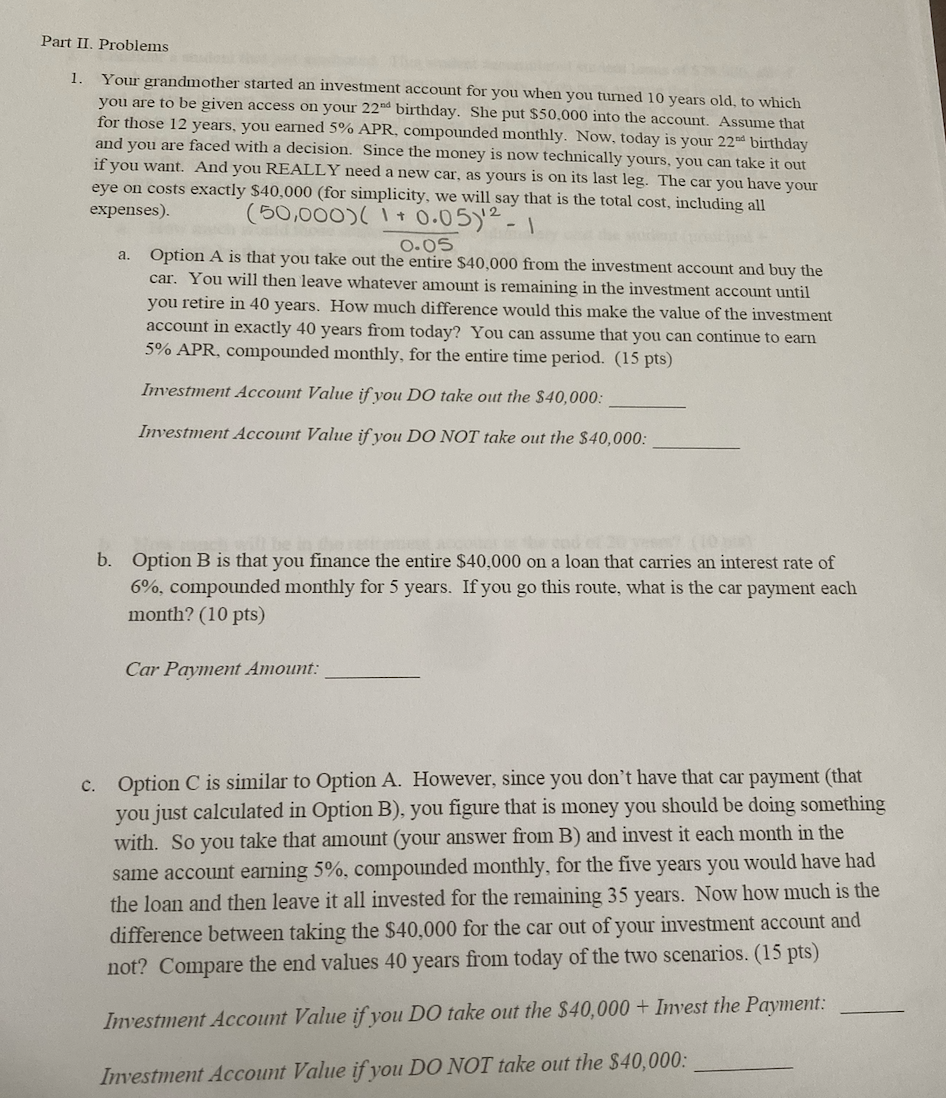

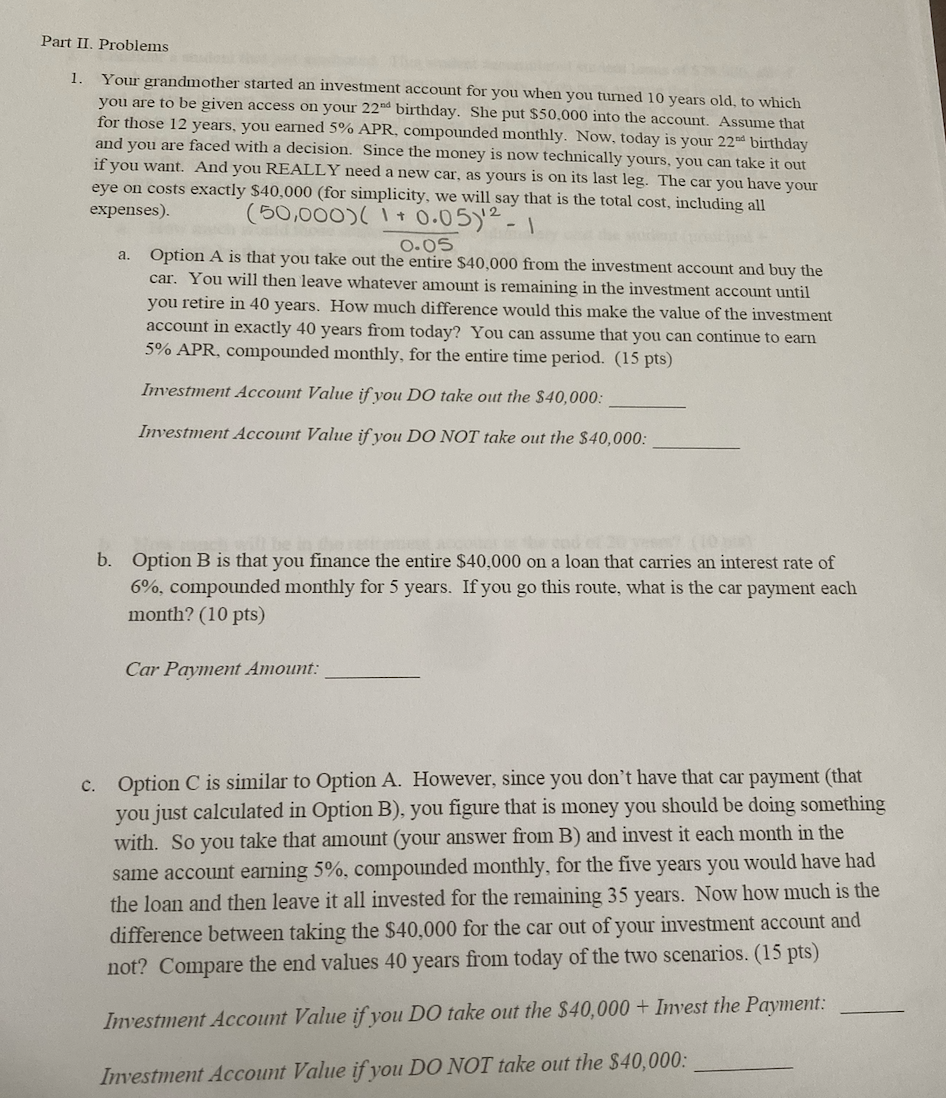

Part II. Problems 1. Your grandmother started an investment account for you when you turned 10 years old, to which you are to be given access on your 22nd birthday. She put $50,000 into the account. Assume that for those 12 years, you earned 5% APR, compounded monthly. Now, today is your 22nd birthday and you are faced with a decision. Since the money is now technically yours, you can take it out if you want. And you REALLY need a new car, as yours is on its last leg. The car you have your eye on costs exactly $40,000 (for simplicity, we will say that is the total cost, including all expenses). (50,000)(1+0.05) -1 0.05 a. Option A is that you take out the entire $40,000 from the investment account and buy the car. You will then leave whatever amount is remaining in the investment account until you retire in 40 years. How much difference would this make the value of the investment account in exactly 40 years from today? You can assume that you can continue to earn 5% APR, compounded monthly, for the entire time period. (15 pts) Investment Account Value if you DO take out the $40,000: Investment Account Value if you DO NOT take out the $40,000: b. Option B is that you finance the entire $40,000 on a loan that carries an interest rate of 6%, compounded monthly for 5 years. If you go this route, what is the car payment each month? (10 pts) Car Payment Amount: c. Option C is similar to Option A. However, since you don't have that car payment (that you just calculated in Option B), you figure that is money you should be doing something with. So you take that amount (your answer from B) and invest it each month in the account earning 5%, compounded monthly, for the five years you would have had the loan and then leave it all invested for the remaining 35 years. Now how much is the difference between taking the $40,000 for the car out of your investment account and not? Compare the end values 40 years from today of the two scenarios. (15 pts) san Investment Account Value if you DO take out the $40,000+ Invest the Payment: Investment Account Value if you DO NOT take out the $40,000