Answered step by step

Verified Expert Solution

Question

1 Approved Answer

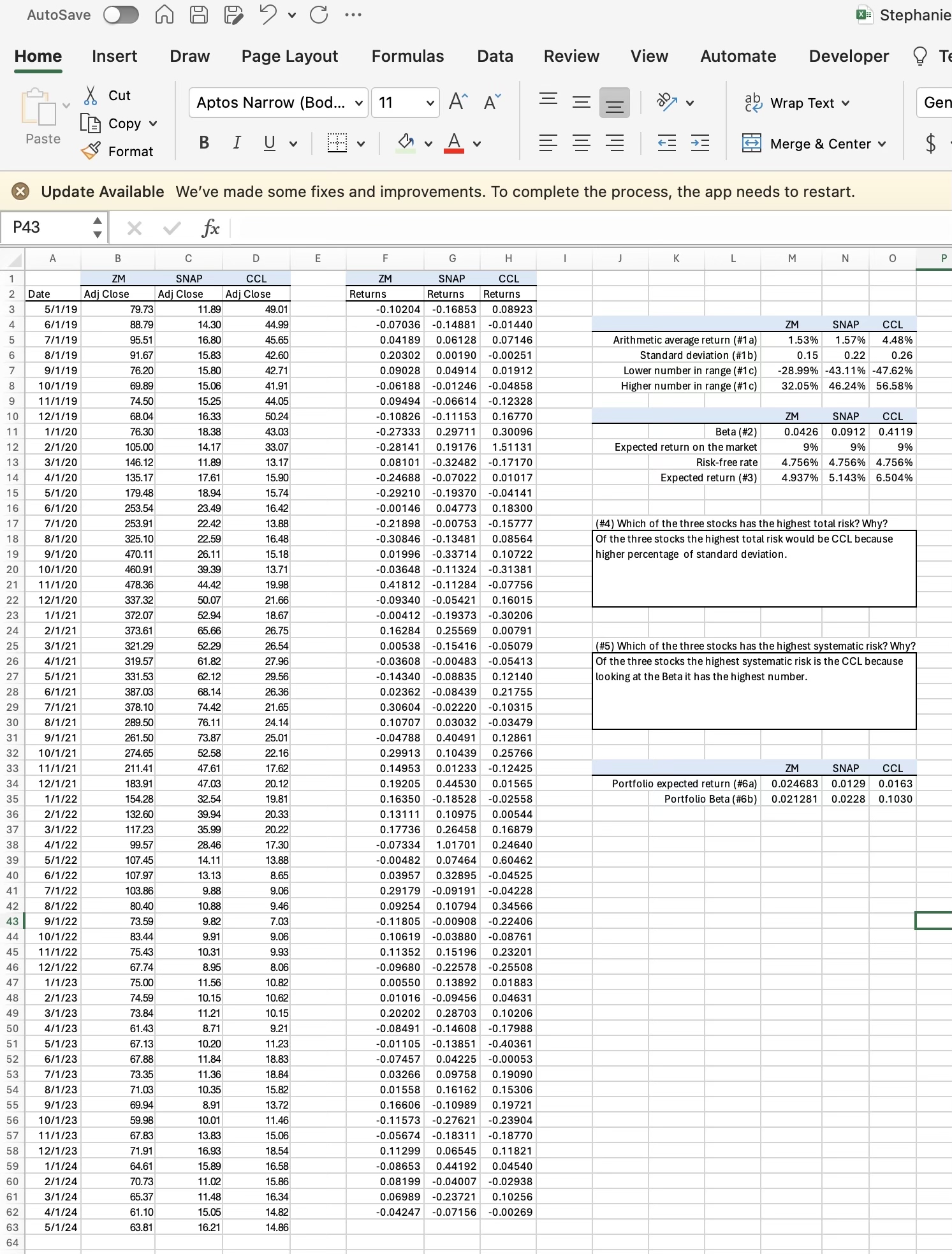

Part II . Answer the following questions by filling in the appropriate cell in the Excel template. All the inputs ( stock prices, beta, expected

Part II Answer the following questions by filling in the appropriate cell in the Excel template. All the inputs stock prices, beta, expected return on the market, and the riskfree rate must be hard coded ie typed in as a number To get full credit, your answers to # # and # must be typed in as formulas and not hard coded this means you need to reference the cells containing your inputs.

Calculate the annual return for each of the three stocks. points For each stock

A What is the arithmetic average return? points

b What is the standard deviation? points

c What range of returns should you expect to see with a percent probability? points

What is the beta of each stock? points. Note: You can get beta from the Summary page on Yahoo!Finance.

Assuming an expected return on the market of and a riskfree rate of what is the expected return for each stock according to the CAPM? points

Which of the three stocks has the highest total risk? points Why? points. Hint: the correct reason is based on one of your answers from # through # above. You need to cite that measure in your answer to this question. Read sections and in the etextbook for more information.

Which of the three stocks has the highest systematic risk? points Why? points. Hint: the correct reason is based on one of your answers from # through # above. You need to cite that measure in your answer to this question. Read sections and in the etextbook for more information.

If you form a portfolio with invested in ZM and the remainder split equally between SNAP and CCL

a What is the expected return on your portfolio? points

b What is the beta of your portfolio? points

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started