Answered step by step

Verified Expert Solution

Question

1 Approved Answer

PART IV Capital Structure and Dividend Policy The company currently has a required return on assets of 1 4 percent. Because of the higl debt

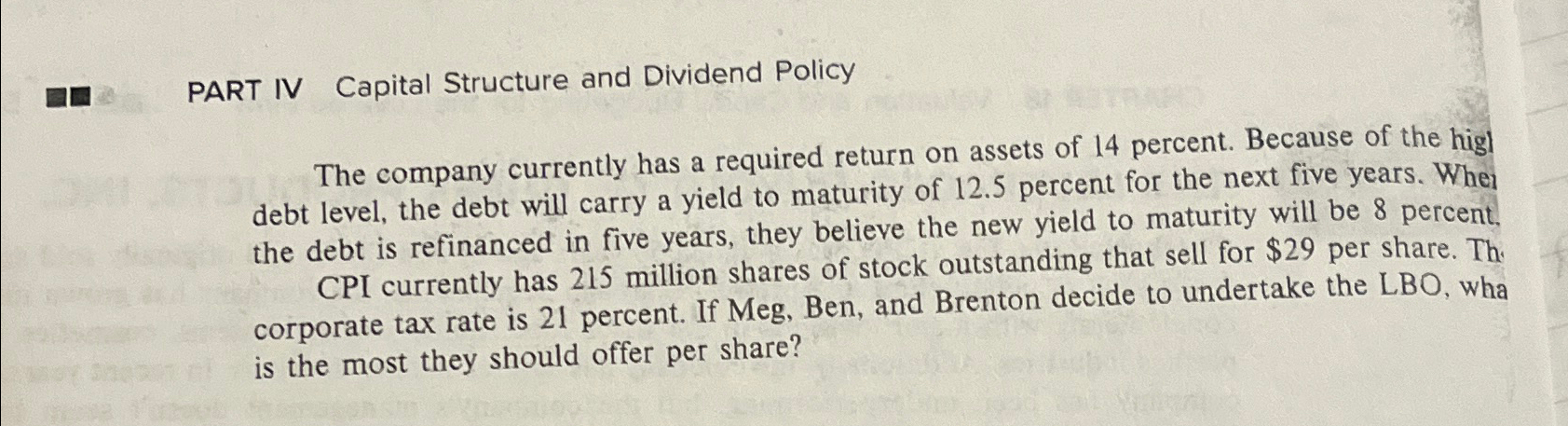

PART IV Capital Structure and Dividend Policy

The company currently has a required return on assets of percent. Because of the higl debt level, the debt will carry a yield to maturity of percent for the next five years. Whe the debt is refinanced in five years, they believe the new yield to maturity will be percent, CPI currently has million shares of stock outstanding that sell for $ per share. Th corporate tax rate is percent. If Meg, Ben, and Brenton decide to undertake the LBO, wha is the most they should offer per share?

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started