Please find the most recent 10-K for Ford Motor Company. Please answer the following questions using the most recent year, and most recent year-end

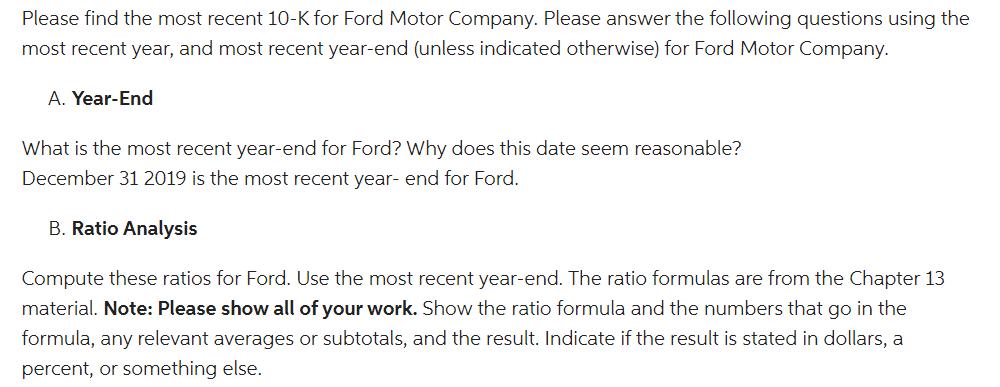

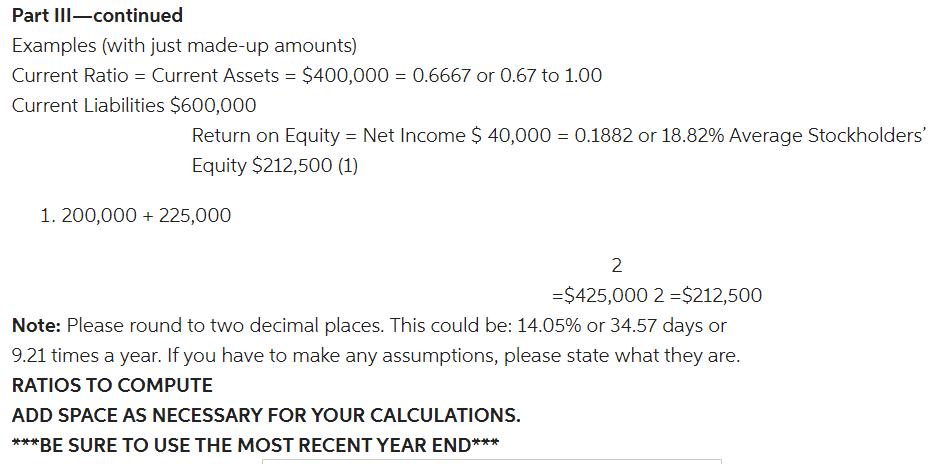

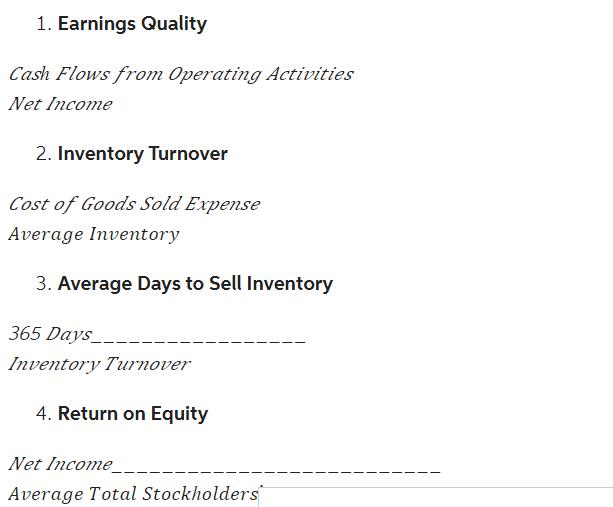

Please find the most recent 10-K for Ford Motor Company. Please answer the following questions using the most recent year, and most recent year-end (unless indicated otherwise) for Ford Motor Company. A. Year-End What is the most recent year-end for Ford? Why does this date seem reasonable? December 31 2019 is the most recent year- end for Ford. B. Ratio Analysis Compute these ratios for Ford. Use the most recent year-end. The ratio formulas are from the Chapter 13 material. Note: Please show all of your work. Show the ratio formula and the numbers that go in the formula, any relevant averages or subtotals, and the result. Indicate if the result is stated in dollars, a percent, or something else. Part III-continued Examples (with just made-up amounts) Current Ratio = Current Assets = $400,000 = 0.6667 or 0.67 to 1.00 Current Liabilities $600,000 Return on Equity = Net Income $ 40,000 = 0.1882 or 18.82% Average Stockholders' Equity $212,500 (1) 1. 200,000 + 225,000 2 =$425,000 2 =$212,500 Note: Please round to two decimal places. This could be: 14.05% or 34.57 days or 9.21 times a year. If you have to make any assumptions, please state what they are. RATIOS TO COMPUTE ADD SPACE AS NECESSARY FOR YOUR CALCULATIONS. ***BE SURE TO USE THE MOST RECENT YEAR END*** 1. Earnings Quality Cash Flows from Operating Activities Net Income 2. Inventory Turnover Cost of Goods Sold Expense Average Inventory 3. Average Days to Sell Inventory 365 Days_ Inventory Turnover 4. Return on Equity Net Income_ Average Total Stockholders 5. Fixed Asset Turnover Net Sales Revenue_ Average Net Fixed Assets (Net PPE) 6. Quick (_Quick _Assets**)_ Current Liabilities 7. Debt Part IlI-continued C. Questions about Ford Credit Finance Receivables 1. Consider Ford's balance sheet. And consider Ford Credit Finance Receivables. Please fill out this table. Dollar Dollar Finance Amount of Amount of Receivables Finance Total Assets as a Receivables Percentage of Total Assets Most Recent Year-End Previous Year-End 2. Why would an automobile manufacturing company have Finance Receivables? What are these Credit Receivables? What do these accounts represent? In your discussion, differentiate between the Consumer Portfolio and the Non-Consumer Portfolio. Suggested length: two paragraphs Please find the most recent 10-K for Ford Motor Company. Please answer the following questions using the most recent year, and most recent year-end (unless indicated otherwise) for Ford Motor Company. A. Year-End What is the most recent year-end for Ford? Why does this date seem reasonable? December 31 2019 is the most recent year- end for Ford. B. Ratio Analysis Compute these ratios for Ford. Use the most recent year-end. The ratio formulas are from the Chapter 13 material. Note: Please show all of your work. Show the ratio formula and the numbers that go in the formula, any relevant averages or subtotals, and the result. Indicate if the result is stated in dollars, a percent, or something else. Part III-continued Examples (with just made-up amounts) Current Ratio = Current Assets = $400,000 = 0.6667 or 0.67 to 1.00 Current Liabilities $600,000 Return on Equity = Net Income $ 40,000 = 0.1882 or 18.82% Average Stockholders' Equity $212,500 (1) 1. 200,000 + 225,000 2 =$425,000 2 =$212,500 Note: Please round to two decimal places. This could be: 14.05% or 34.57 days or 9.21 times a year. If you have to make any assumptions, please state what they are. RATIOS TO COMPUTE ADD SPACE AS NECESSARY FOR YOUR CALCULATIONS. ***BE SURE TO USE THE MOST RECENT YEAR END*** 1. Earnings Quality Cash Flows from Operating Activities Net Income 2. Inventory Turnover Cost of Goods Sold Expense Average Inventory 3. Average Days to Sell Inventory 365 Days_ Inventory Turnover 4. Return on Equity Net Income_ Average Total Stockholders 5. Fixed Asset Turnover Net Sales Revenue_ Average Net Fixed Assets (Net PPE) 6. Quick (_Quick _Assets**)_ Current Liabilities 7. Debt Part IlI-continued C. Questions about Ford Credit Finance Receivables 1. Consider Ford's balance sheet. And consider Ford Credit Finance Receivables. Please fill out this table. Dollar Dollar Finance Amount of Amount of Receivables Finance Total Assets as a Receivables Percentage of Total Assets Most Recent Year-End Previous Year-End 2. Why would an automobile manufacturing company have Finance Receivables? What are these Credit Receivables? What do these accounts represent? In your discussion, differentiate between the Consumer Portfolio and the Non-Consumer Portfolio. Suggested length: two paragraphs Please find the most recent 10-K for Ford Motor Company. Please answer the following questions using the most recent year, and most recent year-end (unless indicated otherwise) for Ford Motor Company. A. Year-End What is the most recent year-end for Ford? Why does this date seem reasonable? December 31 2019 is the most recent year- end for Ford. B. Ratio Analysis Compute these ratios for Ford. Use the most recent year-end. The ratio formulas are from the Chapter 13 material. Note: Please show all of your work. Show the ratio formula and the numbers that go in the formula, any relevant averages or subtotals, and the result. Indicate if the result is stated in dollars, a percent, or something else. Part III-continued Examples (with just made-up amounts) Current Ratio = Current Assets = $400,000 = 0.6667 or 0.67 to 1.00 Current Liabilities $600,000 Return on Equity = Net Income $ 40,000 = 0.1882 or 18.82% Average Stockholders' Equity $212,500 (1) 1. 200,000 + 225,000 2 =$425,000 2 =$212,500 Note: Please round to two decimal places. This could be: 14.05% or 34.57 days or 9.21 times a year. If you have to make any assumptions, please state what they are. RATIOS TO COMPUTE ADD SPACE AS NECESSARY FOR YOUR CALCULATIONS. ***BE SURE TO USE THE MOST RECENT YEAR END*** 1. Earnings Quality Cash Flows from Operating Activities Net Income 2. Inventory Turnover Cost of Goods Sold Expense Average Inventory 3. Average Days to Sell Inventory 365 Days_ Inventory Turnover 4. Return on Equity Net Income_ Average Total Stockholders 5. Fixed Asset Turnover Net Sales Revenue_ Average Net Fixed Assets (Net PPE) 6. Quick (_Quick _Assets**)_ Current Liabilities 7. Debt Part IlI-continued C. Questions about Ford Credit Finance Receivables 1. Consider Ford's balance sheet. And consider Ford Credit Finance Receivables. Please fill out this table. Dollar Dollar Finance Amount of Amount of Receivables Finance Total Assets as a Receivables Percentage of Total Assets Most Recent Year-End Previous Year-End 2. Why would an automobile manufacturing company have Finance Receivables? What are these Credit Receivables? What do these accounts represent? In your discussion, differentiate between the Consumer Portfolio and the Non-Consumer Portfolio. Suggested length: two paragraphs Please find the most recent 10-K for Ford Motor Company. Please answer the following questions using the most recent year, and most recent year-end (unless indicated otherwise) for Ford Motor Company. A. Year-End What is the most recent year-end for Ford? Why does this date seem reasonable? December 31 2019 is the most recent year- end for Ford. B. Ratio Analysis Compute these ratios for Ford. Use the most recent year-end. The ratio formulas are from the Chapter 13 material. Note: Please show all of your work. Show the ratio formula and the numbers that go in the formula, any relevant averages or subtotals, and the result. Indicate if the result is stated in dollars, a percent, or something else. Part III-continued Examples (with just made-up amounts) Current Ratio = Current Assets = $400,000 = 0.6667 or 0.67 to 1.00 Current Liabilities $600,000 Return on Equity = Net Income $ 40,000 = 0.1882 or 18.82% Average Stockholders' Equity $212,500 (1) 1. 200,000 + 225,000 2 =$425,000 2 =$212,500 Note: Please round to two decimal places. This could be: 14.05% or 34.57 days or 9.21 times a year. If you have to make any assumptions, please state what they are. RATIOS TO COMPUTE ADD SPACE AS NECESSARY FOR YOUR CALCULATIONS. ***BE SURE TO USE THE MOST RECENT YEAR END*** 1. Earnings Quality Cash Flows from Operating Activities Net Income 2. Inventory Turnover Cost of Goods Sold Expense Average Inventory 3. Average Days to Sell Inventory 365 Days_ Inventory Turnover 4. Return on Equity Net Income_ Average Total Stockholders 5. Fixed Asset Turnover Net Sales Revenue_ Average Net Fixed Assets (Net PPE) 6. Quick (_Quick _Assets**)_ Current Liabilities 7. Debt Part IlI-continued C. Questions about Ford Credit Finance Receivables 1. Consider Ford's balance sheet. And consider Ford Credit Finance Receivables. Please fill out this table. Dollar Dollar Finance Amount of Amount of Receivables Finance Total Assets as a Receivables Percentage of Total Assets Most Recent Year-End Previous Year-End 2. Why would an automobile manufacturing company have Finance Receivables? What are these Credit Receivables? What do these accounts represent? In your discussion, differentiate between the Consumer Portfolio and the Non-Consumer Portfolio. Suggested length: two paragraphs Please find the most recent 10-K for Ford Motor Company. Please answer the following questions using the most recent year, and most recent year-end (unless indicated otherwise) for Ford Motor Company. A. Year-End What is the most recent year-end for Ford? Why does this date seem reasonable? December 31 2019 is the most recent year- end for Ford. B. Ratio Analysis Compute these ratios for Ford. Use the most recent year-end. The ratio formulas are from the Chapter 13 material. Note: Please show all of your work. Show the ratio formula and the numbers that go in the formula, any relevant averages or subtotals, and the result. Indicate if the result is stated in dollars, a percent, or something else. Part III-continued Examples (with just made-up amounts) Current Ratio = Current Assets = $400,000 = 0.6667 or 0.67 to 1.00 Current Liabilities $600,000 Return on Equity = Net Income $ 40,000 = 0.1882 or 18.82% Average Stockholders' Equity $212,500 (1) 1. 200,000 + 225,000 2 =$425,000 2 =$212,500 Note: Please round to two decimal places. This could be: 14.05% or 34.57 days or 9.21 times a year. If you have to make any assumptions, please state what they are. RATIOS TO COMPUTE ADD SPACE AS NECESSARY FOR YOUR CALCULATIONS. ***BE SURE TO USE THE MOST RECENT YEAR END*** 1. Earnings Quality Cash Flows from Operating Activities Net Income 2. Inventory Turnover Cost of Goods Sold Expense Average Inventory 3. Average Days to Sell Inventory 365 Days_ Inventory Turnover 4. Return on Equity Net Income_ Average Total Stockholders 5. Fixed Asset Turnover Net Sales Revenue_ Average Net Fixed Assets (Net PPE) 6. Quick (_Quick _Assets**)_ Current Liabilities 7. Debt Part IlI-continued C. Questions about Ford Credit Finance Receivables 1. Consider Ford's balance sheet. And consider Ford Credit Finance Receivables. Please fill out this table. Dollar Dollar Finance Amount of Amount of Receivables Finance Total Assets as a Receivables Percentage of Total Assets Most Recent Year-End Previous Year-End 2. Why would an automobile manufacturing company have Finance Receivables? What are these Credit Receivables? What do these accounts represent? In your discussion, differentiate between the Consumer Portfolio and the Non-Consumer Portfolio. Suggested length: two paragraphs Please find the most recent 10-K for Ford Motor Company. Please answer the following questions using the most recent year, and most recent year-end (unless indicated otherwise) for Ford Motor Company. A. Year-End What is the most recent year-end for Ford? Why does this date seem reasonable? December 31 2019 is the most recent year- end for Ford. B. Ratio Analysis Compute these ratios for Ford. Use the most recent year-end. The ratio formulas are from the Chapter 13 material. Note: Please show all of your work. Show the ratio formula and the numbers that go in the formula, any relevant averages or subtotals, and the result. Indicate if the result is stated in dollars, a percent, or something else. Part III-continued Examples (with just made-up amounts) Current Ratio = Current Assets = $400,000 = 0.6667 or 0.67 to 1.00 Current Liabilities $600,000 Return on Equity = Net Income $ 40,000 = 0.1882 or 18.82% Average Stockholders' Equity $212,500 (1) 1. 200,000 + 225,000 2 =$425,000 2 =$212,500 Note: Please round to two decimal places. This could be: 14.05% or 34.57 days or 9.21 times a year. If you have to make any assumptions, please state what they are. RATIOS TO COMPUTE ADD SPACE AS NECESSARY FOR YOUR CALCULATIONS. ***BE SURE TO USE THE MOST RECENT YEAR END*** 1. Earnings Quality Cash Flows from Operating Activities Net Income 2. Inventory Turnover Cost of Goods Sold Expense Average Inventory 3. Average Days to Sell Inventory 365 Days_ Inventory Turnover 4. Return on Equity Net Income_ Average Total Stockholders 5. Fixed Asset Turnover Net Sales Revenue_ Average Net Fixed Assets (Net PPE) 6. Quick (_Quick _Assets**)_ Current Liabilities 7. Debt Part IlI-continued C. Questions about Ford Credit Finance Receivables 1. Consider Ford's balance sheet. And consider Ford Credit Finance Receivables. Please fill out this table. Dollar Dollar Finance Amount of Amount of Receivables Finance Total Assets as a Receivables Percentage of Total Assets Most Recent Year-End Previous Year-End 2. Why would an automobile manufacturing company have Finance Receivables? What are these Credit Receivables? What do these accounts represent? In your discussion, differentiate between the Consumer Portfolio and the Non-Consumer Portfolio. Suggested length: two paragraphs

Step by Step Solution

3.48 Rating (161 Votes )

There are 3 Steps involved in it

Step: 1

A Most Recent Financial Year The most recent yearend for Ford Motors is 2019 The date is reasonable ...

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started