Answered step by step

Verified Expert Solution

Question

1 Approved Answer

Part II. True or false questions. ASAP WITHOUT EXPLAINATION 1. The ultimate goal of a corporation is to maximize shareholder value. 2. Under perfect capital

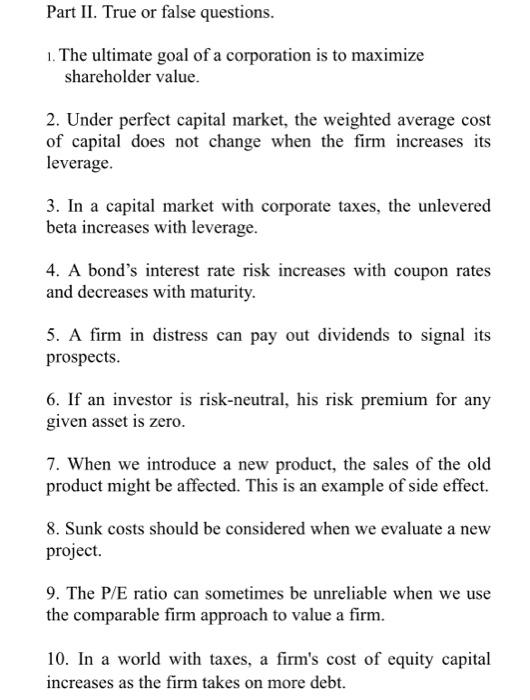

Part II. True or false questions. ASAP WITHOUT EXPLAINATION 1. The ultimate goal of a corporation is to maximize shareholder value. 2. Under perfect capital market, the weighted average cost of capital does not change when the firm increases its leverage. 3. In a capital market with corporate taxes, the unlevered beta increases with leverage. 4. A bond's interest rate risk increases with coupon rates and decreases with maturity. 5. A firm in distress can pay out dividends to signal its prospects. 6. If an investor is risk-neutral, his risk premium for any given asset is zero. 7. When we introduce a new product, the sales of the old product might be affected. This is an example of side effect. 8. Sunk costs should be considered when we evaluate a new project. 9. The P/E ratio can sometimes be unreliable when we use the comparable firm approach to value a firm. 10. In a world with taxes, a firm's cost of equity capital increases as the firm takes on more debt.

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started