Answered step by step

Verified Expert Solution

Question

1 Approved Answer

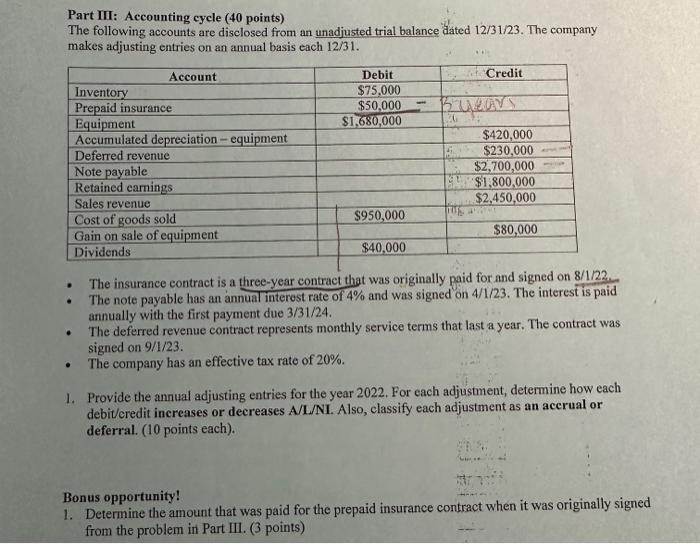

Part III: Accounting cycle (40 points) The following accounts are disclosed from an unadjusted trial balance dated 12/31/23. The company makes adjusting entries on

Part III: Accounting cycle (40 points) The following accounts are disclosed from an unadjusted trial balance dated 12/31/23. The company makes adjusting entries on an annual basis each 12/31. . . . Account Equipment Accumulated depreciation - equipment Deferred revenue Note payable Retained earnings Sales revenue Cost of goods sold Gain on sale of equipment Dividends Inventory Prepaid insurance Debit $75,000 $50,000 $1,680,000 $950,000 www 20 Credit $420,000 $230,000 $2,700,000 $1,800,000 $2,450,000 $80,000 $40,000 The insurance contract is a three-year contract that was originally paid for and signed on 8/1/22 The note payable has an annual interest rate of 4% and was signed on 4/1/23. The interest is paid annually with the first payment due 3/31/24. The deferred revenue contract represents monthly service terms that last a year. The contract was signed on 9/1/23. The company has an effective tax rate of 20%. 1. Provide the annual adjusting entries for the year 2022. For each adjustment, determine how each debit/credit increases or decreases A/L/NI. Also, classify each adjustment as an accrual or deferral. (10 points each). Bonus opportunity! 1. Determine the amount that was paid for the prepaid insurance contract when it was originally signed from the problem in Part III. (3 points)

Step by Step Solution

★★★★★

3.37 Rating (156 Votes )

There are 3 Steps involved in it

Step: 1

1 Prepaid insurance adjustment Debit Prepaid insurance expense 16667 Credit Prep...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started