Answered step by step

Verified Expert Solution

Question

1 Approved Answer

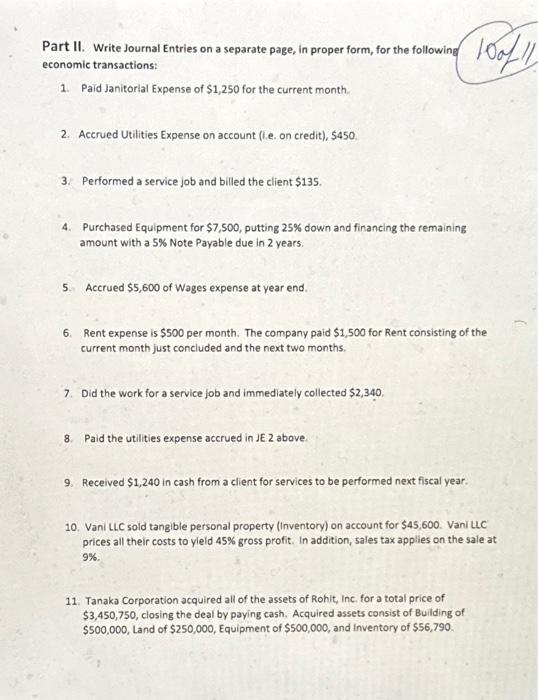

Part II. Write Journal Entries on a separate page, in proper form, for the following economic transactions: 1. Paid Janitorial Expense of $1,250 for the

Part II. Write Journal Entries on a separate page, in proper form, for the following economic transactions: 1. Paid Janitorial Expense of $1,250 for the current month. 2. Accrued Utilities Expense on account (i.e. on credit), $450. 3. Performed a service job and billed the client $135. 4. Purchased Equipment for $7,500, putting 25% down and financing the remaining amount with a 5% Note Payable due in 2 years. 5. Accrued $5,600 of Wages expense at year end. 6. Rent expense is $500 per month. The company paid $1,500 for Rent consisting of the current month just concluded and the next two months. 7. Did the work for a service job and immediately collected $2,340. 8. Paid the utilities expense accrued in JE 2 above. 9. Received $1,240 in cash from a client for services to be performed next fiscal year. Tool !! 10. Vani LLC sold tangible personal property (Inventory) on account for $45,600. Vani LLC prices all their costs to yield 45% gross profit. In addition, sales tax applies on the sale at 9%. 11. Tanaka Corporation acquired all of the assets of Rohit, Inc. for a total price of $3,450,750, closing the deal by paying cash. Acquired assets consist of Building of $500,000, Land of $250,000, Equipment of $500,000, and Inventory of $56,790.

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started