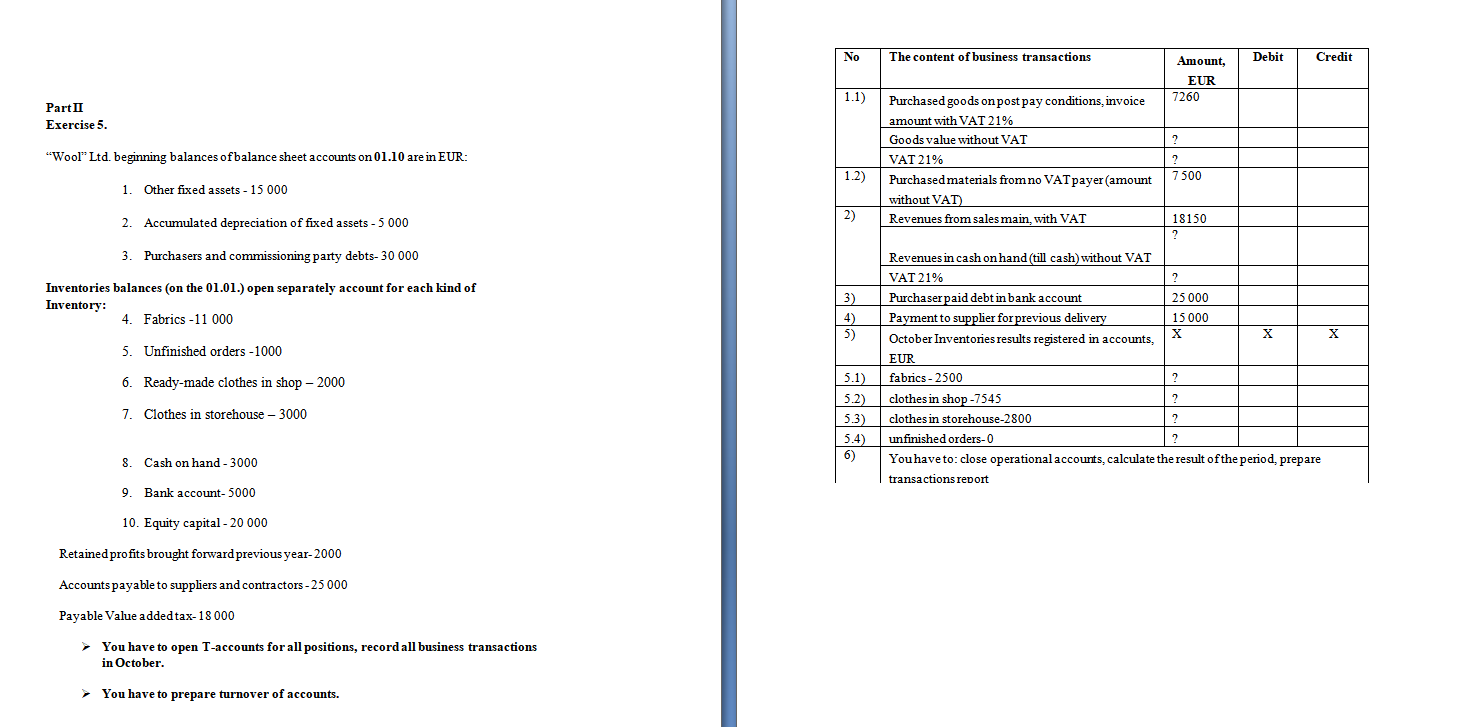

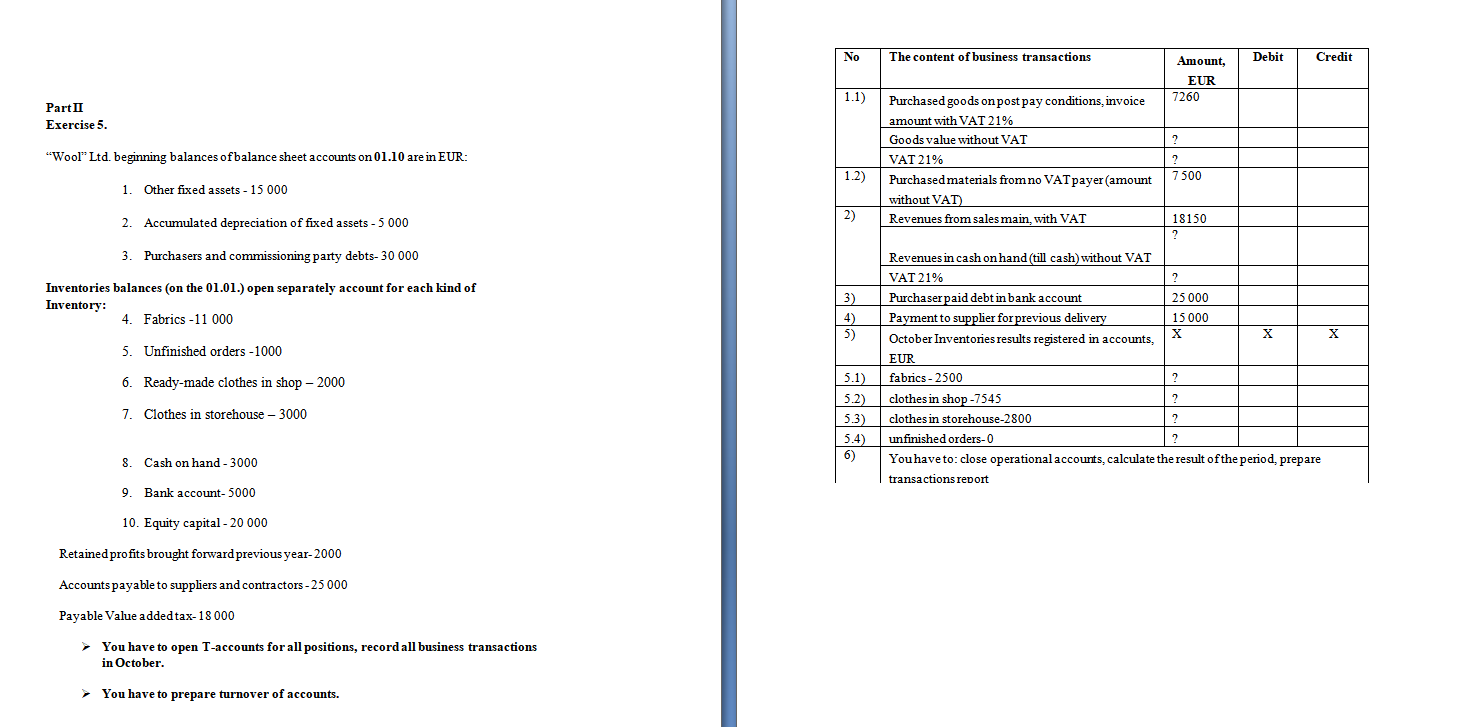

Part II Exercise 5. "Wool" Ltd. beginning balances of balance sheet accounts on 01.10 are in EUR: 1. Other fixed assets - 15 000 2. Accumulated depreciation of fixed assets - 5 000 3 Purchasers and commissioning party debts- 30 000 Inventories balances (on the 01.01.) open separately account for each kind of Inventory: 4. Fabrics -11 000 5. Unfinished orders -1000 6. Ready-made clothes in shop - 2000 7. Clothes in storehouse - 3000 8. Cash on hand - 3000 9. Bank account- 5000 10. Equity capital - 20 000 Retained profits brought forward previous year-2000 Accounts payable to suppliers and contractors - 25 000 Payable Value added tax- 18 000 You have to open T-accounts for all positions, record all business transactions in October. You have to prepare turnover of accounts. No 1.1) 1.2) 2) 3) 4) 5) 5.1) 5.2) 5.3) 5.4) 6) Debit The content of business transactions Amount, Credit EUR 7260 Purchased goods on post pay conditions, invoice amount with VAT 21% Goods value without VAT ? VAT 21% ? 7500 Purchased materials from no VAT payer (amount without VAT) Revenues from sales main, with VAT 18150 ? Revenues in cash on hand (till cash) without VAT VAT 21% ? Purchaser paid debt in bank account 25 000 Payment to supplier for previous delivery 15 000 October Inventories results registered in accounts, X X X EUR fabrics-2500 ? clothes in shop-7545 ? clothes in storehouse-2800 ? unfinished orders-0 ? You have to: close operational accounts, calculate the result of the period, prepare transactions report Part II Exercise 5. "Wool" Ltd. beginning balances of balance sheet accounts on 01.10 are in EUR: 1. Other fixed assets - 15 000 2. Accumulated depreciation of fixed assets - 5 000 3 Purchasers and commissioning party debts- 30 000 Inventories balances (on the 01.01.) open separately account for each kind of Inventory: 4. Fabrics -11 000 5. Unfinished orders -1000 6. Ready-made clothes in shop - 2000 7. Clothes in storehouse - 3000 8. Cash on hand - 3000 9. Bank account- 5000 10. Equity capital - 20 000 Retained profits brought forward previous year-2000 Accounts payable to suppliers and contractors - 25 000 Payable Value added tax- 18 000 You have to open T-accounts for all positions, record all business transactions in October. You have to prepare turnover of accounts. No 1.1) 1.2) 2) 3) 4) 5) 5.1) 5.2) 5.3) 5.4) 6) Debit The content of business transactions Amount, Credit EUR 7260 Purchased goods on post pay conditions, invoice amount with VAT 21% Goods value without VAT ? VAT 21% ? 7500 Purchased materials from no VAT payer (amount without VAT) Revenues from sales main, with VAT 18150 ? Revenues in cash on hand (till cash) without VAT VAT 21% ? Purchaser paid debt in bank account 25 000 Payment to supplier for previous delivery 15 000 October Inventories results registered in accounts, X X X EUR fabrics-2500 ? clothes in shop-7545 ? clothes in storehouse-2800 ? unfinished orders-0 ? You have to: close operational accounts, calculate the result of the period, prepare transactions report