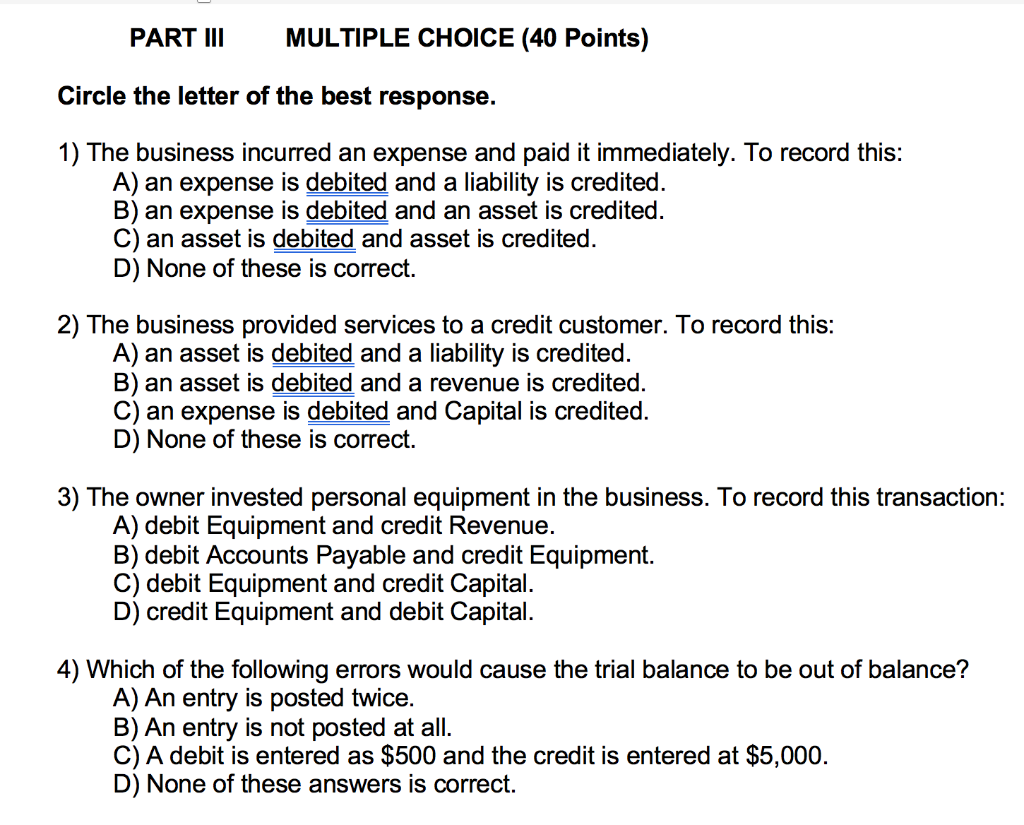

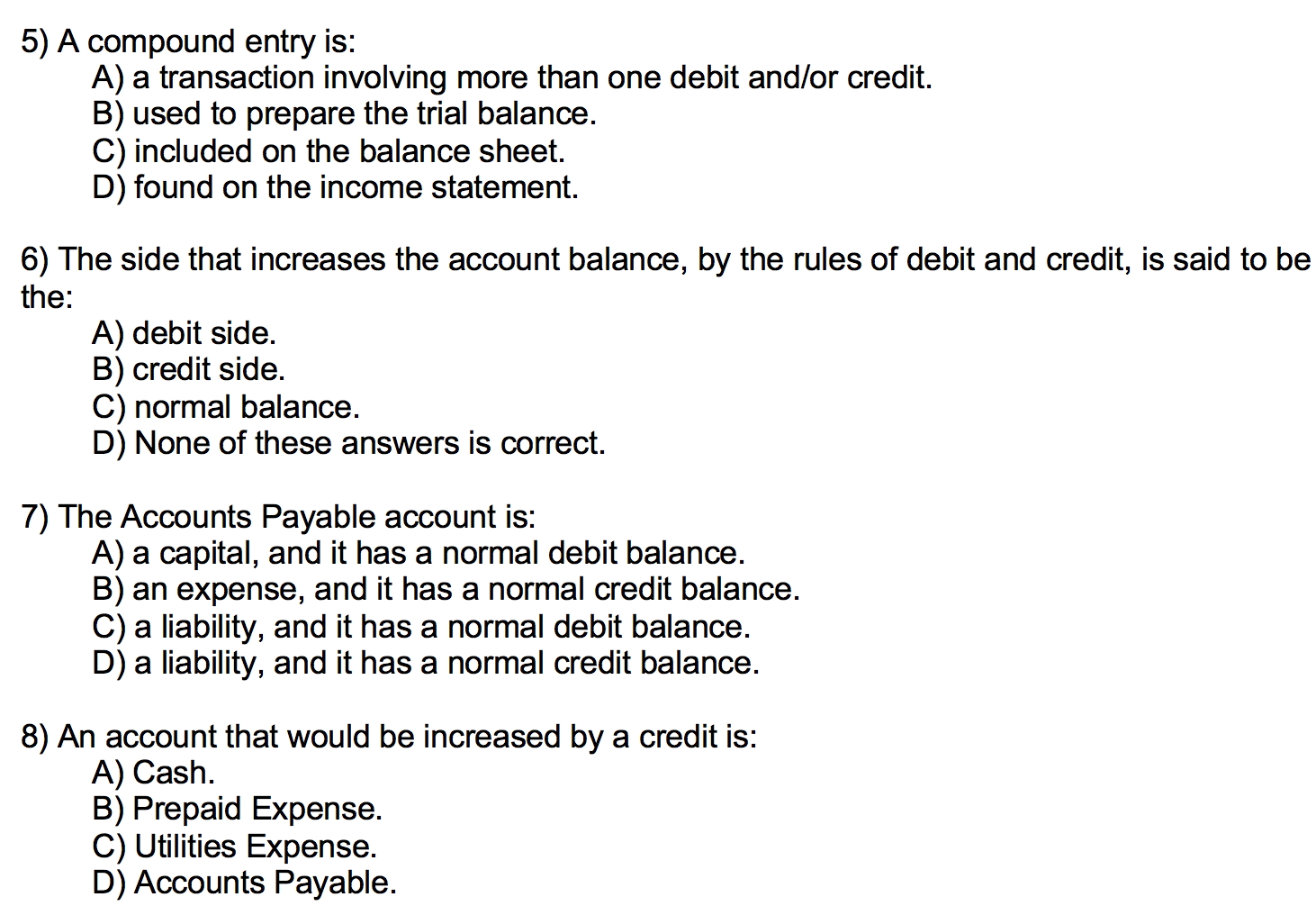

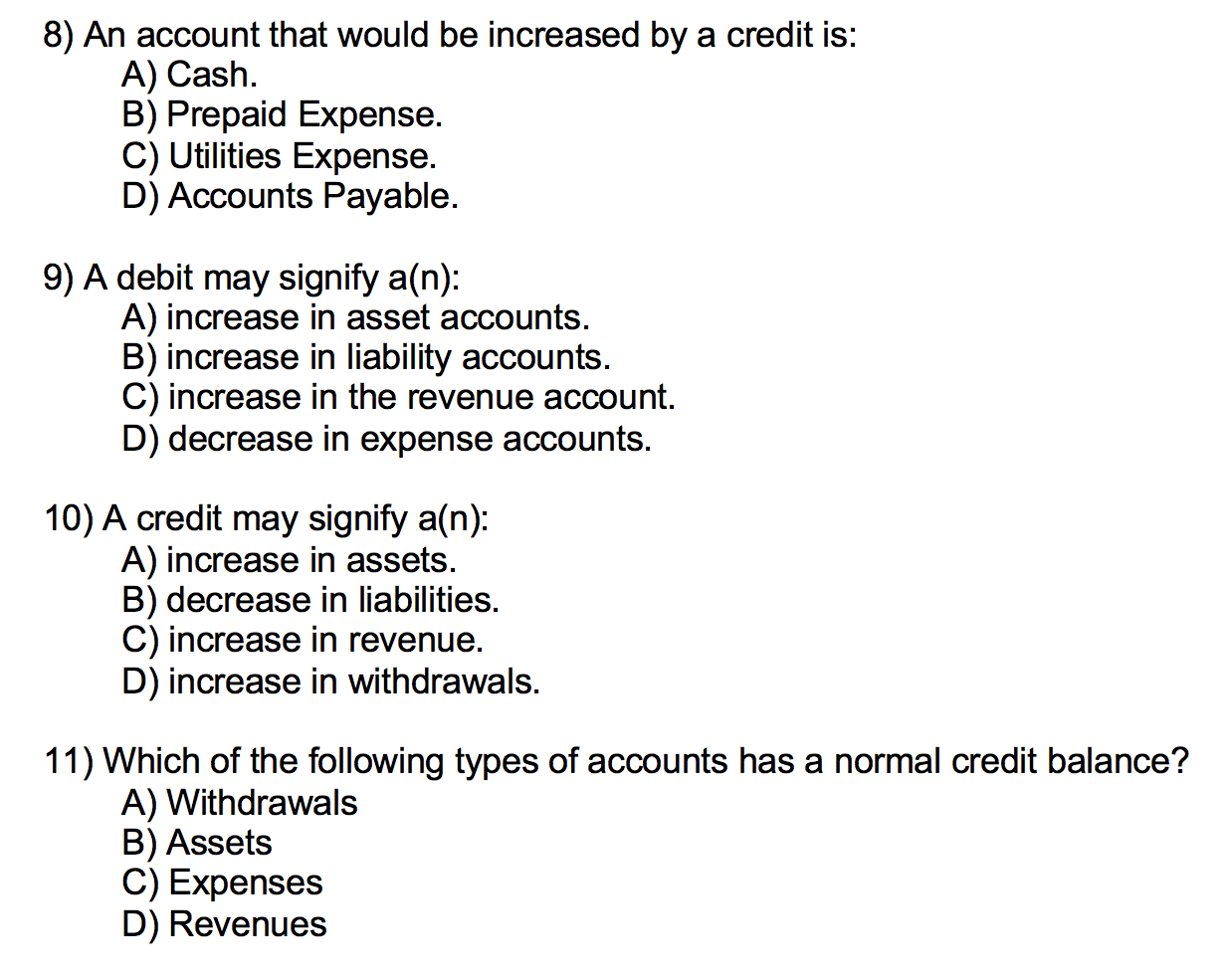

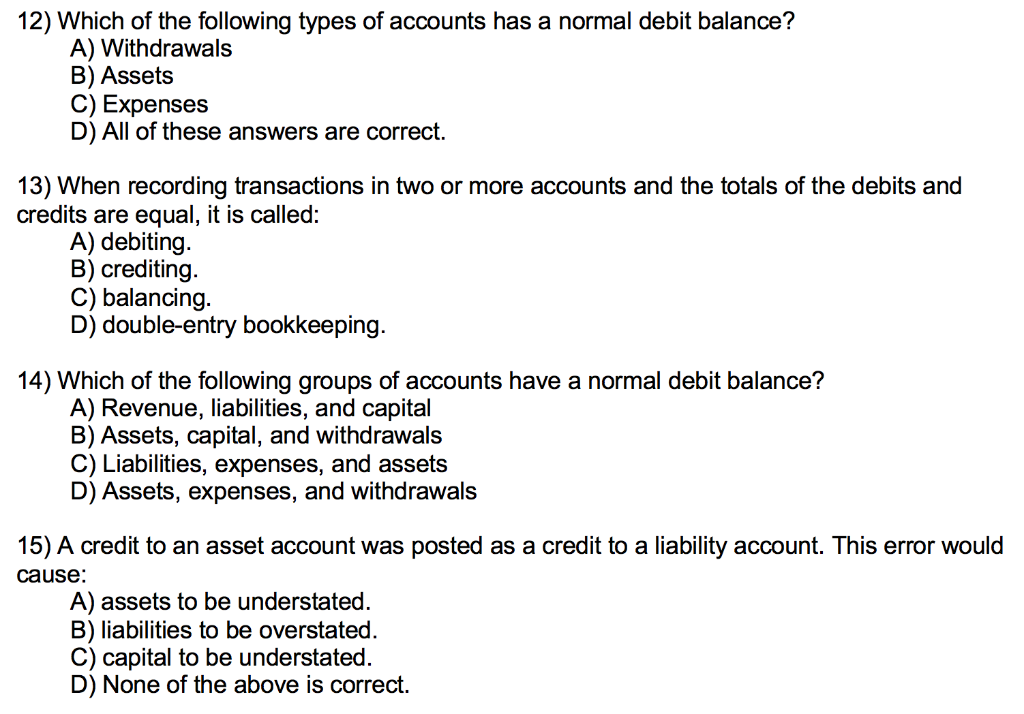

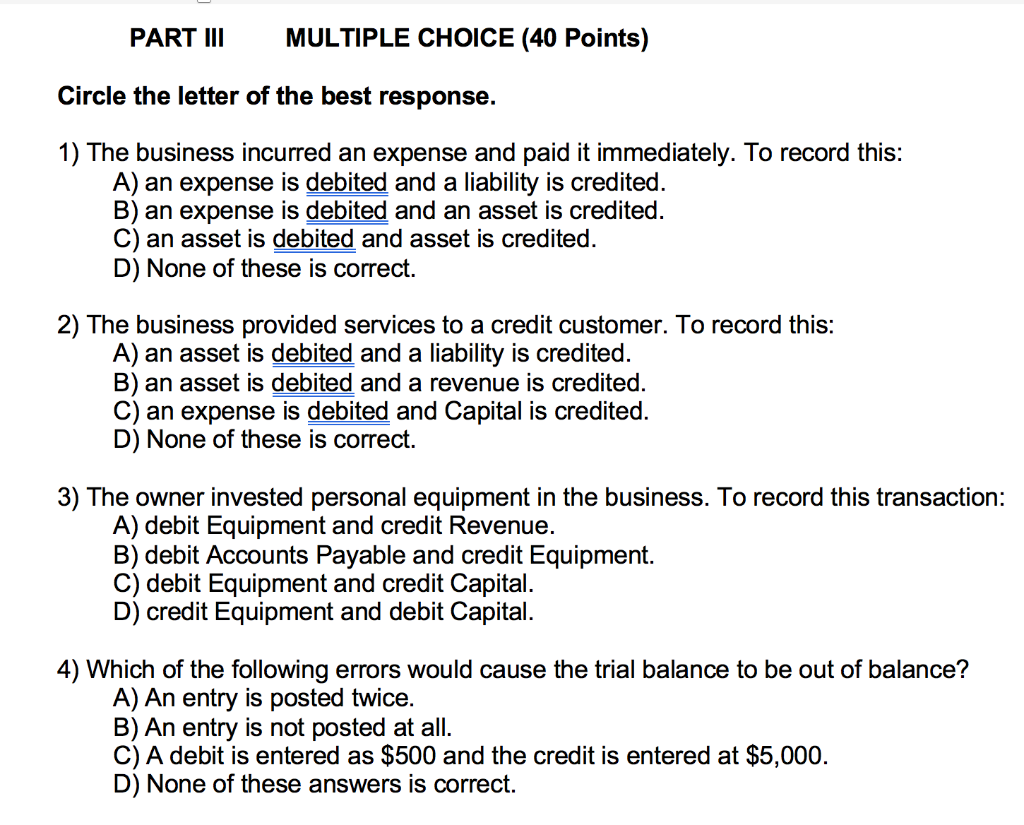

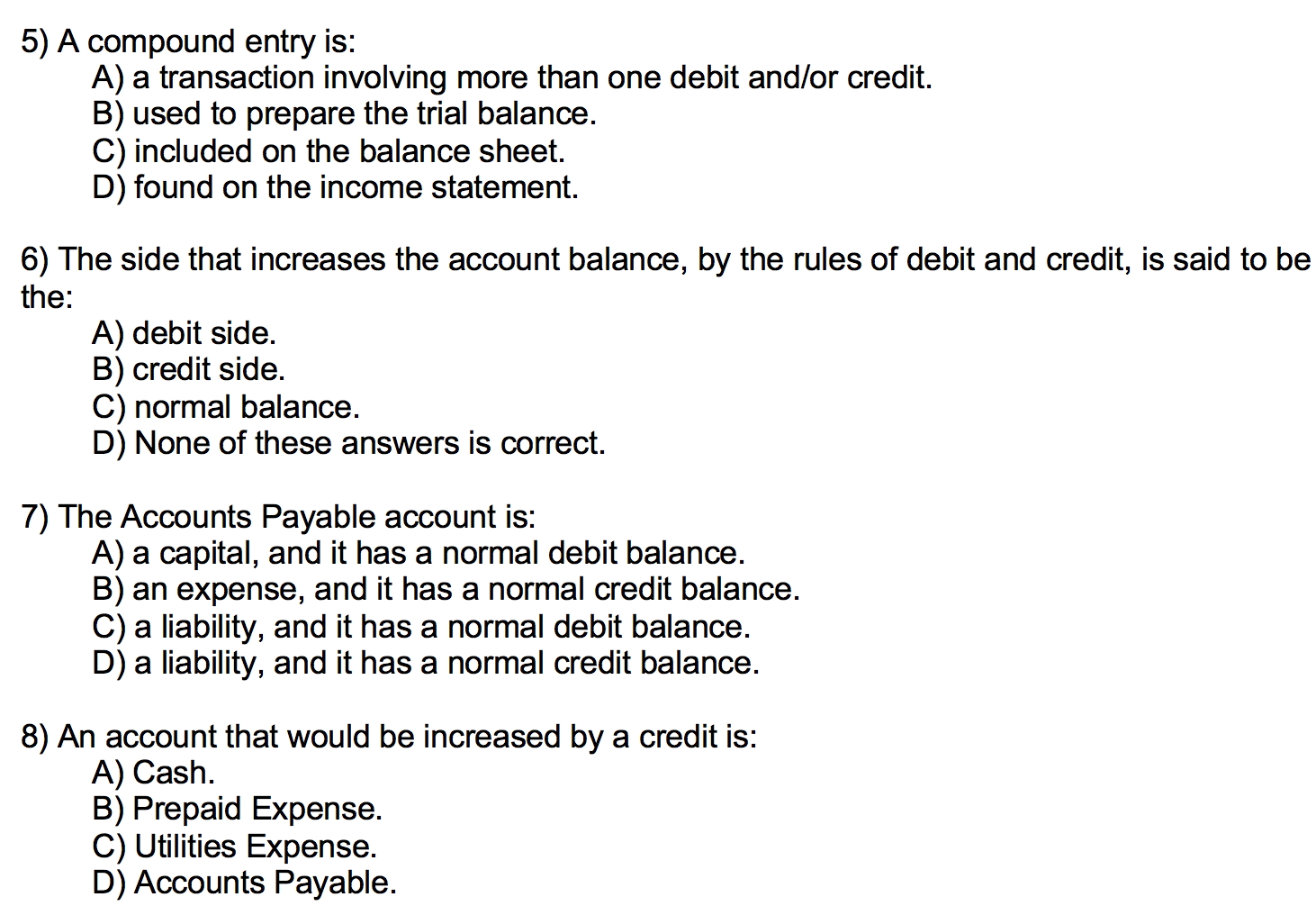

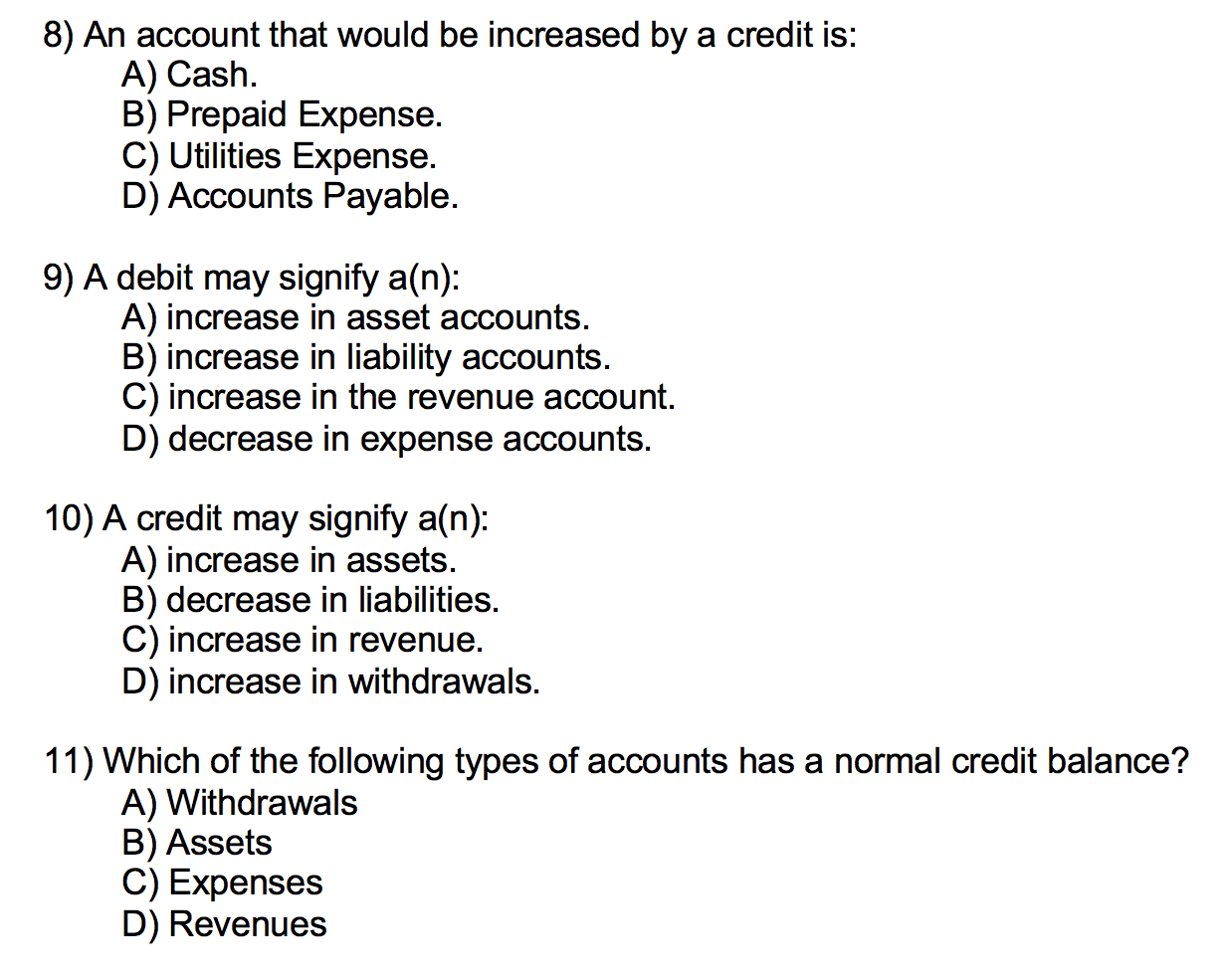

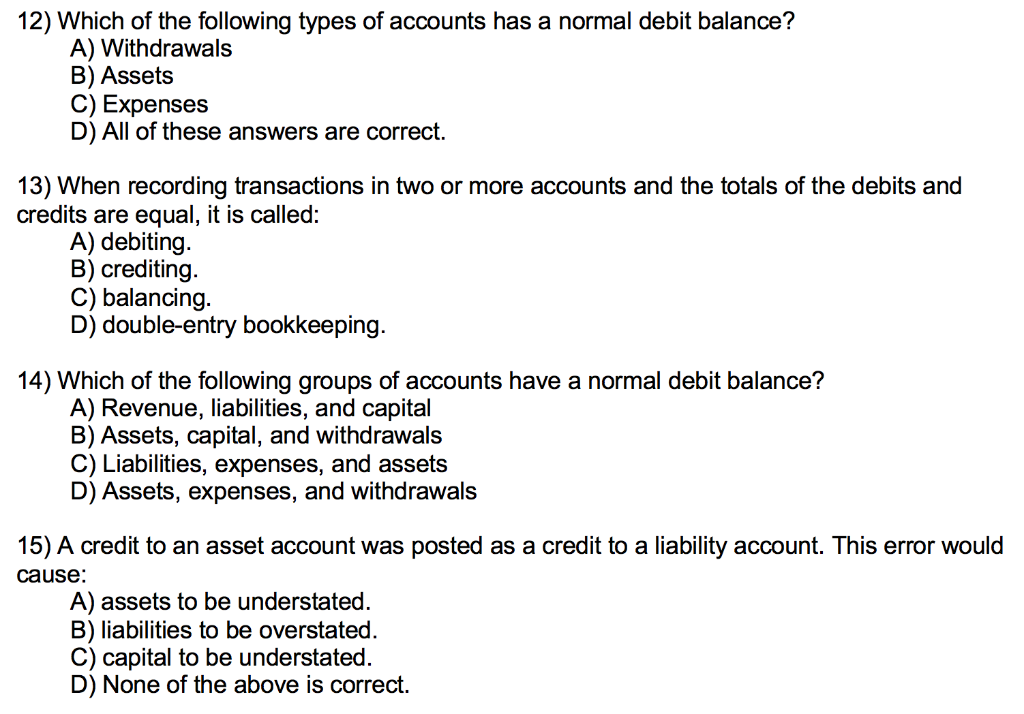

PART III MULTIPLE CHOICE (40 Points) Circle the letter of the best response. 1) The business incurred an expense and paid it immediately. To record this: A) an expense is debited and a liability is credited. B) an expense is debited and an asset is credited. C) an asset is debited and asset is credited. D) None of these is correct. 2) The business provided services to a credit customer. To record this: A) an asset is debited and a liability is credited. B) an asset is debited and a revenue is credited. C) an expense is debited and Capital is credited. D) None of these is correct. 3) The owner invested personal equipment in the business. To record this transaction: A) debit Equipment and credit Revenue. B) debit Accounts Payable and credit Equipment. C) debit Equipment and credit Capital. D) credit Equipment and debit Capital. 4) Which of the following errors would cause the trial balance to be out of balance? A) An entry is posted twice. B) An entry is not posted at all. C) A debit is entered as $500 and the credit is entered at $5,000. D) None of these answers is correct. 5) A compound entry is: A) a transaction involving more than one debit and/or credit. B) used to prepare the trial balance. C) included on the balance sheet. D) found on the income statement. 6) The side that increases the account balance, by the rules of debit and credit, is said to be the: A) debit side. B) credit side. C) normal balance. D) None of these answers is correct. 7) The Accounts Payable account is: A) a capital, and it has a normal debit balance. B) an expense, and it has a normal credit balance. C) a liability, and it has a normal debit balance. D) a liability, and it has a normal credit balance. 8) An account that would be increased by a credit is: A) Cash. B) Prepaid Expense. C) Utilities Expense. D) Accounts Payable. 8) An account that would be increased by a credit is: A) Cash. B) Prepaid Expense. C) Utilities Expense. D) Accounts Payable. 9) A debit may signify a(n): A) increase in asset accounts. B) increase in liability accounts. C) increase in the revenue account. D) decrease in expense accounts. 10) A credit may signify a(n): A) increase in assets. B) decrease in liabilities. C) increase in revenue. D) increase in withdrawals. 11) Which of the following types of accounts has a normal credit balance? A) Withdrawals B) Assets C) Expenses D) Revenues 12) Which of the following types of accounts has a normal debit balance? A) Withdrawals B) Assets C) Expenses D) All of these answers are correct. 13) When recording transactions in two or more accounts and the totals of the debits and credits are equal, it is called: A) debiting. B) crediting. C) balancing. D) double-entry bookkeeping. 14) Which of the following groups of accounts have a normal debit balance? A) Revenue, liabilities, and capital B) Assets, capital, and withdrawals C) Liabilities, expenses, and assets D) Assets, expenses, and withdrawals 15) A credit to an asset account was posted as a credit to a liability account. This error would cause: A) assets to be understated. B) liabilities to be overstated. C) capital to be understated. D) None of the above is correct