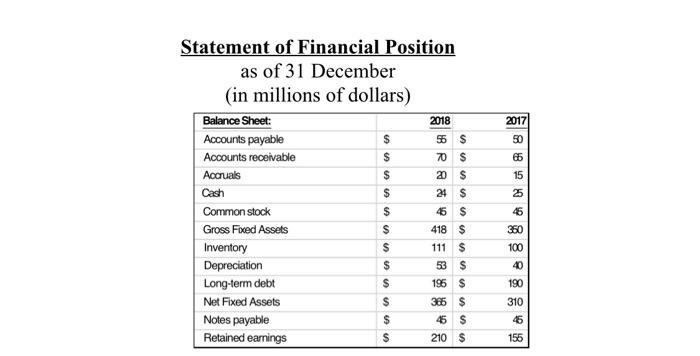

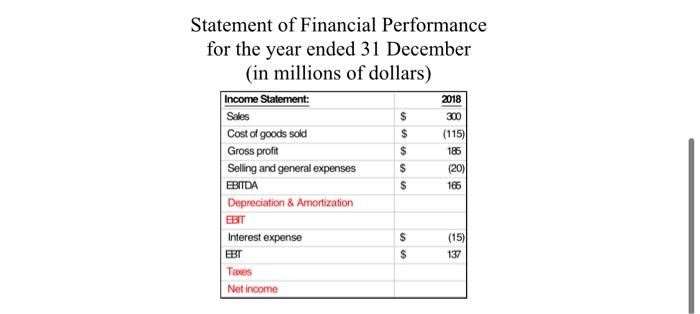

Part II: (8 marks) Question 3: (8 marks) John and Rice founded the East Time Company back in 2010, Today, as a profitable and successful business, the company manufactures a wide variety of components for high-quality Watches and clocks In 2018, the firm's operating profit was $152 million. This is when the corporate taxation rate was 34.31%. . Further information about the company's financial performance and position can be obtained from the its income statement and balance sheet extracts for years 2017 and 2018 which are provided below Statement of Financial Position as of 31 December fin millions of dollars) Det De an. re Statement of Financial Performance for the year ended 31 December (in millions of dollars) Fill in the blanks in the company's income statement for year 2018 above. Show all workings, formulas and calculations. (2 marks) b. Present the company's balance sheet (starting from the most liquid assets) for year 2018. Show all workings, formulas and calculations. (2 marks) c. Prepare the company's statement of cash flow for year 2018. Show all workings, formulas and calculations. (4 marks) Part II: (8 marks) Question 3: (8 marks) John and Rice founded the East Time Company back in 2010. Today, as a profitable and successful business, the company manufactures a wide variety of components for high-quality watches and clocks. In 2018, the firm's operating profit was $152 million. This is when the corporate taxation rate was 34.31%. Further information about the company's financial performance and position can be obtained from the its income statement and balance sheet extracts for years 2017 and 2018, which are provided below: 56 $ 70 $ 2017 50 66 $ 15 Statement of Financial Position as of 31 December (in millions of dollars) Balance Sheet: 2018 Accounts payable $ Accounts receivable Accruals 20 $ Cash Common stock Gross Fixed Assets $ Inventory Depreciation $ Long-term debt $ Net Fixed Assets 366 $ Notes payable 46 $ Retained earnings 210 $ $ $ 24 $ 45 $ 418 $ 111 $ 53 $ 196 $ V M O W W v v 8888888 $ 25 46 360 100 40 190 310 46 155 Statement of Financial Performance for the year ended 31 December (in millions of dollars) Income Statement: Sales Cost of goods sold Gross profit Selling and general expenses EBITDA Depreciation & Amortization $ $ $ $ $ 2018 300 (115) 186 (20) 166 BIT Interest expense BT Taxes Net income (15) 137 GA a. Fill in the blanks in the company's income statement for year 2018 above. Show all workings, formulas and calculations. (2 marks) b. Present the company's balance sheet (starting from the most liquid assets) for year 2018. Show all workings, formulas and calculations. (2 marks) c. Prepare the company's statement of cash flow for year 2018. Show all workings, formulas and calculations. (4 marks)