Answered step by step

Verified Expert Solution

Question

1 Approved Answer

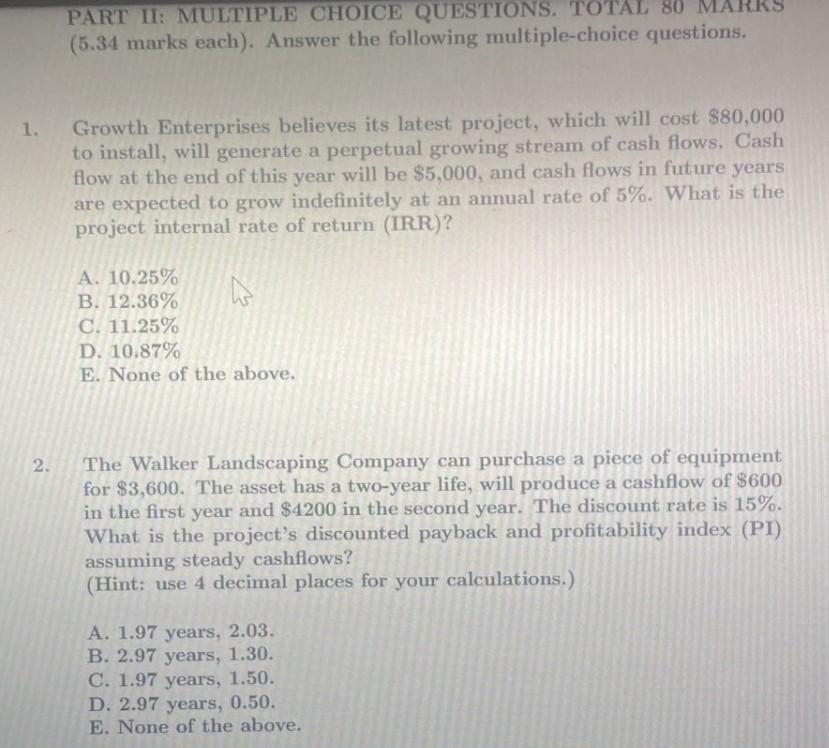

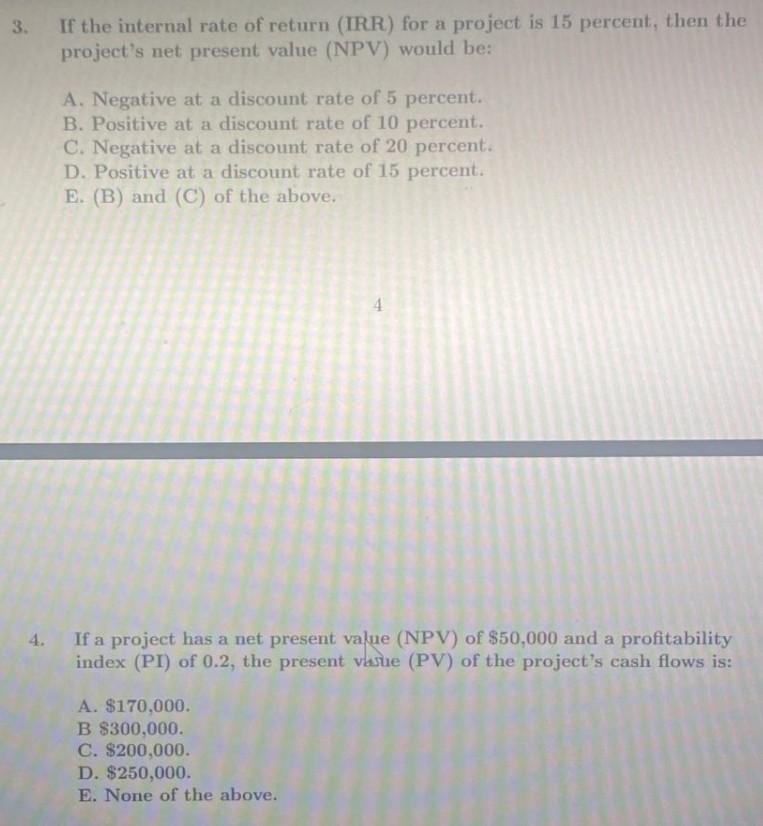

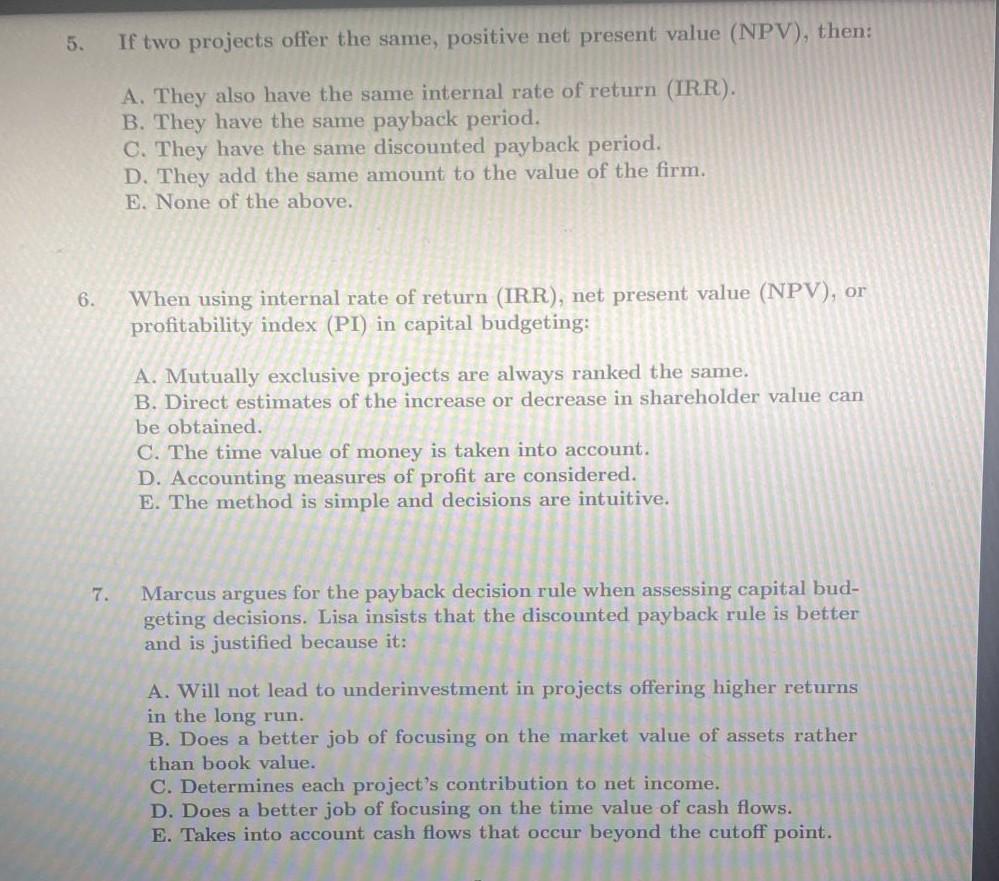

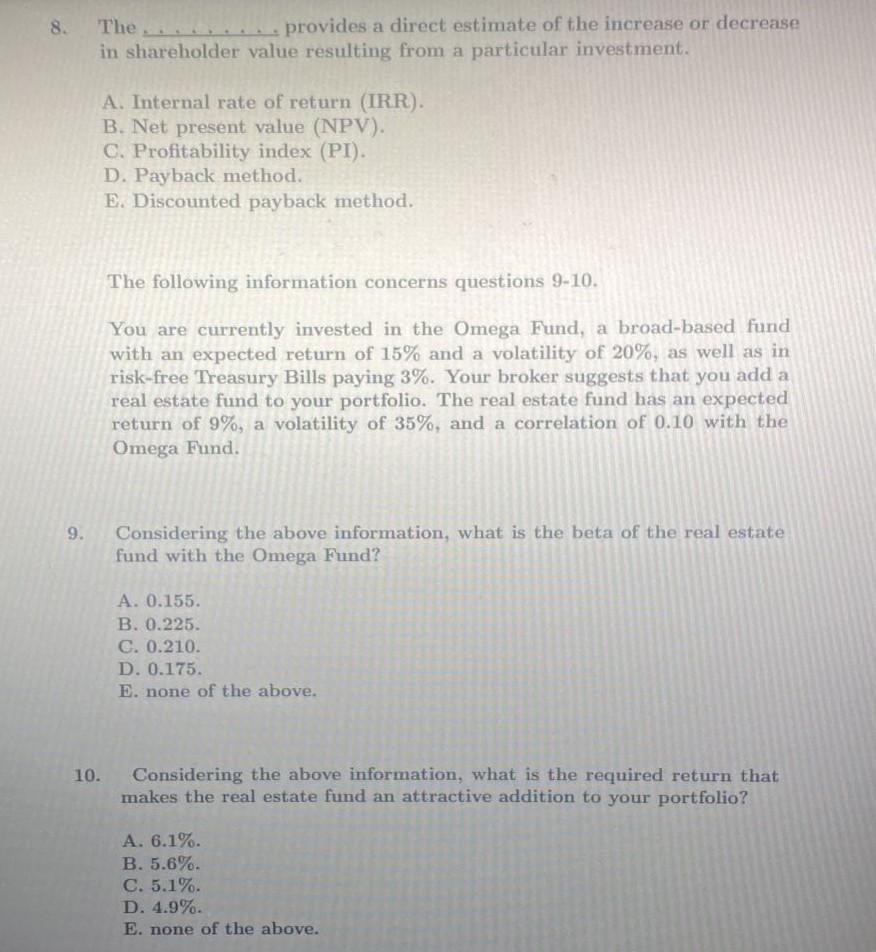

PART II: MULTIPLE CHOICE QUESTIONS. TOTAL 80 MARKS (5.34 marks each). Answer the following multiple-choice questions. 1. Growth Enterprises believes its latest project, which will

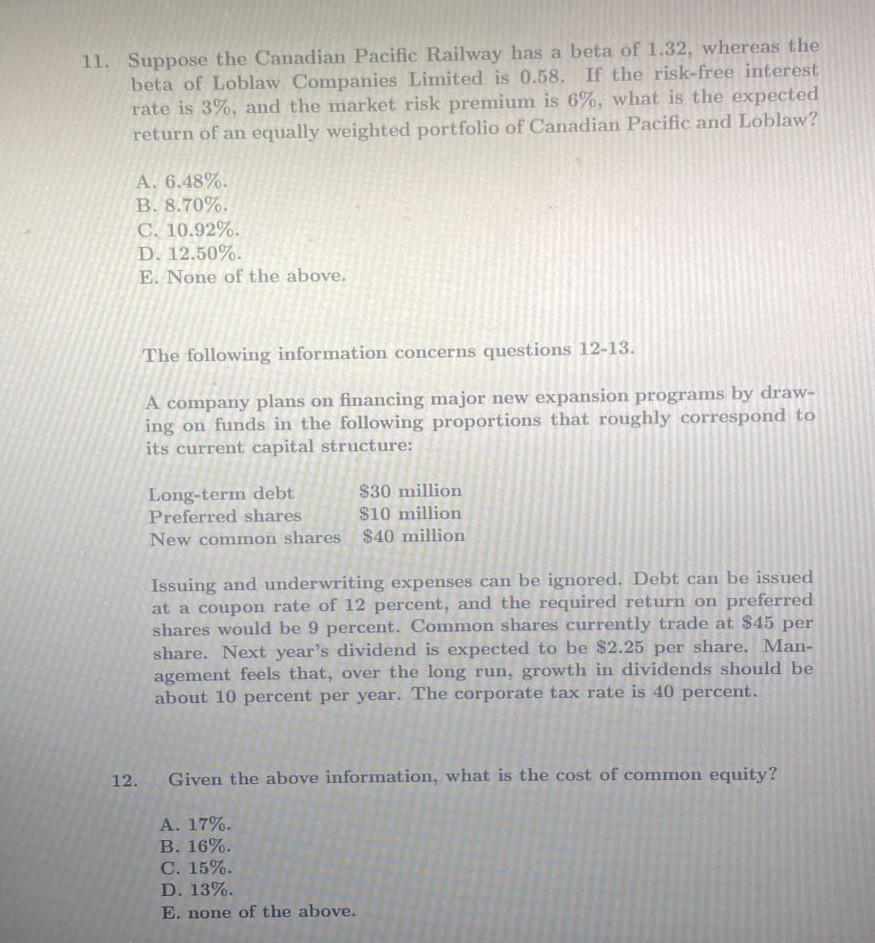

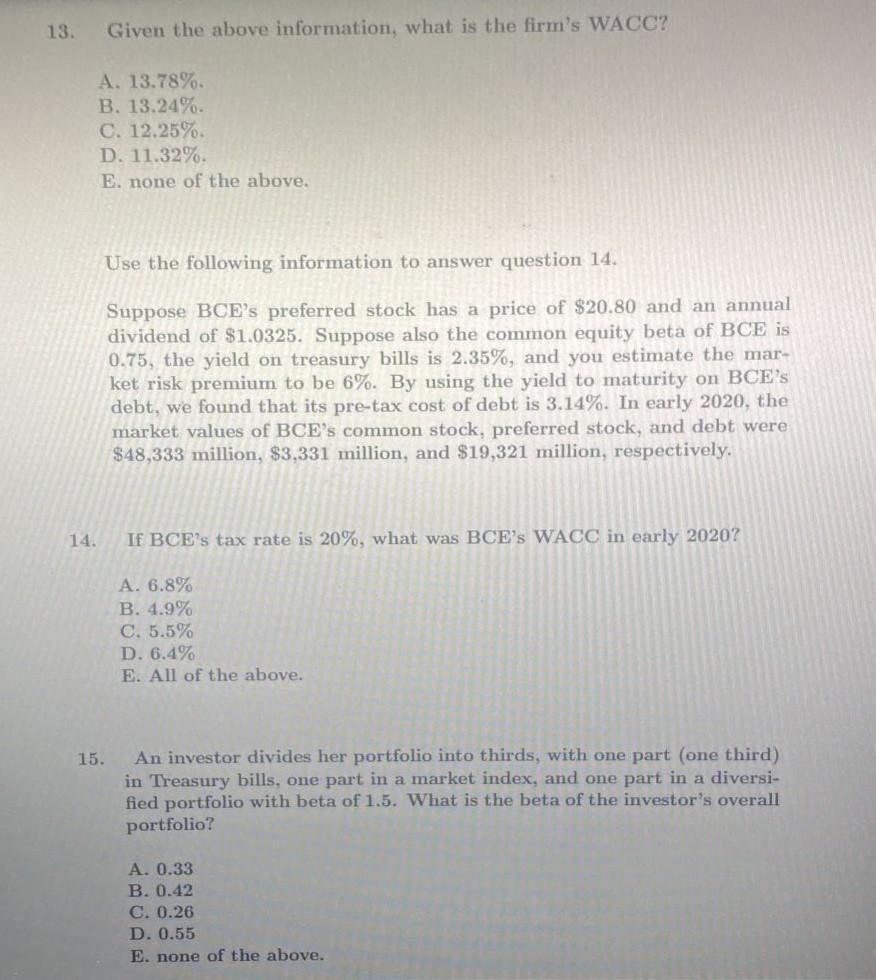

PART II: MULTIPLE CHOICE QUESTIONS. TOTAL 80 MARKS (5.34 marks each). Answer the following multiple-choice questions. 1. Growth Enterprises believes its latest project, which will cost $80,000 to install, will generate a perpetual growing stream of cash flows. Cash flow at the end of this year will be $5,000, and cash flows in future years are expected to grow indefinitely at an annual rate of 5%. What is the project internal rate of return (IRR)? a A. 10.25% B. 12.36% . 11.25% D. 10.87% E. None of the above. 2. The Walker Landscaping Company can purchase a piece of equipment for $3,600. The asset has a two-year life, will produce a cashflow of $600 in the first year and $4200 in the second year. The discount rate is 15%. What is the project's discounted payback and profitability index (PI) assuming steady cashflows? (Hint: use 4 decimal places for your calculations.) A. 1.97 years, 2.03. B. 2.97 years, 1.30. C. 1.97 years, 1.50. D. 2.97 years, 0.50. E. None of the above. 3. If the internal rate of return (IRR) for a project is 15 percent, then the project's net present value (NPV) would be: A. Negative at a discount rate of 5 percent. B. Positive at a discount rate of 10 percent. C. Negative at a discount rate of 20 percent. D. Positive at a discount rate of 15 percent. E. (B) and (C) of the above. 4. If a project has a net present value (NPV) of $50,000 and a profitability index (PI) of 0.2, the present vlasue (PV) of the project's cash flows is: A. $170,000. B $300,000 C. $200,000. D. $250,000 E. None of the above. 5. If two projects offer the same, positive net present value (NPV), then: A. They also have the same internal rate of return (IRR). B. They have the same payback period. C. They have the same discounted payback period. D. They add the same amount to the value of the firm. E. None of the above. 6. When using internal rate of return (IRR), net present value (NPV), or profitability index (PI) in capital budgeting: A. Mutually exclusive projects are always ranked the same. B. Direct estimates of the increase or decrease in shareholder value can be obtained. C. The time value of money is taken into account. D. Accounting measures of profit are considered. E. The method is simple and decisions are intuitive. 7. Marcus argues for the payback decision rule when assessing capital bud- geting decisions. Lisa insists that the discounted payback rule is better and is justified because it: A. Will not lead to underinvestment in projects offering higher returns in the long run. B. Does a better job of focusing on the market value of assets rather than book value. C. Determines each project's contribution to net income. D. Does a better job of focusing on the time value of cash flows. E. Takes into account cash flows that occur beyond the cutoff point. 8. The provides a direct estimate of the increase or decrease in shareholder value resulting from a particular investment. A. Internal rate of return (IRR). B. Net present value (NPV). C. Profitability index (PI). D. Payback method. E. Discounted payback method. The following information concerns questions 9-10. You are currently invested in the Omega Fund, a broad-based fund with an expected return of 15% and a volatility of 20%, as well as in risk-free Treasury Bills paying 3%. Your broker suggests that you add a real estate fund to your portfolio. The real estate fund has an expected return of 9%, a volatility of 35%, and a correlation of 0.10 with the Omega Fund. 9. Considering the above information, what is the beta of the real estate fund with the Omega Fund? A. 0.155. B. 0.225. C. 0.210. D. 0.175. E. none of the above. 10. Considering the above information, what is the required return that makes the real estate fund an attractive addition to your portfolio? A. 6.1%. B. 5.6%. C. 5.1%. D. 4.9%. E. none of the above. 11. Suppose the Canadian Pacific Railway has a beta of 1.32, whereas the beta of Loblaw Companies Limited is 0.58. If the risk-free interest rate is 3%, and the market risk premium is 6%, what is the expected return of an equally weighted portfolio of Canadian Pacific and Loblaw? A. 6.48%. B. 8.70% C. 10.92% D. 12.50% E. None of the above. The following information concerns questions 12-13. A company plans on financing major new expansion programs by draw- ing on funds in the following proportions that roughly correspond to its current capital structure: Long-term debt $30 million Preferred shares $10 million New common shares $40 million Issuing and underwriting expenses can be ignored. Debt can be issued at a coupon rate of 12 percent, and the required return on preferred shares would be 9 percent. Common shares currently trade at $45 per share. Next year's dividend is expected to be $2.25 per share. Man- agement feels that, over the long run, growth in dividends should be about 10 percent per year. The corporate tax rate is 40 percent. 12. Given the above information, what is the cost of common equity? A. 17%. B. 16%. C. 15%. D. 13%. E. none of the above. 13. Given the above information, what is the firm's WACC? A. 13.78% B. 13.24% C. 12.25%. D. 11.32%. E none of the above. Use the following information to answer question 14. Suppose BCE's preferred stock has a price of $20.80 and an annual dividend of $1.0325. Suppose also the common equity beta of BCE is 0.75, the yield on treasury bills is 2.35%, and you estimate the mar- ket risk premium to be 6%. By using the yield to maturity on BCE'S debt, we found that its pre-tax cost of debt is 3.14%. In early 2020, the market values of BCE's common stock, preferred stock, and debt were $48,333 million, $3,331 million, and $19,321 million, respectively. 14. If BCE's tax rate is 20%, what was BCE's WACC in early 2020? A. 6.8% B. 4.9% C. 5.5% D. 6.4% E. All of the above. 15. An investor divides her portfolio into thirds, with one part (one third) in Treasury bills, one part in a market index, and one part in a diversi- fied portfolio with beta of 1.5. What is the beta of the investor's overall portfolio? A. 0.33 B. 0.42 C. 0.26 D. 0.55 E. none of the above

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started