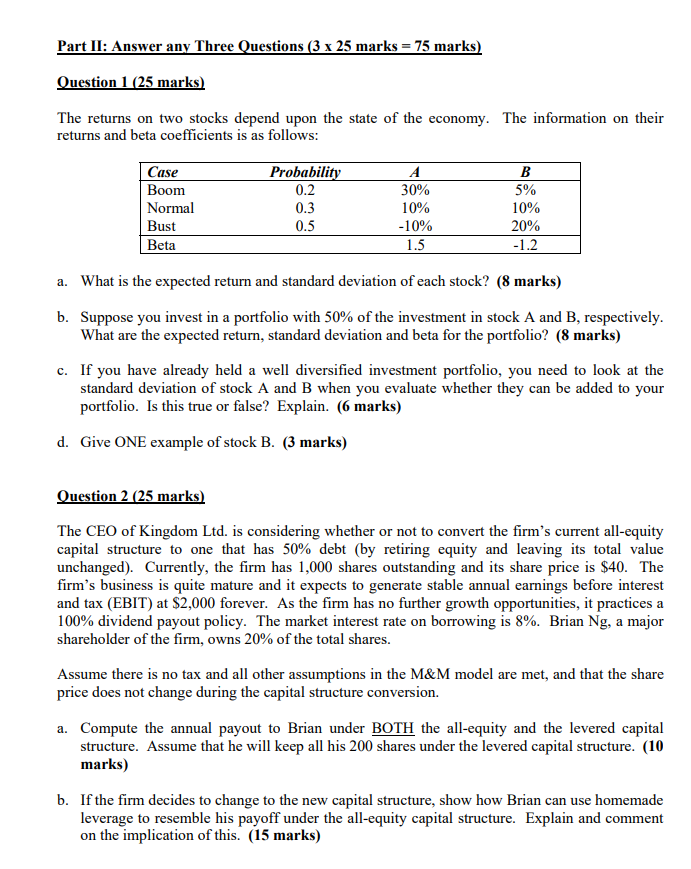

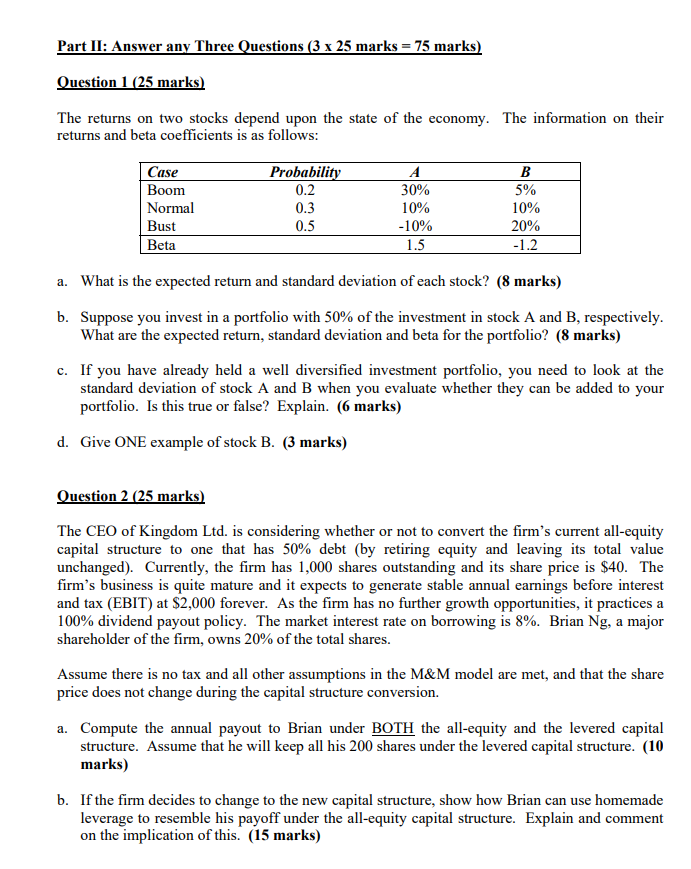

Part II: Answer any Three Questions (3 x 25 marks = 75 marks) Question 1 (25 marks) The returns on two stocks depend upon the state of the economy. The information on their returns and beta coefficients is as follows: | Case Boom Normal Bust Beta Probability 0.2 0.3 0.5 30% 10% -10% 1.5 5% 10% 20% a. What is the expected return and standard deviation of each stock? (8 marks) b. Suppose you invest in a portfolio with 50% of the investment in stock A and B, respectively. What are the expected return, standard deviation and beta for the portfolio? (8 marks) c. If you have already held a well diversified investment portfolio, you need to look at the standard deviation of stock A and B when you evaluate whether they can be added to your portfolio. Is this true or false? Explain. (6 marks) d. Give ONE example of stock B. (3 marks) Question 2 (25 marks) The CEO of Kingdom Ltd. is considering whether or not to convert the firm's current all-equity capital structure to one that has 50% debt (by retiring equity and leaving its total value unchanged). Currently, the firm has 1,000 shares outstanding and its share price is $40. The firm's business is quite mature and it expects to generate stable annual earnings before interest and tax (EBIT) at $2,000 forever. As the firm has no further growth opportunities, it practices a 100% dividend payout policy. The market interest rate on borrowing is 8%. Brian Ng, a major shareholder of the firm, owns 20% of the total shares. Assume there is no tax and all other assumptions in the M&M model are met, and that the share price does not change during the capital structure conversion. a. Compute the annual payout to Brian under BOTH the all-equity and the levered capital structure. Assume that he will keep all his 200 shares under the levered capital structure. (10 marks) b. If the firm decides to change to the new capital structure, show how Brian can use homemade leverage to resemble his payoff under the all-equity capital structure. Explain and comment on the implication of this. (15 marks) Part II: Answer any Three Questions (3 x 25 marks = 75 marks) Question 1 (25 marks) The returns on two stocks depend upon the state of the economy. The information on their returns and beta coefficients is as follows: | Case Boom Normal Bust Beta Probability 0.2 0.3 0.5 30% 10% -10% 1.5 5% 10% 20% a. What is the expected return and standard deviation of each stock? (8 marks) b. Suppose you invest in a portfolio with 50% of the investment in stock A and B, respectively. What are the expected return, standard deviation and beta for the portfolio? (8 marks) c. If you have already held a well diversified investment portfolio, you need to look at the standard deviation of stock A and B when you evaluate whether they can be added to your portfolio. Is this true or false? Explain. (6 marks) d. Give ONE example of stock B. (3 marks) Question 2 (25 marks) The CEO of Kingdom Ltd. is considering whether or not to convert the firm's current all-equity capital structure to one that has 50% debt (by retiring equity and leaving its total value unchanged). Currently, the firm has 1,000 shares outstanding and its share price is $40. The firm's business is quite mature and it expects to generate stable annual earnings before interest and tax (EBIT) at $2,000 forever. As the firm has no further growth opportunities, it practices a 100% dividend payout policy. The market interest rate on borrowing is 8%. Brian Ng, a major shareholder of the firm, owns 20% of the total shares. Assume there is no tax and all other assumptions in the M&M model are met, and that the share price does not change during the capital structure conversion. a. Compute the annual payout to Brian under BOTH the all-equity and the levered capital structure. Assume that he will keep all his 200 shares under the levered capital structure. (10 marks) b. If the firm decides to change to the new capital structure, show how Brian can use homemade leverage to resemble his payoff under the all-equity capital structure. Explain and comment on the implication of this. (15 marks)