Answered step by step

Verified Expert Solution

Question

1 Approved Answer

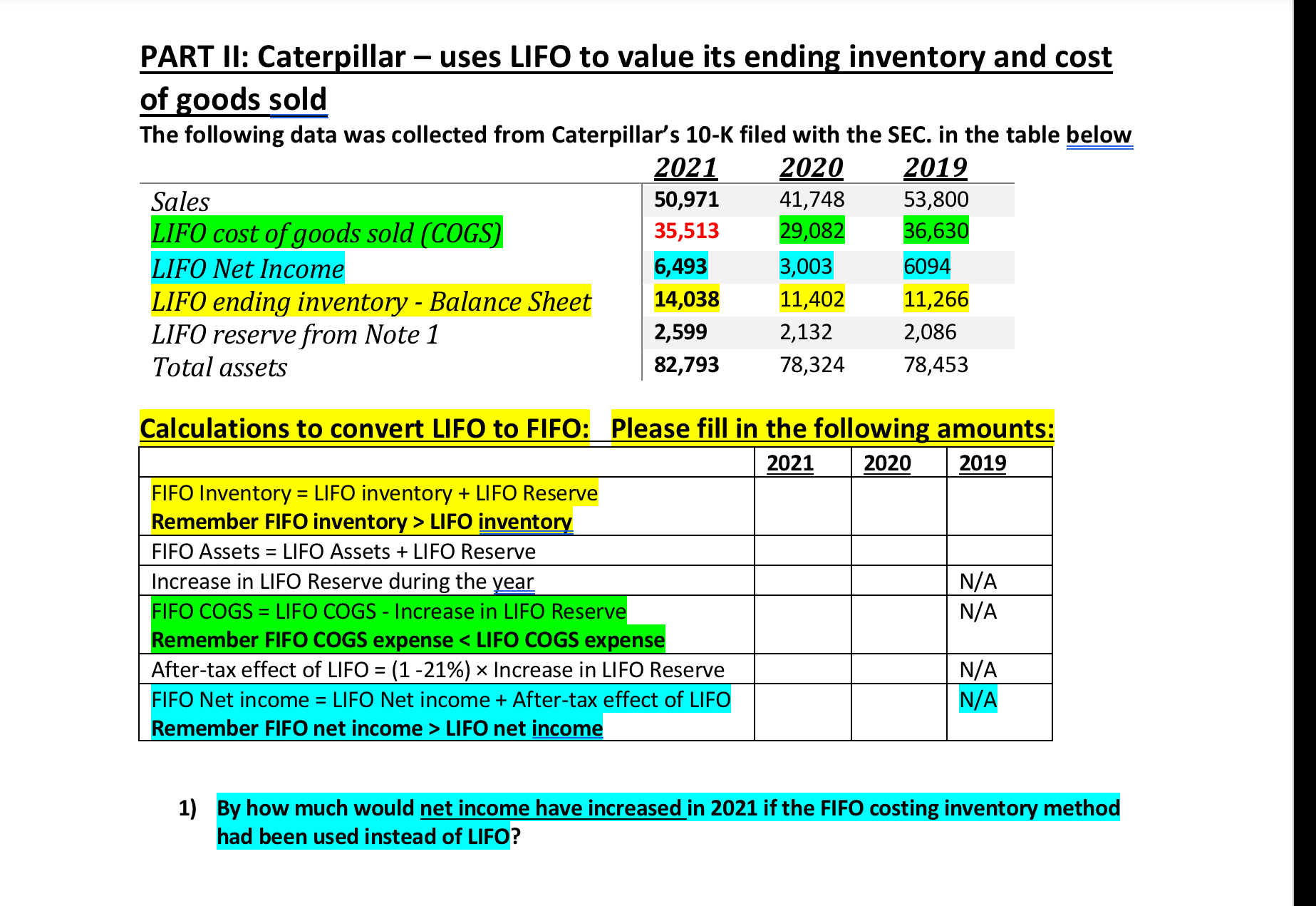

PART II: Caterpillar uses LIFO to value its ending inventory and cost of goods sold The following data was collected from Caterpillar's 10-K filed

PART II: Caterpillar uses LIFO to value its ending inventory and cost of goods sold The following data was collected from Caterpillar's 10-K filed with the SEC. in the table below 2021 2020 2019 Sales 50,971 41,748 53,800 LIFO cost of goods sold (COGS) 35,513 29,082 36,630 LIFO Net Income 6,493 3,003 6094 LIFO ending inventory - Balance Sheet 14,038 11,402 11,266 LIFO reserve from Note 1 2,599 2,132 2,086 Total assets 82,793 78,324 78,453 Calculations to convert LIFO to FIFO: Please fill in the following amounts: FIFO Inventory = LIFO inventory + LIFO Reserve Remember FIFO inventory > LIFO inventory FIFO Assets = LIFO Assets + LIFO Reserve Increase in LIFO Reserve during the year FIFO COGS LIFO COGS - Increase in LIFO Reserve = Remember FIFO COGS expense < LIFO COGS expense After-tax effect of LIFO = (1-21%) Increase in LIFO Reserve FIFO Net income = LIFO Net income + After-tax effect of LIFO Remember FIFO net income > LIFO net income 2021 2020 2019 N/A N/A N/A N/A 1) By how much would net income have increased in 2021 if the FIFO costing inventory method had been used instead of LIFO?

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started