PART I:

- prepare a common-size Consolidated Statements of Financial Position;

- Using the template provided, prepare a common-size Consolidated Statements of Operations;

- Using the template provided, prepare all of the financial ratios including:

- Liquidity ratios

- Activity ratios

- Leverage ratios

- Profitability ratios

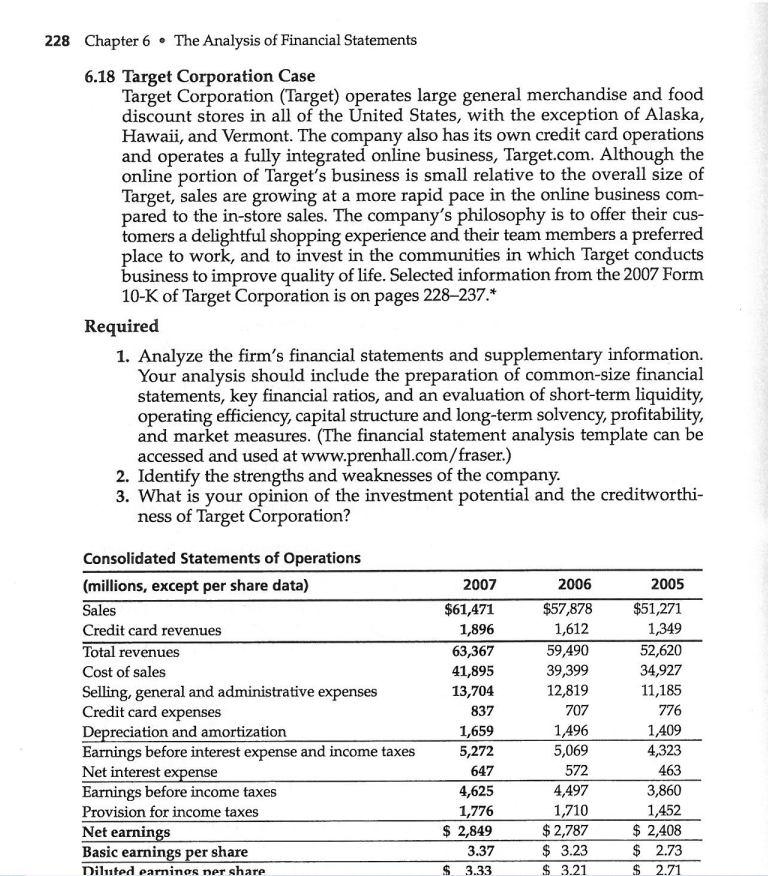

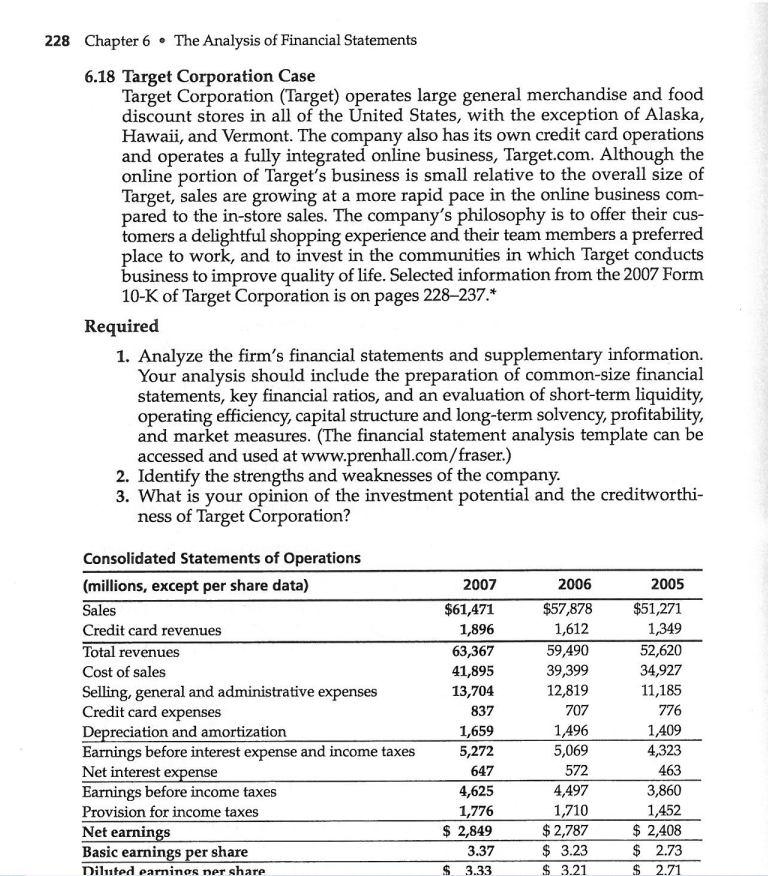

228 Chapter 6 The Analysis of Financial Statements 6.18 Target Corporation Case Target Corporation (Target) operates large general merchandise and food discount stores in all of the United States, with the exception of Alaska, Hawaii, and Vermont. The company also has its own credit card operations and operates a fully integrated online business, Target.com. Although the online portion of Target's business is small relative to the overall size of Target, sales are growing at a more rapid pace in the online business com- pared to the in-store sales. The company's philosophy is to offer their cus- tomers a delightful shopping experience and their team members a preferred place to work, and to invest in the communities in which Target conducts business to improve quality of life. Selected information from the 2007 Form 10-K of Target Corporation is on pages 228-237.* Required 1. Analyze the firm's financial statements and supplementary information. Your analysis should include the preparation of common-size financial statements, key financial ratios, and an evaluation of short-term liquidity, operating efficiency, capital structure and long-term solvency, profitability, and market measures. The financial statement analysis template can be accessed and used at www.prenhall.com/fraser.) 2. Identify the strengths and weaknesses of the company. 3. What is your opinion of the investment potential and the creditworthi- ness of Target Corporation? Consolidated Statements of Operations (millions, except per share data) Sales Credit card revenues Total revenues Cost of sales Selling, general and administrative expenses Credit card expenses Depreciation and amortization Earnings before interest expense and income taxes Net interest expense Earnings before income taxes Provision for income taxes Net earnings Basic earnings per share Diluted earnings ner share 2007 $61,471 1,896 63,367 41,895 13,704 837 1,659 5,272 647 4,625 1,776 $ 2,849 3.37 $ 3.33 2006 $57,878 1,612 59,490 39,399 12,819 707 1,496 5,069 572 4,497 1,710 $ 2,787 $ 3.23 $ 3.21 2005 $51,271 1,349 52,620 34,927 11,185 776 1,409 4,323 463 3,860 1,452 $ 2,408 $ 2.73 $ 2.71 228 Chapter 6 The Analysis of Financial Statements 6.18 Target Corporation Case Target Corporation (Target) operates large general merchandise and food discount stores in all of the United States, with the exception of Alaska, Hawaii, and Vermont. The company also has its own credit card operations and operates a fully integrated online business, Target.com. Although the online portion of Target's business is small relative to the overall size of Target, sales are growing at a more rapid pace in the online business com- pared to the in-store sales. The company's philosophy is to offer their cus- tomers a delightful shopping experience and their team members a preferred place to work, and to invest in the communities in which Target conducts business to improve quality of life. Selected information from the 2007 Form 10-K of Target Corporation is on pages 228-237.* Required 1. Analyze the firm's financial statements and supplementary information. Your analysis should include the preparation of common-size financial statements, key financial ratios, and an evaluation of short-term liquidity, operating efficiency, capital structure and long-term solvency, profitability, and market measures. The financial statement analysis template can be accessed and used at www.prenhall.com/fraser.) 2. Identify the strengths and weaknesses of the company. 3. What is your opinion of the investment potential and the creditworthi- ness of Target Corporation? Consolidated Statements of Operations (millions, except per share data) Sales Credit card revenues Total revenues Cost of sales Selling, general and administrative expenses Credit card expenses Depreciation and amortization Earnings before interest expense and income taxes Net interest expense Earnings before income taxes Provision for income taxes Net earnings Basic earnings per share Diluted earnings ner share 2007 $61,471 1,896 63,367 41,895 13,704 837 1,659 5,272 647 4,625 1,776 $ 2,849 3.37 $ 3.33 2006 $57,878 1,612 59,490 39,399 12,819 707 1,496 5,069 572 4,497 1,710 $ 2,787 $ 3.23 $ 3.21 2005 $51,271 1,349 52,620 34,927 11,185 776 1,409 4,323 463 3,860 1,452 $ 2,408 $ 2.73 $ 2.71