B$12 a $B$13 b 3363636.36 1E+30 636363.6364 5.82077E-11 0.011363636 0 600000 1600000 $B$14 c 2000000 0.034290909 2000000 378378.3784 2000000 0 466666.6667 0 0.031181818 0 0.025454545 $B$15 d 800000 $B$16 e 700000 620000 Use the above MS Excel Sensitivity report to answer the following questions. Obtain the optimal value of the objective function Question 1 continued What is the total amount of monev to be invested under the optimal investment plan? Explain your answer How much can be invested in CO, futures and gold according to the optimal investment plan? The management of the company wants to limit the combined investment in CO2 futures and gold to 1 million dollars. Explain clearly how this resolution will affect the optimal investment plan and the objective function value. Question 1 continued The senior management has decided to release some of the available total investment fund to train staff in Workplace Health and Safety (WHS. Calculate the amount of money that can be released for WHS training given that the management now has only $3 950 000 available for investment. What is the annual return on the optimal portfolio expressed as a percentage? Part I Nanuq Australia is looking for new opportunity to invest up to 4 million dollars for one year in international shares, CO2 futures, gold and Australian governmental bonds. The projected annual return on the investment in the international shares is 3%, CO2 futures are 2%, gold is 1.5%, and the Australian governmental bond is 1.8%. In anticipation of financial markets' rebound, the company's management imposed the following recommendations: The international shares and CO2 futures must not receive more than 60% of the total investment; Investment in CO2 futures and gold must not exceed 2 million dollars; No more than 40% of the funds invested in CO2 futures and gold can be invested in the Australian governmental bonds; No more than 25% of the funds invested in CO2 futures and the Australian governmental bonds can be invested into the international shares The following decision variables are defined: X the amount of money to be invested in the international shares; X2 the amount of money to be invested in CO2 futures; X3 the amount of money to be invested in gold; X2 the amount of money to be invested in the Australian governmental bonds Formulate the linear program to maximize the projected annual return on the investment portfolio. Part II For the question from Part I the optimal investment plan was obtained by solving the linear program using MS Excel Solver Microsoft Excel 14.0 Sensitivity Report Variable Cells Objective Allowable Final Reduced Allowable Cell Name Value Coefficient Increase Cost Decrease $B$5 X1 $B$6 X2 0.03 1E+30 563636.36 0.028 1454545.45 0 0.02 0.07 0.0125 $B$7 X3 545454.55 0 0.015 0.0125 0.07 $B$8 X4 800000 0 0.018 1E+30 0.031181818 Constraints Final Constraint Allowable Allowable Shadow Cell Name Value Price R.H. Side Decrease Increase 0 4000000 $B$12 a $B$13 b 3363636.36 1E+30 636363.6364 5.82077E-11 0.011363636 0 600000 1600000 $B$14 c 2000000 0.034290909 2000000 378378.3784 2000000 0 466666.6667 0 0.031181818 0 0.025454545 $B$15 d 800000 $B$16 e 700000 620000 Use the above MS Excel Sensitivity report to answer the following questions. Obtain the optimal value of the objective function Question 1 continued What is the total amount of monev to be invested under the optimal investment plan? Explain your answer How much can be invested in CO, futures and gold according to the optimal investment plan? The management of the company wants to limit the combined investment in CO2 futures and gold to 1 million dollars. Explain clearly how this resolution will affect the optimal investment plan and the objective function value. Question 1 continued The senior management has decided to release some of the available total investment fund to train staff in Workplace Health and Safety (WHS. Calculate the amount of money that can be released for WHS training given that the management now has only $3 950 000 available for investment. What is the annual return on the optimal portfolio expressed as a percentage