Answered step by step

Verified Expert Solution

Question

1 Approved Answer

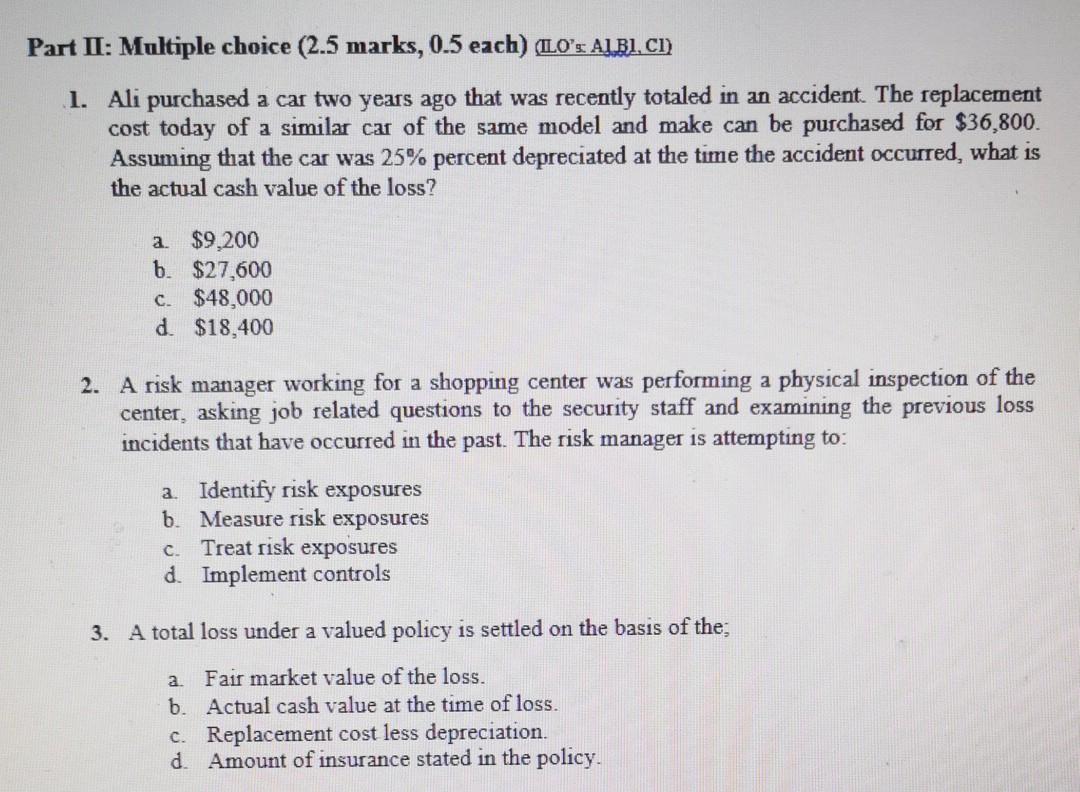

Part II: Multiple choice (2.5 marks, 0.5 each) (ILO's AIBI, CI) 1. Ali purchased a car two years ago that was recently totaled in an

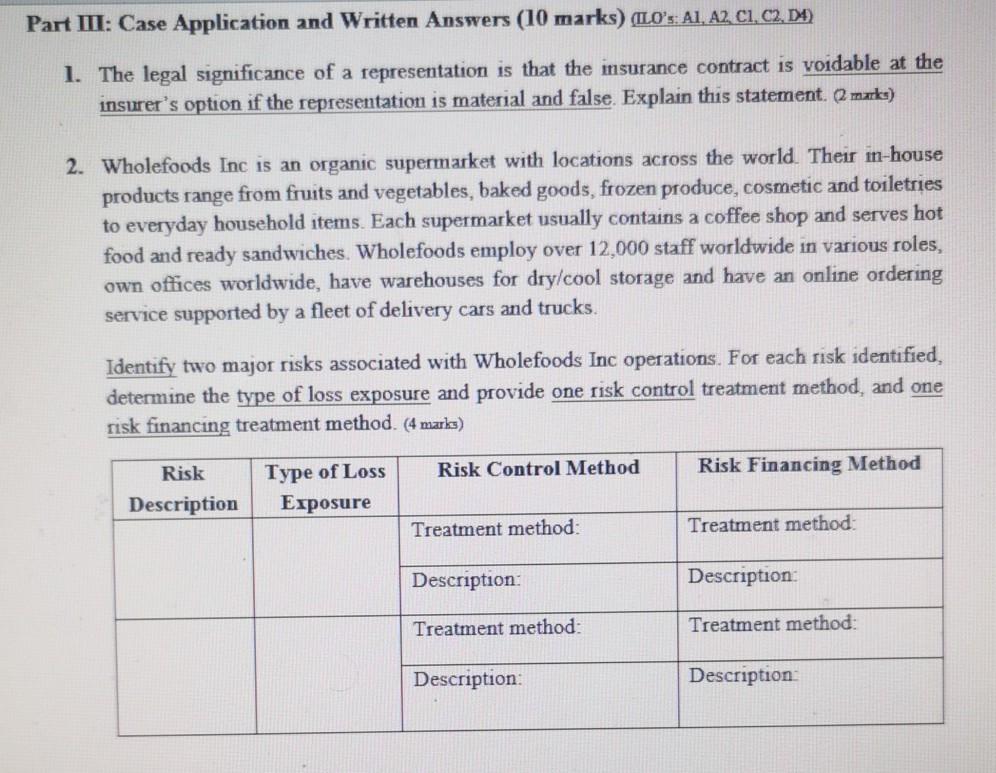

Part II: Multiple choice (2.5 marks, 0.5 each) (ILO's AIBI, CI) 1. Ali purchased a car two years ago that was recently totaled in an accident. The replacement cost today of a similar car of the same model and make can be purchased for $36,800. Assuming that the car was 25% percent depreciated at the time the accident occurred, what is the actual cash value of the loss? a $9,200 b. $27,600 $48,000 d $18,400 C. 2. A risk manager working for a shopping center was performing a physical inspection of the center, asking job related questions to the security staff and examining the previous loss incidents that have occurred in the past. The risk manager is attempting to a. Identify risk exposures b. Measure risk exposures c. Treat risk exposures d. Implement controls 3. A total loss under a valued policy is settled on the basis of the; a Fair market value of the loss. b. Actual cash value at the time of loss. c. Replacement cost less depreciation. d Amount of insurance stated in the policy. Part III: Case Application and Written Answers (10 marks) (LO's: A1, A2, C1, C2, D4) 1. The legal significance of a representation is that the insurance contract is voidable at the insurer's option if the representation is material and false Explain this statement. Q marks) 2. Wholefoods Inc is an organic supermarket with locations across the world. Their in-house products range from fruits and vegetables, baked goods, frozen produce, cosmetic and toiletries to everyday household items. Each supermarket usually contains a coffee shop and serves hot food and ready sandwiches. Wholefoods employ over 12,000 staff worldwide in various roles, own offices worldwide, have warehouses for dry/cool storage and have an online ordering service supported by a fleet of delivery cars and trucks. Identify two major risks associated with Wholefoods Inc operations. For each risk identified, determine the type of loss exposure and provide one risk control treatment method, and one risk financing treatment method. (4 marks) Risk Control Method Risk Financing Method Risk Description Type of Loss Exposure Treatment method Treatment method: Description: Description: Treatment method Treatment method: Description: Description

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started