Answered step by step

Verified Expert Solution

Question

1 Approved Answer

Part I: WACC Use this information to answer questions 1-8 Suppose Intel wants to raise capital to start a new project to bring their manufacturing

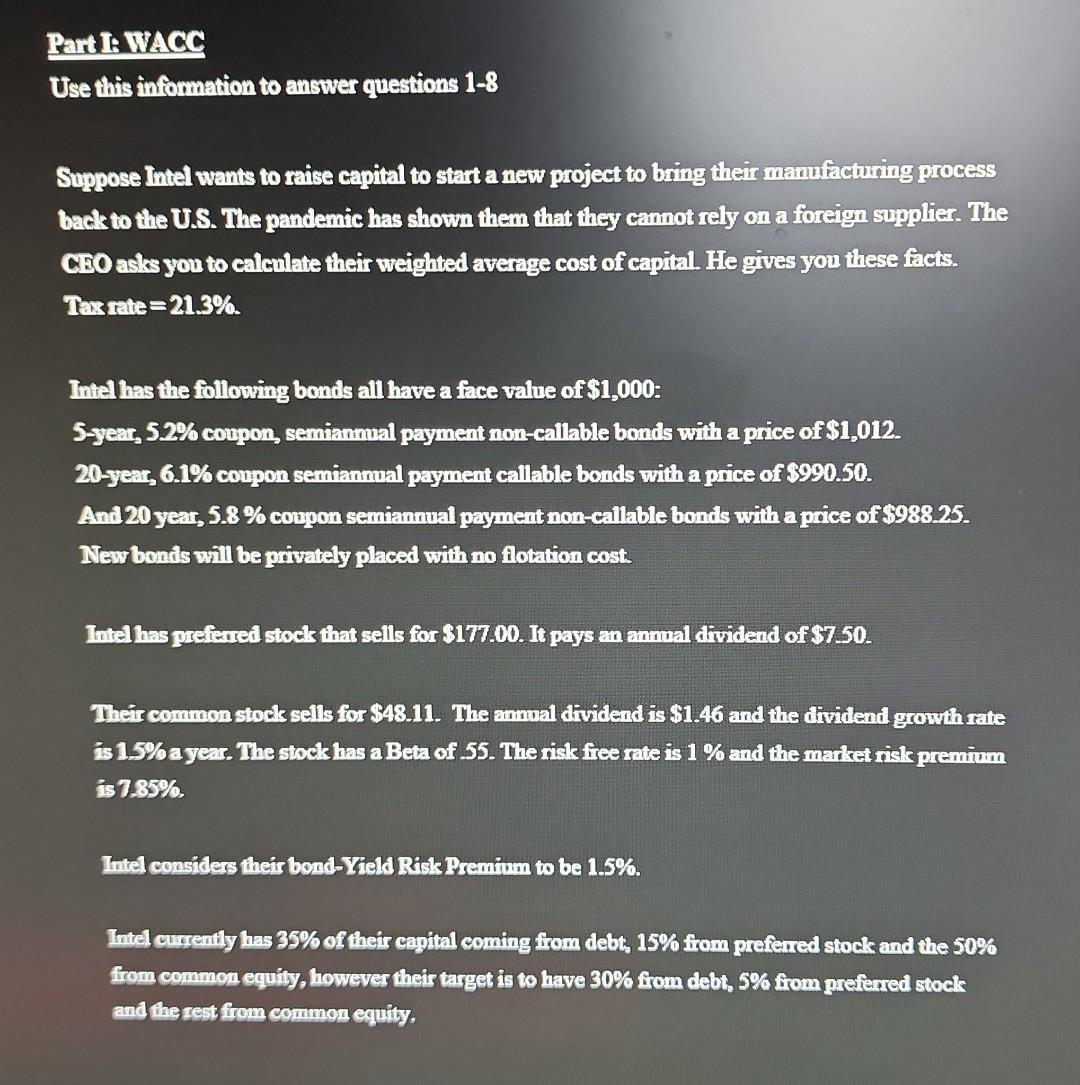

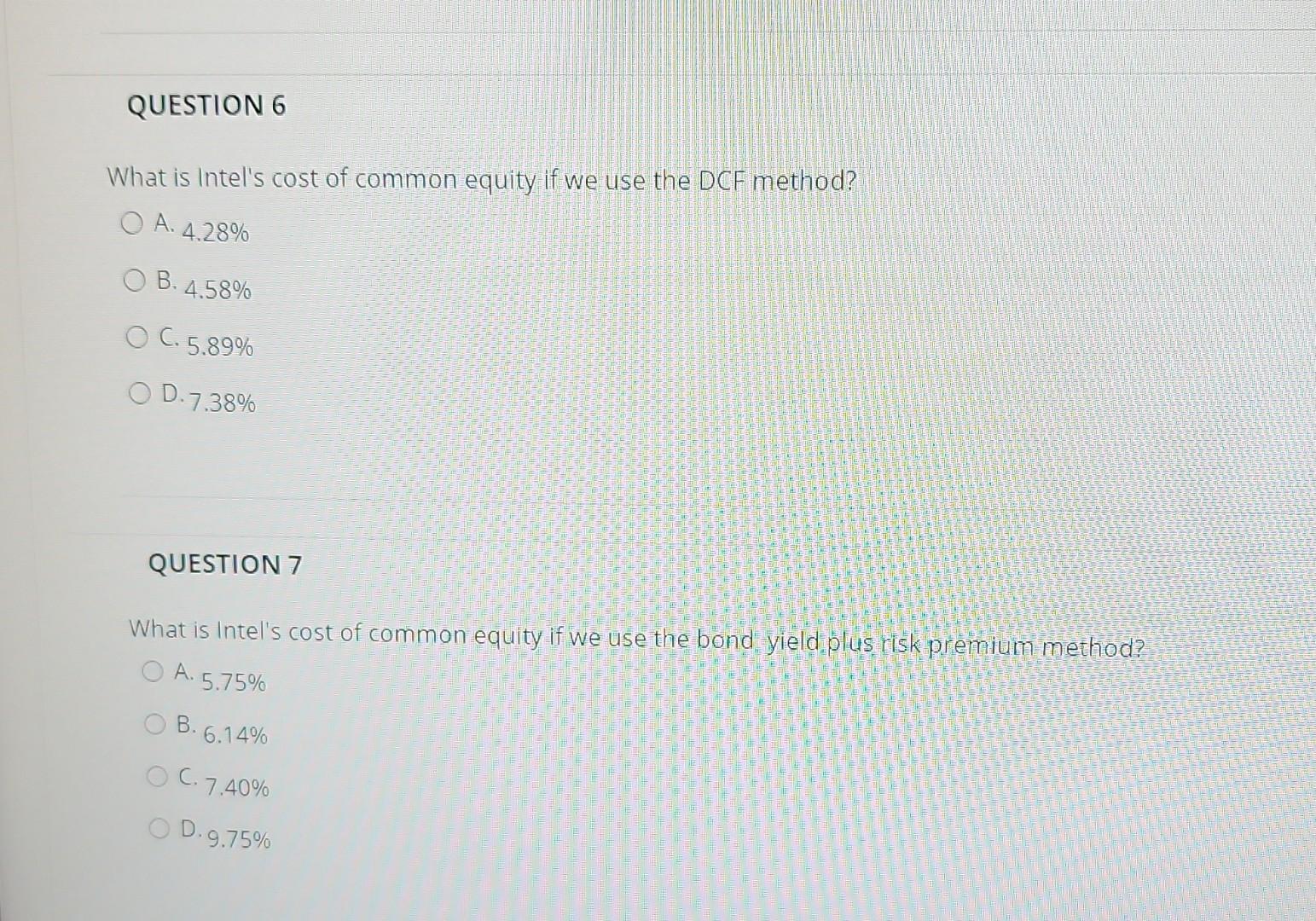

Part I: WACC Use this information to answer questions 1-8 Suppose Intel wants to raise capital to start a new project to bring their manufacturing process back to the U.S. The pandemic has shown them that they cannot rely on a foreign supplier. The CEO asks you to calculate their weighted average cost of capital. He gives you these facts. Tax rate= 21.3%. Intel has the following bonds all have a face value of $1,000: 5-year, 5.2% coupon, semianmal payment non-callable bonds with a price of $1,012. 20-year, 6.1% coupon semiannual payment callable bonds with a price of $990.50. And 20 year, 5.8 % coupon semiannual payment non-callable bonds with a price of $988.25. New bonds will be privately placed with no flotation cost. Intel has prefered stock that sells for $177.00. It pays an annual dividend of $7.50. Their common stock sells for $48.11. The annual dividend is $1.46 and the dividend growth rate is 1.5% a year. The stock has a Beta of 55. The risk free rate is 1% and the market risk premium is 7.85% Intel considers their bond-Yield Risk Premium to be 1.5%. Intel currently has 35% of their capital coming from debt, 15% from preferred stock and the 50% from common equity, however their target is to have 30% from debt, 5% from preferred stock and the rest from common equity. QUESTION 6 What is Intel's cost of common equity if we use the DCF method? A. 4.28% OB. 4.58% O C.5.89% OD.7.38% QUESTION 7 What is Intel's cost of common equity if we use the bond yield plus risk premium method? O A. 5.75% B.6.14% O C.7.40% D.9.75%

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started