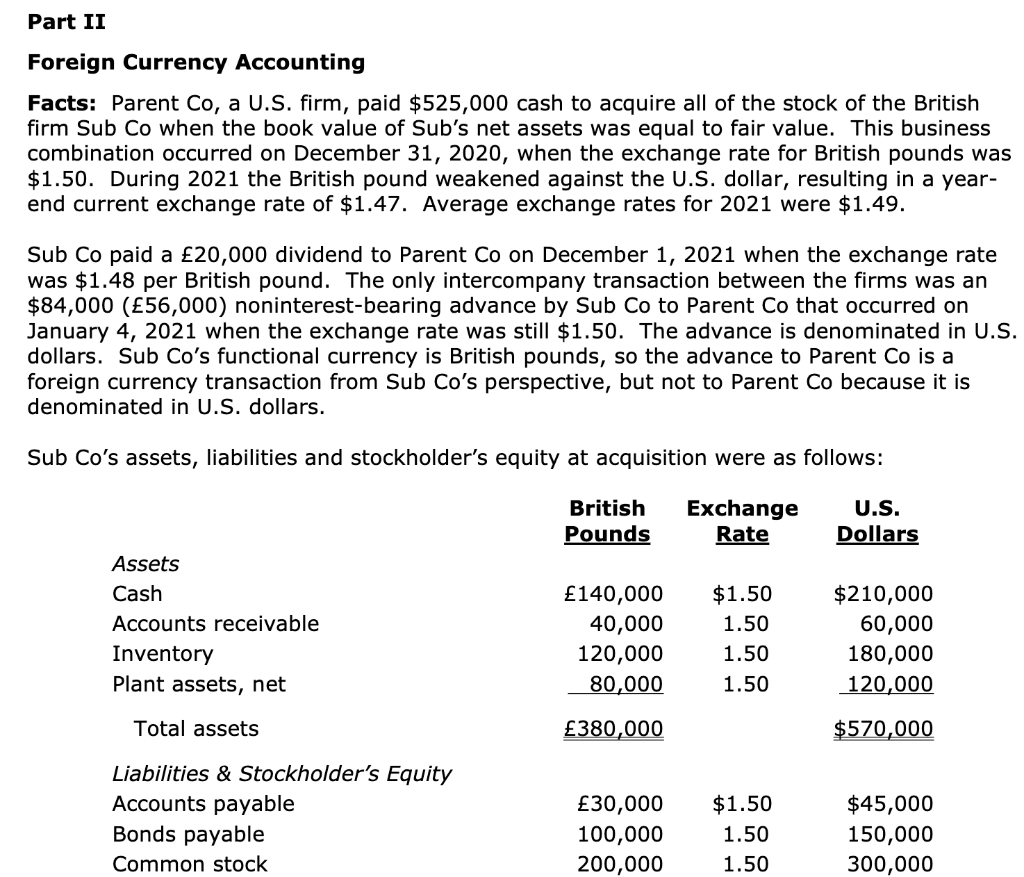

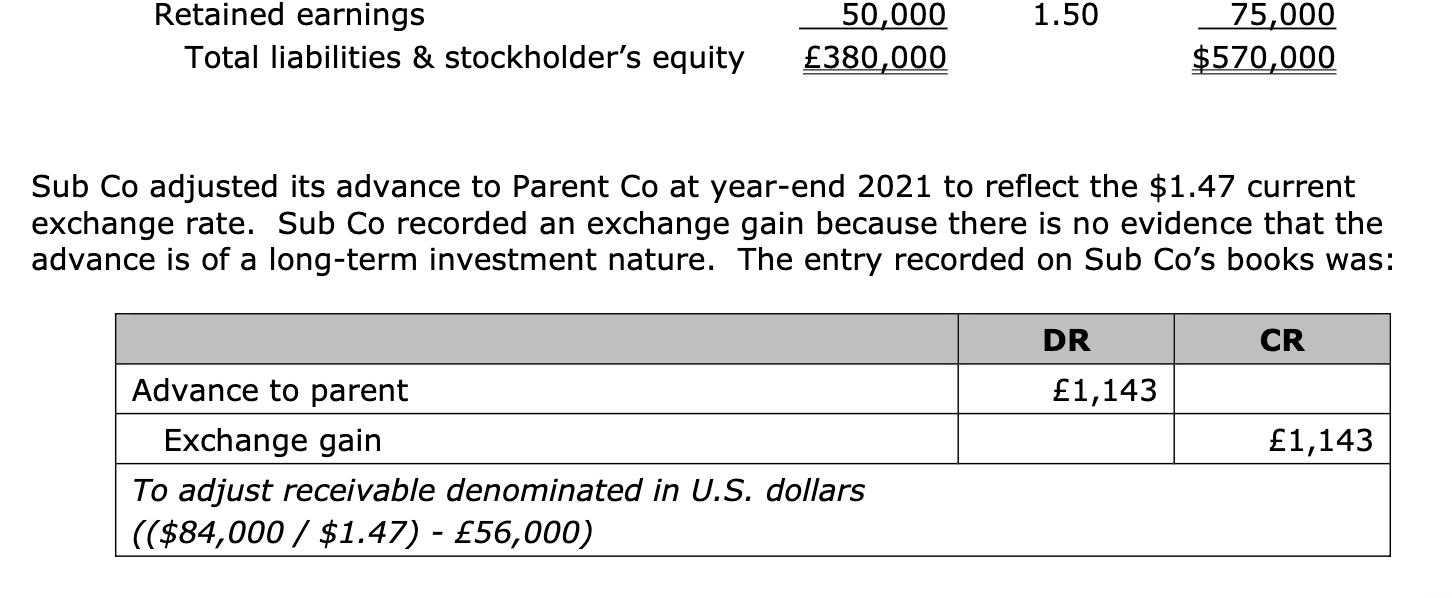

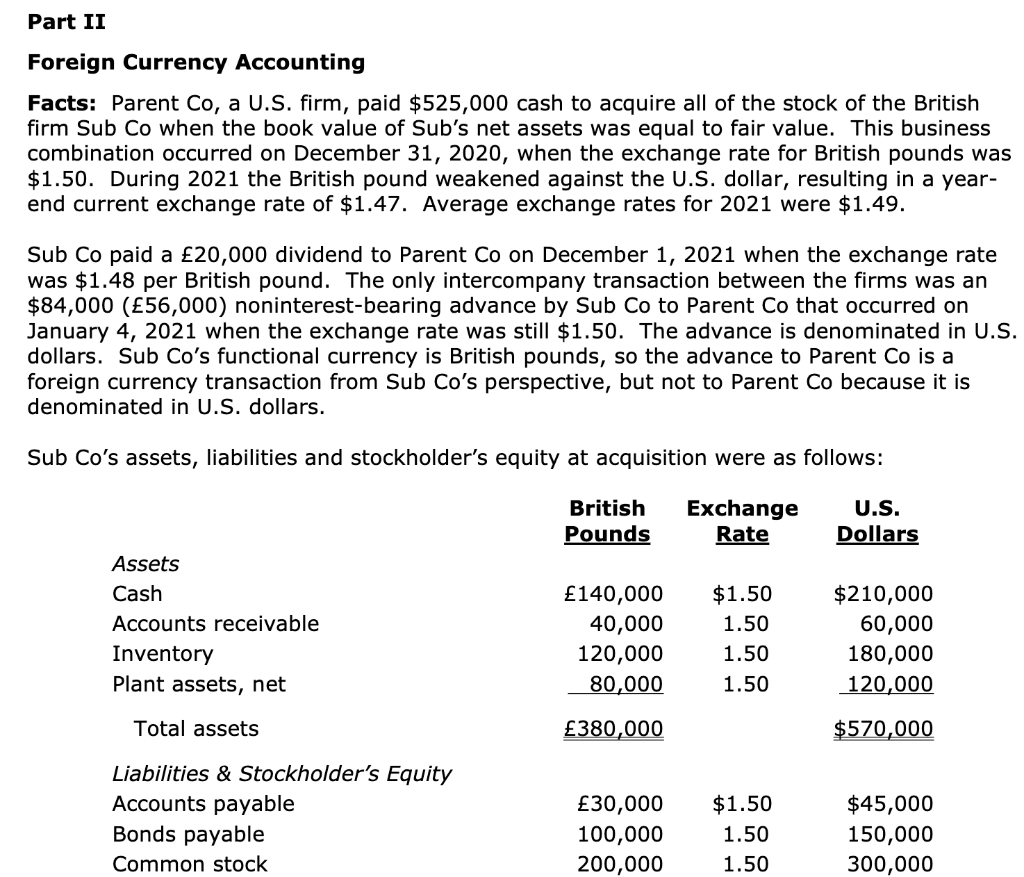

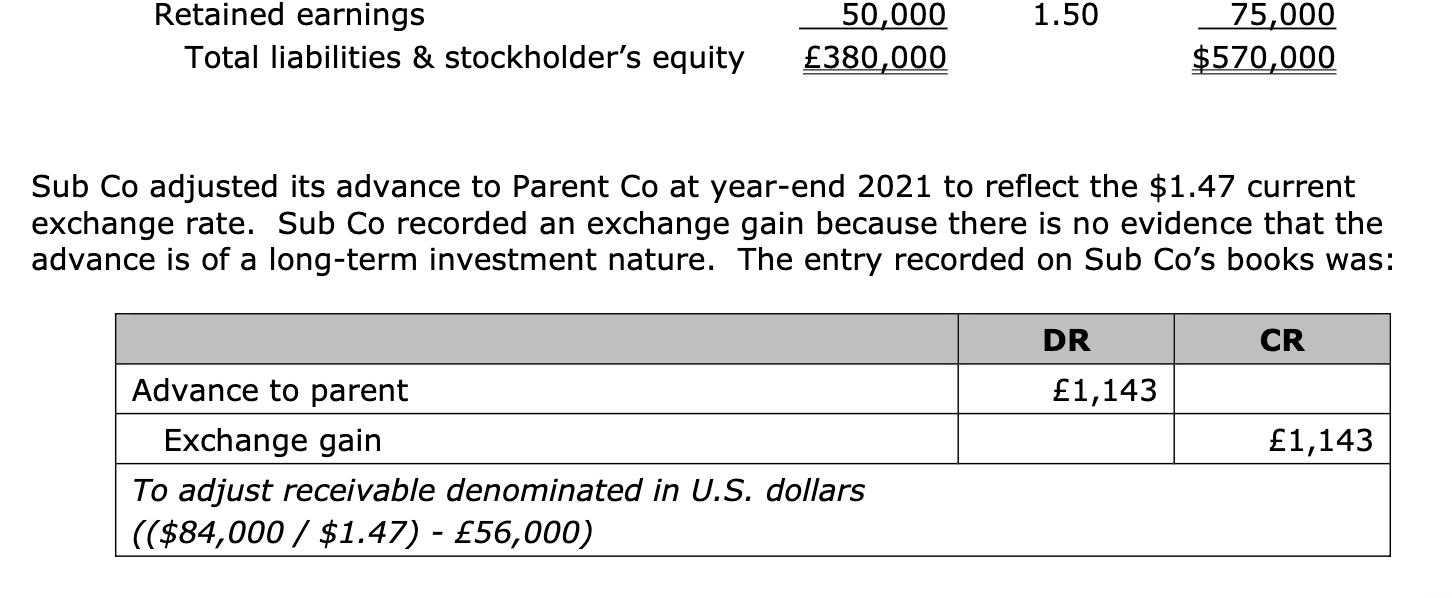

Part II Foreign Currency Accounting Facts: Parent Co, a U.S. firm, paid $525,000 cash to acquire all of the stock of the British firm Sub Co when the book value of Sub's net assets was equal to fair value. This business combination occurred on December 31, 2020, when the exchange rate for British pounds was $1.50. During 2021 the British pound weakened against the U.S. dollar, resulting in a year- end current exchange rate of $1.47. Average exchange rates for 2021 were $1.49. Sub Co paid a 20,000 dividend to Parent Co on December 1, 2021 when the exchange rate was $1.48 per British pound. The only intercompany transaction between the firms was an $84,000 (56,000) noninterest-bearing advance by Sub Co to Parent Co that occurred on January 4, 2021 when the exchange rate was still $1.50. The advance is denominated in U.S. dollars. Sub Co's functional currency is British pounds, so the advance to Parent Co is a foreign currency transaction from Sub Co's perspective, but not to Parent Co because it is denominated in U.S. dollars. Sub Co's assets, liabilities and stockholder's equity at acquisition were as follows: British Pounds Exchange Rate U.S. Dollars Assets Cash Accounts receivable Inventory Plant assets, net 140,000 40,000 120,000 80,000 $1.50 1.50 1.50 1.50 $210,000 60,000 180,000 120,000 Total assets 380,000 $570,000 Liabilities & Stockholder's Equity Accounts payable Bonds payable Common stock 30,000 100,000 200,000 $1.50 1.50 1.50 $45,000 150,000 300,000 1.50 Retained earnings Total liabilities & stockholder's equity 50,000 380,000 75,000 $570,000 Sub Co adjusted its advance to Parent Co at year-end 2021 to reflect the $1.47 current exchange rate. Sub Co recorded an exchange gain because there is no evidence that the advance is of a long-term investment nature. The entry recorded on Sub Co's books was: DR CR 1,143 1,143 Advance to parent Exchange gain To adjust receivable denominated in U.S. dollars (($84,000 / $1.47) - 56,000) Part II Foreign Currency Accounting Facts: Parent Co, a U.S. firm, paid $525,000 cash to acquire all of the stock of the British firm Sub Co when the book value of Sub's net assets was equal to fair value. This business combination occurred on December 31, 2020, when the exchange rate for British pounds was $1.50. During 2021 the British pound weakened against the U.S. dollar, resulting in a year- end current exchange rate of $1.47. Average exchange rates for 2021 were $1.49. Sub Co paid a 20,000 dividend to Parent Co on December 1, 2021 when the exchange rate was $1.48 per British pound. The only intercompany transaction between the firms was an $84,000 (56,000) noninterest-bearing advance by Sub Co to Parent Co that occurred on January 4, 2021 when the exchange rate was still $1.50. The advance is denominated in U.S. dollars. Sub Co's functional currency is British pounds, so the advance to Parent Co is a foreign currency transaction from Sub Co's perspective, but not to Parent Co because it is denominated in U.S. dollars. Sub Co's assets, liabilities and stockholder's equity at acquisition were as follows: British Pounds Exchange Rate U.S. Dollars Assets Cash Accounts receivable Inventory Plant assets, net 140,000 40,000 120,000 80,000 $1.50 1.50 1.50 1.50 $210,000 60,000 180,000 120,000 Total assets 380,000 $570,000 Liabilities & Stockholder's Equity Accounts payable Bonds payable Common stock 30,000 100,000 200,000 $1.50 1.50 1.50 $45,000 150,000 300,000 1.50 Retained earnings Total liabilities & stockholder's equity 50,000 380,000 75,000 $570,000 Sub Co adjusted its advance to Parent Co at year-end 2021 to reflect the $1.47 current exchange rate. Sub Co recorded an exchange gain because there is no evidence that the advance is of a long-term investment nature. The entry recorded on Sub Co's books was: DR CR 1,143 1,143 Advance to parent Exchange gain To adjust receivable denominated in U.S. dollars (($84,000 / $1.47) - 56,000)