Answered step by step

Verified Expert Solution

Question

1 Approved Answer

Part II Applications of TVM (15 marks) 1. Your daughter is currently eight years old. You anticipate that she will be going to college in

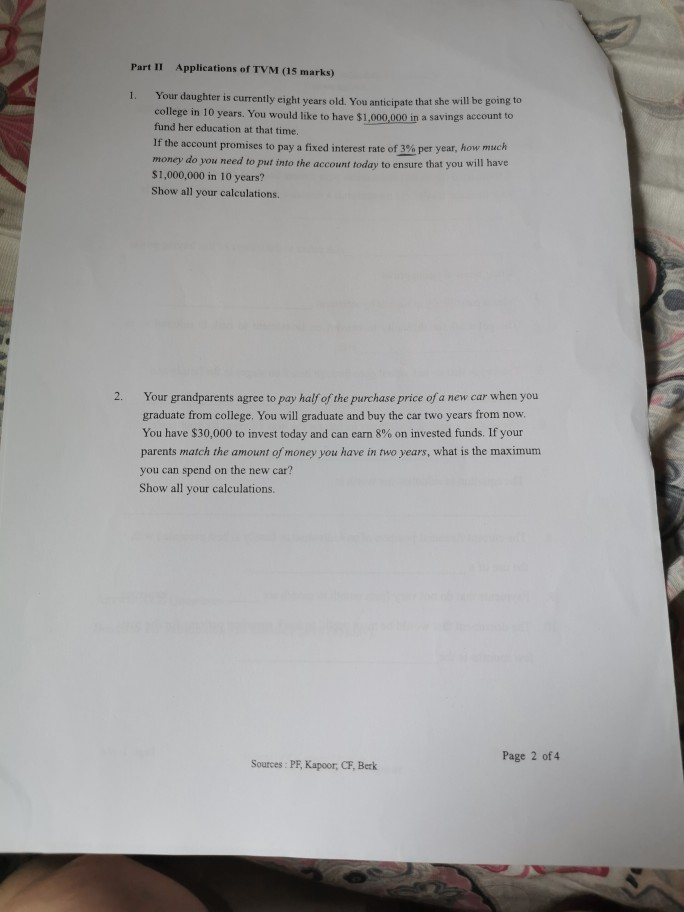

Part II Applications of TVM (15 marks) 1. Your daughter is currently eight years old. You anticipate that she will be going to college in 10 years. You would like to have $1,000,000 in a savings account to fund her education at that time. If the account promises to pay a fixed interest rate of 3% per year, how much money do you need to put into the account today to ensure that you will have $1,000,000 in 10 years? Show all your calculations. Your grandparents agree to pay half of the purchase price of a new car when you graduate from college. You will graduate and buy the car two years from now. You have $30,000 to invest today and can earn 8% on invested funds. If your parents match the amount of money you have in two vears, what is the maximum you can spend on the new car? Show all your calculations Page 2 of 4 Sources: PF, Kapoor, CF, Berk

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started